Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Raymond James | Aaron Kessler | aaron.kessler@raymondjames.com |

| Nomura Research | Anthony DiClemente | anthony.diclemente@nomura.com |

| CRT Capital Group | Arvind Bhatia | abhatia@sterneageecrt.com |

| Sterne Agee & Leach | Arvind Bhatia | abhatia@sterneageecrt.com |

| Pivotal Research Group | Brian Wieser | brian@pvtl.com |

| Bernstein Research | Carlos Kirjner | carlos.kirjner@bernstein.com |

| Atlantic Equities | James Cordwell | j.cordwell@atlantic-equities.com |

| Oppenheimer | Jason Helfstein | jason.helfstein@opco.com |

| Cowen & Company | John Blackledge | john.blackledge@cowen.com |

| Needham | Laura Martin | lmartin@needhamco.com |

| Rosenblatt Securities | Martin Pyykkonen | mpyykkonen@rblt.com |

| Wedbush Securities | Michael Pachter | michael.pachter@wedbush.com |

| Wells Fargo Securities | Peter Stabler | peter.stabler@wellsfargo.com |

| William Blair | Ralph Schackart | rschackart@williamblair.com |

| SunTrust Robinson Humphrey | Robert S. Peck | robert.peck@suntrust.com |

| JMP Securities | Ronald V. Josey | rjosey@jmpsecurities.com |

| Deutsche Bank Research | Ross Sandler | ross.sandler@db.com |

| Stifel Nicolaus | Scott W. Devitt | swdevitt@stifel.com |

| Susquehanna Financial Group | Shyam Patil | shyam.patil@sig.com |

| Credit Suisse | Stephen Ju | stephen.ju@credit-suisse.com |

| Hilliard Lyons | Stephen Turner | sturner@hilliard.com |

| Cantor Fitzgerald | Youssef H. Squali | ysquali@cantor.com |

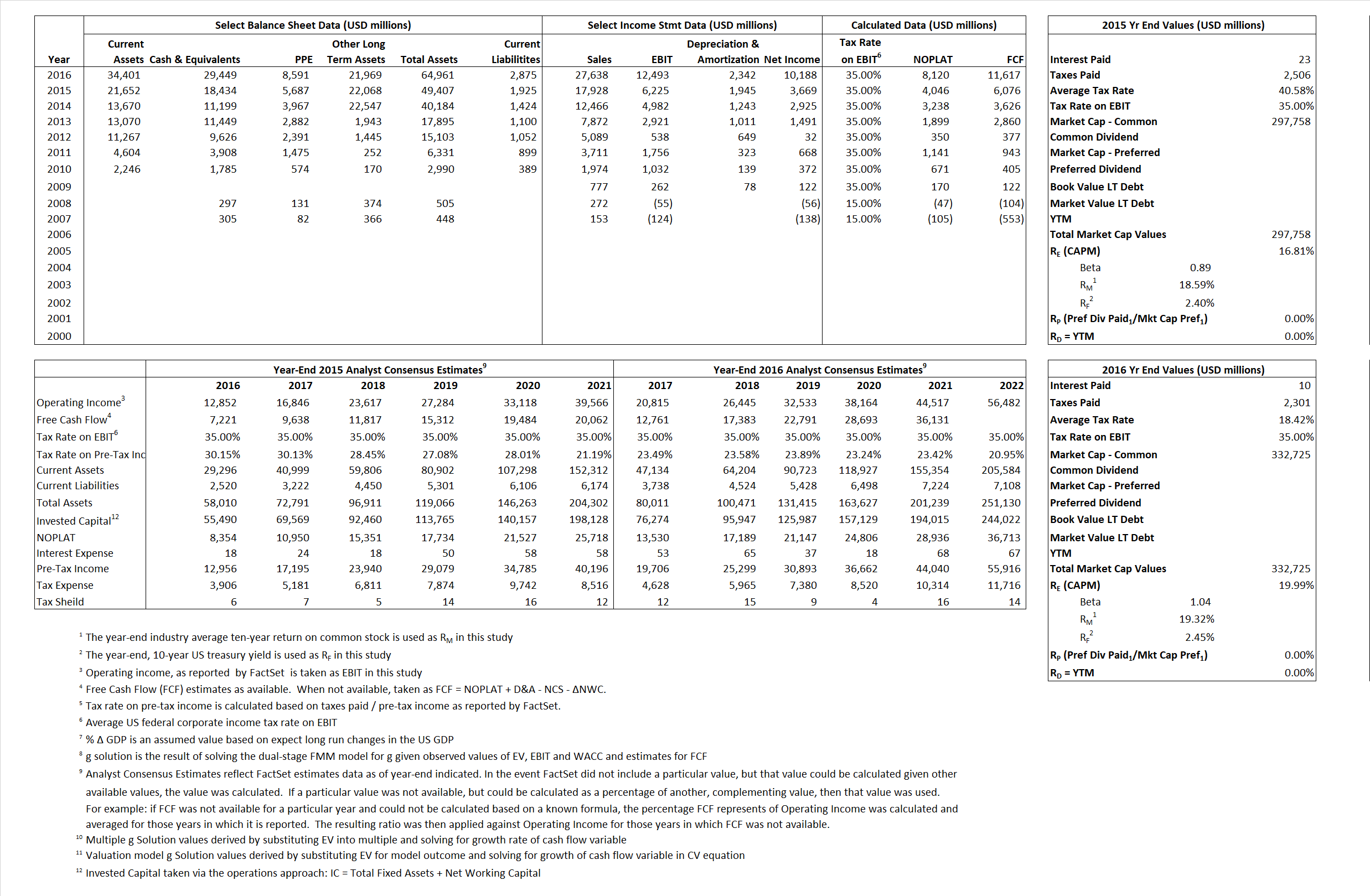

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 4,046 | 8,120 | |

| Free Cash Flow | FCF | 6,076 | 11,617 | |

| Tax Shield | TS | 9 | 2 | |

| Invested Capital | IC | 47,482 | 62,086 | |

| Return on Invested Capital | ROIC | 8.52% | 13.08% | |

| Net Investment | NetInv | 10,667 | 16,946 | |

| Investment Rate | IR | 263.63% | 208.68% | |

| Weighted Average Cost of Capital |

WACCMarket | 16.81% | 19.99% | |

| WACCBook | 8.58% | 9.24% | ||

| Enterprise value |

EVMarket | 279,324 | 303,276 | |

| EVBook | 279,324 | 303,276 | ||

| Long-Run Growth |

g = IR x ROIC |

22.47% | 27.29% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 34.72% | 45.20% | |

| Depreciation/Amortization Rate | D | 23.81% | 15.79% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

15.58 | 10.97 | 18.51% | 21.77% | 17.63% | 20.61% |

|

|

34.19 | 20.44 | 18.51% | 21.77% | 17.63% | 20.61% |

|

|

69.03 | 37.35 | 18.51% | 21.77% | 17.63% | 20.61% |

|

|

45.97 | 26.11 | 18.51% | 21.77% | 17.63% | 20.61% |

|

|

44.87 | 24.28 | 18.51% | 21.77% | 17.63% | 20.61% |

|

|

5.88 | 4.88 | 18.51% | 21.77% | 17.63% | 20.61% |