Amgen Inc.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Credit Suisse | Alethia Young | alethia.young@credit-suisse.com |

| Raymond James | Christopher J. Raymond | chris.raymond@raymondjames.com |

| Cowen & Company | Eric Schmidt | eric.schmidt@cowen.com |

| Jefferies | Eun K. Yang | eyang@jefferies.com |

| Leerink Partners | Geoffrey C. Porges | geoffrey.porges@leerink.com |

| BTIG | Hartaj Singh | hsingh@btig.com |

| Wells Fargo Securities | Jim Birchenough | jim.birchenough@wellsfargo.com |

| William Blair | John Sonnier | jsonnier@williamblair.com |

| Piper Jaffray | Joshua Schimmer | joshua.e.schimmer@pjc.com |

| BMO Capital Markets | M. Ian Somaiya | ian.somaiya@bmo.com |

| Evercore ISI | Mark Schoenebaum | mark.schoenebaum@evercoreisi.com |

| RBC Capital Markets | Michael J. Yee | michael.yee@rbccm.com |

| Atlantic Equities | Steve Chesney | s.chesney@atlantic-equities.com |

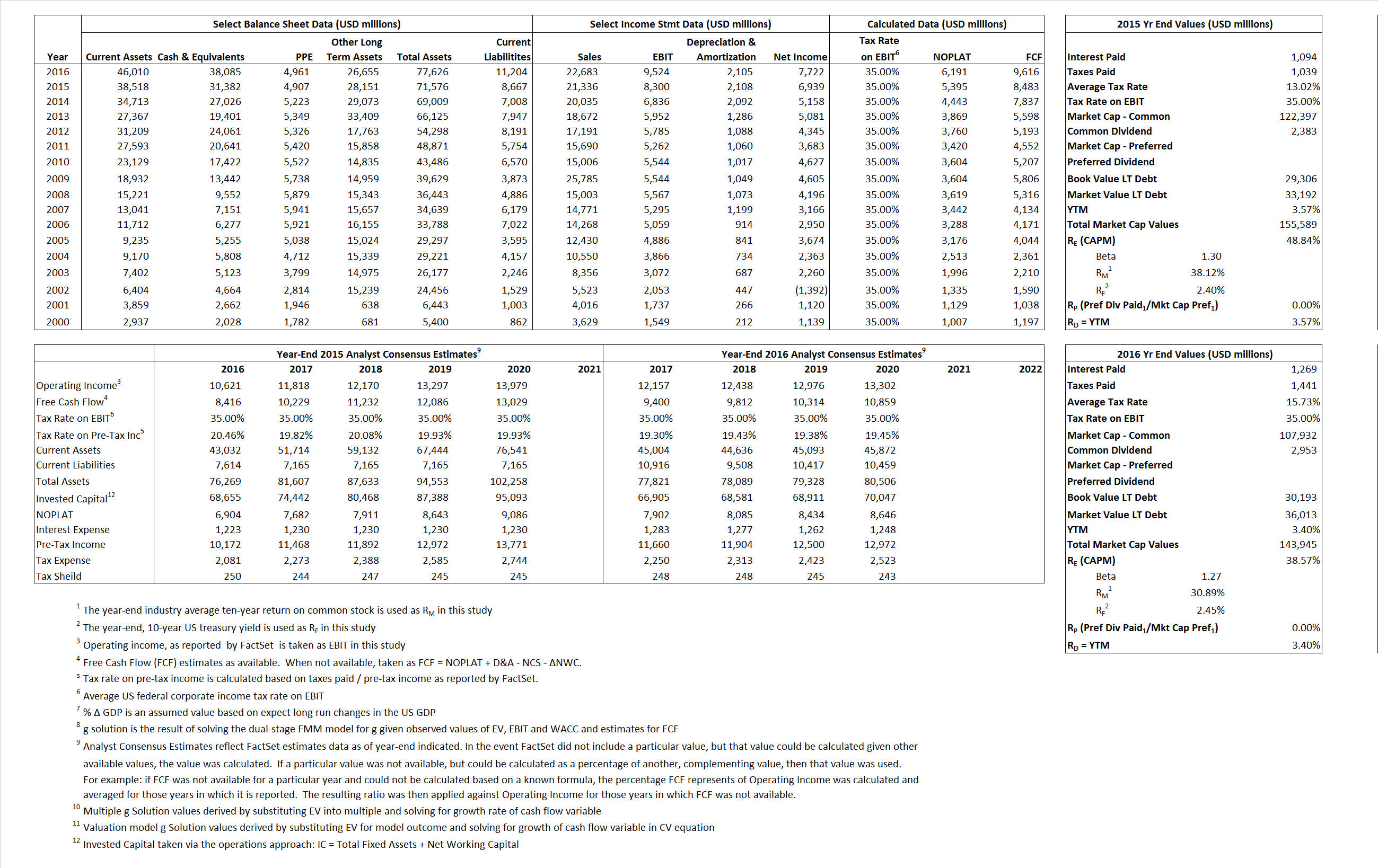

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 5,395 | 6,191 | |

| Free Cash Flow | FCF | 8,483 | 9,616 | |

| Tax Shield | TS | 142 | 200 | |

| Invested Capital | IC | 62,909 | 66,422 | |

| Return on Invested Capital | ROIC | 8.58% | 9.32% | |

| Net Investment | NetInv | 3,016 | 5,618 | |

| Investment Rate | IR | 55.90% | 90.75% | |

| Weighted Average Cost of Capital |

WACCMarket | 39.08% | 29.64% | |

| WACCBook | 9.71% | 8.73% | ||

| Enterprise value |

EVMarket | 124,207 | 105,860 | |

| EVBook | 120,321 | 100,040 | ||

| Long-Run Growth |

g = IR x ROIC |

4.79% | 8.46% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 38.90% | 41.99% | |

| Depreciation/Amortization Rate | D | 20.25% | 18.10% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

5.82 | 4.67 | 70.39% | 63.85% | 43.14% | 35.44% |

|

|

11.93 | 9.10 | 70.39% | 63.85% | 43.14% | 35.44% |

|

|

23.02 | 17.10 | 70.39% | 63.85% | 43.14% | 35.44% |

|

|

14.64 | 11.01 | 70.39% | 63.85% | 43.14% | 35.44% |

|

|

14.96 | 11.12 | 70.39% | 63.85% | 43.14% | 35.44% |

|

|

1.97 | 1.59 | 70.39% | 63.85% | 43.14% | 35.44% |