Apache Corp.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Wells Fargo Securities | David Tameron | david.tameron@wellsfargo.com |

| BMO Capital Markets | Phillip Jungwirth | phillip.jungwirth@bmo.com |

| Johnson Rice & Company | Charles Meade | cmeade@jrco.com |

| Evercore ISI | Stephen Richardson | stephen.richardson@evercoreisi.com |

| Scotia Howard Weil | Peter Kissel | peter.kissel@scotiabank.com |

| Raymond James | John Freeman | john.freeman@raymondjames.com |

| Deutsche Bank Research | Ryan Todd | ryan.todd@db.com |

| Wolfe Research | Paul Sankey | psankey@wolferesearch.com |

| RBC Capital Markets | Scott Hanold | scott.hanold@rbccm.com |

| Atlantic Equities | Barry MacCarthy | b.maccarthy@atlantic-equities.com |

| Capital One Securities | Richard Tullis | richard.tullis@capitalone.com |

| Credit Suisse | Edward Westlake | edward.westlake@credit-suisse.com |

| Piper Jaffray | Pearce Hammond | pearce.w.hammond@simmonspjc.com |

| Alembic Global Advisors | James Sullivan | james.sullivan@alembicglobal.com |

| IBERIA Capital Partners | Eric Fox | eric.fox@iberiabank.com |

| Cowen & Company | Charles Robertson | charles.robertson@cowen.com |

| Jefferies | Jonathan D. Wolff | jwolff@jefferies.com |

| Nomura Research | Lloyd Byrne | lloyd.byrne@nomura.com |

| Seaport Global Securities | Michael Kelly | mkelly@seaportglobal.com |

| KLR Group | Gail Nicholson | gn@klrgroup.com |

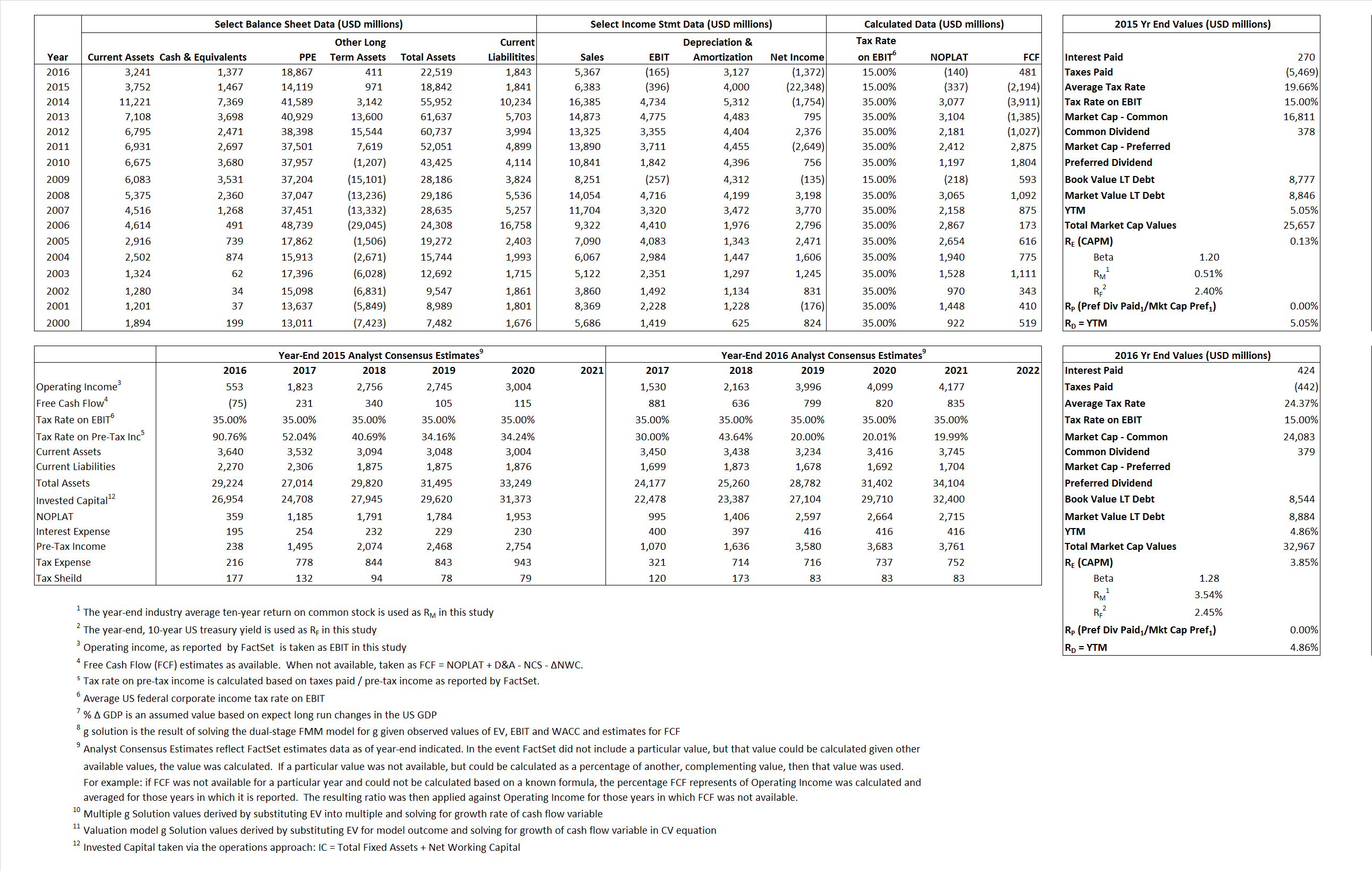

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | (337) | (140) | |

| Free Cash Flow | FCF | (2,194) | 481 | |

| Tax Shield | TS | 53 | 103 | |

| Invested Capital | IC | 17,001 | 20,676 | |

| Return on Invested Capital | ROIC | -1.98% | -0.68% | |

| Net Investment | NetInv | (24,717) | 6,802 | |

| Investment Rate | IR | 7,343.14% | -4,849.91% | |

| Weighted Average Cost of Capital |

WACCMarket | 1.49% | 3.80% | |

| WACCBook | 8.20% | 8.88% | ||

| Enterprise value |

EVMarket | 24,190 | 31,590 | |

| EVBook | 24,121 | 31,250 | ||

| Long-Run Growth |

g = IR x ROIC |

-145.39% | 32.90% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | -6.20% | -3.07% | |

| Depreciation/Amortization Rate | D | 110.99% | 105.57% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

3.79 | 5.89 | 9.68% | 12.28% | 8.58% | 9.12% |

|

|

6.71 | 10.66 | 9.68% | 12.28% | 8.58% | 9.12% |

|

|

-71.87 | -225.24 | 9.68% | 12.28% | 8.58% | 9.12% |

|

|

-11.03 | 65.67 | 9.68% | 12.28% | 8.58% | 9.12% |

|

|

-61.09 | -191.45 | 9.68% | 12.28% | 8.58% | 9.12% |

|

|

1.42 | 1.53 | 9.68% | 12.28% | 8.58% | 9.12% |