Abbot Laboratories

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| BTIG | Dane Leone | dleone@btig.com |

| Leerink Partners | Danielle Antalffy | danielle.antalffy@leerink.com |

| Argus Research | David Toung | dtoung@argusresearch.com |

| Morningstar | Debbie S. Wang | debbie.wang@morningstar.com |

| RBC Capital Markets | Glenn Novarro | glenn.novarro@rbccm.com |

| Erste Group | Hans Engel | hans.engel@erstegroup.com |

| Raymond James | Jayson Bedford | jayson.bedford@raymondjames.com |

| Jefferies | Jeffrey Holford | jholford@jefferies.com |

| Gabelli & Company | Jennie Tsai | jtsai@gabelli.com |

| BMO Capital Markets | Joanne K. Wuensch | joanne.wuensch@bmo.com |

| Cowen & Company | Joshua Jennings | josh.jennings@cowen.com |

| First Global Stockbroking | Kavita Thomas | kavita.thomas@fglobal.com |

| Deutsche Bank Research | Kristen Stewart | kristen.stewart@db.com |

| Wells Fargo Securities | Larry Biegelsen | lawrence.biegelsen@wellsfargo.com |

| William Blair | Margaret Kaczor | mkaczor@williamblair.com |

| Credit Suisse | Matthew Keeler | matthew.keeler@credit-suisse.com |

| Stifel Nicolaus | Rick Wise | wiser@stifel.com |

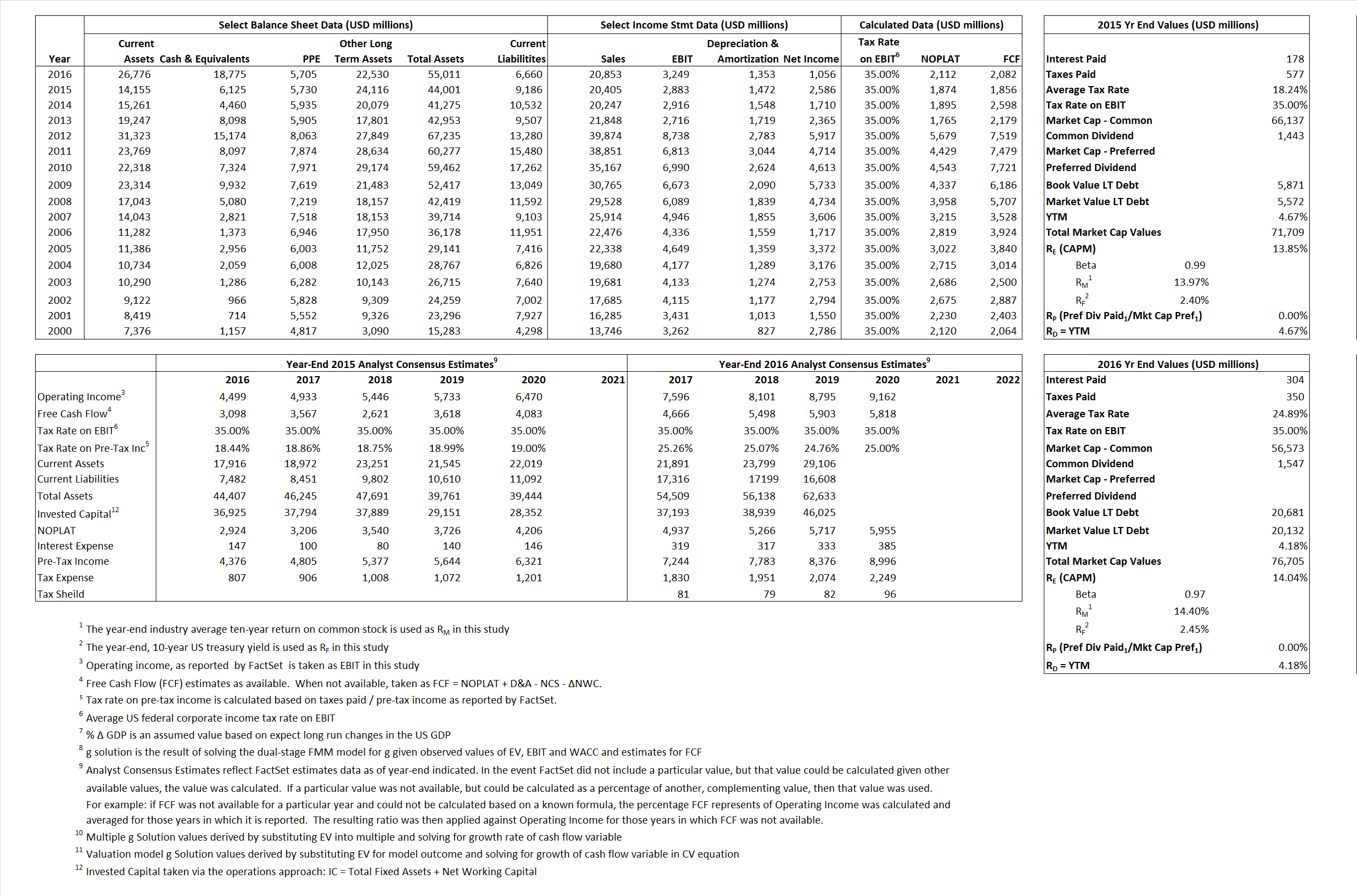

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,874 | 2,112 | |

| Free Cash Flow | FCF | 1,856 | 2,082 | |

| Tax Shield | TS | 32 | 76 | |

| Invested Capital | IC | 34,815 | 48,351 | |

| Return on Invested Capital | ROIC | 5.38% | 4.37% | |

| Net Investment | NetInv | 5,544 | 14,889 | |

| Investment Rate | IR | 295.85% | 705.02% | |

| Weighted Average Cost of Capital |

WACCMarket | 13.07% | 11.18% | |

| WACCBook | 8.46% | 6.96% | ||

| Enterprise value |

EVMarket | 65,584 | 57,930 | |

| EVBook | 65,883 | 58,479 | ||

| Long-Run Growth |

g = IR x ROIC |

15.92% | 30.79% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 14.13% | 15.58% | |

| Depreciation/Amortization Rate | D | 33.80% | 29.40% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

3.21 | 2.78 | 21.78% | 45.57% | 17.22% | 31.70% |

|

|

15.06 | 12.59 | 21.78% | 45.57% | 17.22% | 31.70% |

|

|

35.00 | 27.43 | 21.78% | 45.57% | 17.22% | 31.70% |

|

|

35.34 | 27.82 | 21.78% | 45.57% | 17.22% | 31.70% |

|

|

22.75 | 17.83 | 21.78% | 45.57% | 17.22% | 31.70% |

|

|

1.88 | 1.20 | 21.78% | 45.57% | 17.22% | 31.70% |