Simon Property Group Inc.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Boenning & Scattergood | Floris Van Dijkum | fvandijkum@boenninginc.com |

| SunTrust Robinson Humphrey | Ki Bin Kim | kibin.kim@suntrust.com |

| Jefferies | Omotayo Okusanya | tokusanya@jefferies.com |

| Canaccord Genuity | Paul Morgan | pmorgan@canaccordgenuity.com |

| RBC Capital Markets | Rich C. Moore | rich.moore@rbccm.com |

| Evercore ISI | Steve Sakwa | steve.sakwa@evercoreisi.com |

| Deutsche Bank Research | Vin Chao | vincent.chao@db.com |

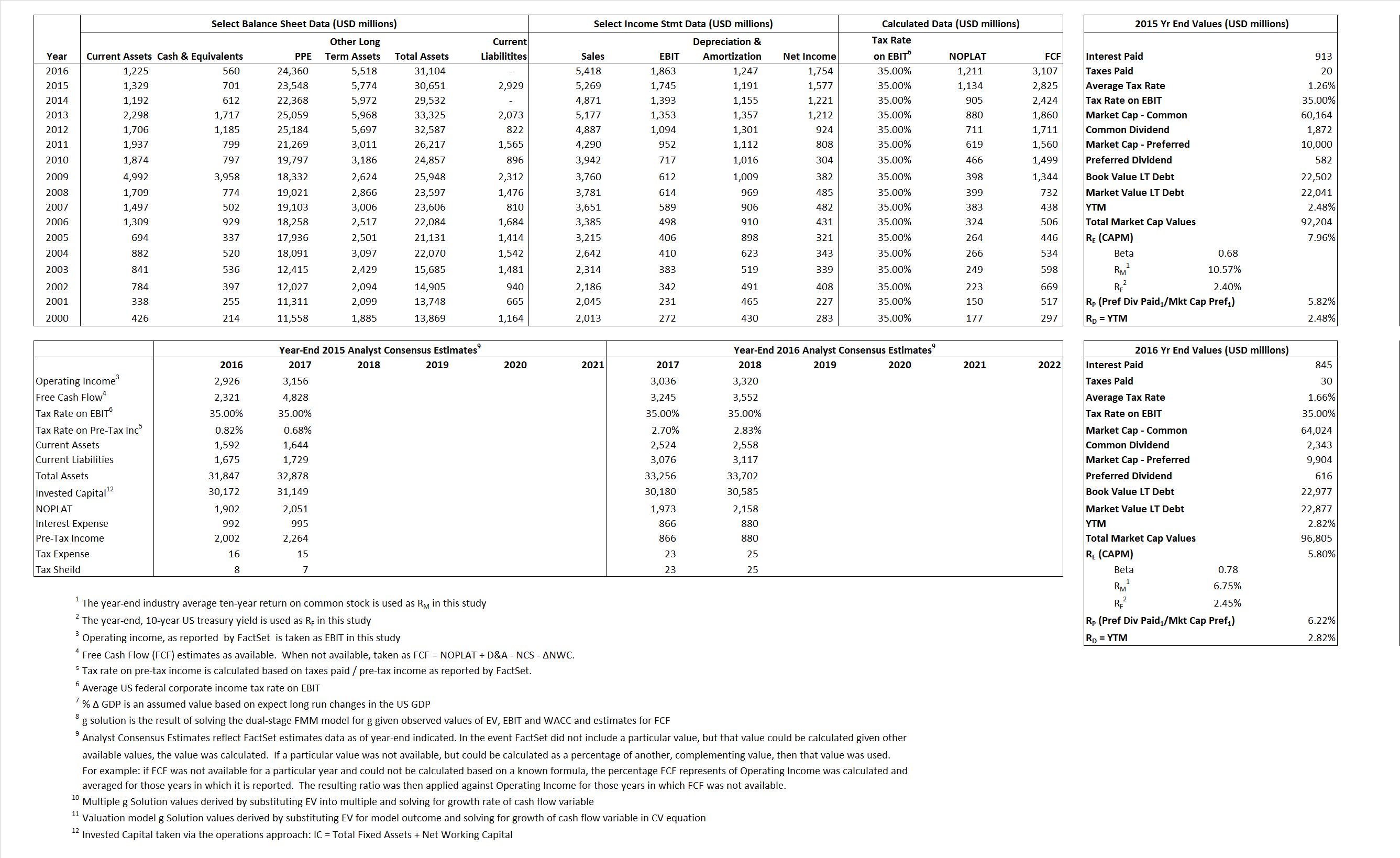

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,134 | 1,211 | |

| Free Cash Flow | FCF | 2,825 | 3,107 | |

| Tax Shield | TS | 12 | 14 | |

| Invested Capital | IC | 27,722 | 31,104 | |

| Return on Invested Capital | ROIC | 4.09% | 3.89% | |

| Net Investment | NetInv | (619) | 4,629 | |

| Investment Rate | IR | -54.57% | 382.18% | |

| Weighted Average Cost of Capital |

WACCMarket | 6.41% | 5.13% | |

| WACCBook | 5.69% | 0.78% | ||

| Enterprise value |

EVMarket | 91,503 | 96,245 | |

| EVBook | 92,106 | 96,345 | ||

| Long-Run Growth |

g = IR x ROIC |

-2.23% | 14.88% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 33.12% | 34.39% | |

| Depreciation/Amortization Rate | D | 40.57% | 40.10% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

17 | 17.77 | 7.41% | 5.72% | 7.34% | 5.64% |

|

|

.37 | 30.94 | 7.41% | 5.72% | 7.34% | 5.64% |

|

|

31.16 | 79.47 | 7.41% | 5.72% | 7.34% | 5.64% |

|

|

80.66 | 30.97 | 7.41% | 5.72% | 7.34% | 5.64% |

|

|

32.39 | 51.65 | 7.41% | 5.72% | 7.34% | 5.64% |

|

|

3.30 | 3.09 | 7.41% | 5.72% | 7.34% | 5.64% |