Bristol-Myers Squibb

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| BMO Capital Markets | Alex Arfaei | alex.arfaei@bmo.com |

| Deutsche Bank Research | Gregg Gilbert | gregg.gilbert@db.com |

| William Blair | John Sonnier | jsonnier@williamblair.com |

| SunTrust Robinson Humphrey | John T. Boris | john.t.boris@suntrust.com |

| Piper Jaffray | Richard J. Purkiss | richard.j.purkiss@pjc.com |

| Leerink Partners | Seamus Fernandez | seamus.fernandez@leerink.com |

| Atlantic Equities | Steve Chesney | s.chesney@atlantic-equities.com |

| Cowen & Company | Steve Scala | steve.scala@cowen.com |

| Bernstein Research | Tim Anderson | tim.anderson@bernstein.com |

| Guggenheim Securities | Tony Butler | tony.butler@guggenheimpartners.com |

| Credit Suisse | Vamil Divan | vamil.divan@credit-suisse.com |

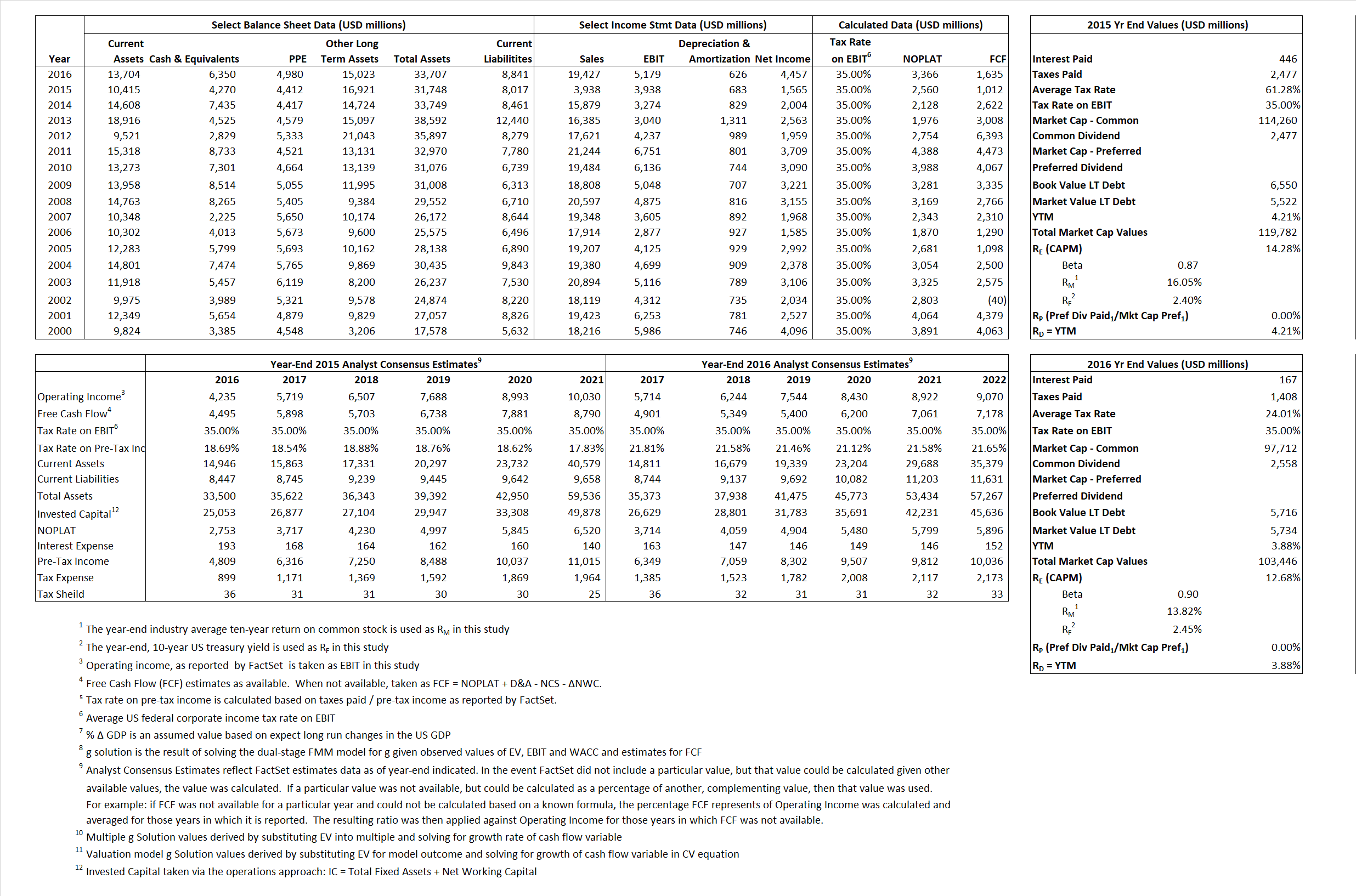

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,560 | 3,366 | |

| Free Cash Flow | FCF | 1,012 | 1,635 | |

| Tax Shield | TS | 273 | 40 | |

| Invested Capital | IC | 23,731 | 24,866 | |

| Return on Invested Capital | ROIC | 10.79% | 13.54% | |

| Net Investment | NetInv | (874) | 1,761 | |

| Investment Rate | IR | -34.14% | 52.31% | |

| Weighted Average Cost of Capital |

WACCMarket | 13.69% | 12.14% | |

| WACCBook | 8.14% | 7.89% | ||

| Enterprise value |

EVMarket | 115,512 | 97,096 | |

| EVBook | 116,540 | 97,078 | ||

| Long-Run Growth |

g = IR x ROIC |

-3.68% | 7.08% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 100.00% | 26.66% | |

| Depreciation/Amortization Rate | D | 14.78% | 10.78% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

29.33 | 5.00 | 14.44% | 11.66% | 14.13% | 11.91% |

|

|

25.00 | 16.73 | 14.44% | 11.66% | 14.13% | 11.91% |

|

|

45.13 | 28.84 | 14.44% | 11.66% | 14.13% | 11.91% |

|

|

114.14 | 59.39 | 14.44% | 11.66% | 14.13% | 11.91% |

|

|

29.33 | 18.75 | 14.44% | 11.66% | 14.13% | 11.91% |

|

|

4.87 | 3.90 | 14.44% | 11.66% | 14.13% | 11.91% |