Apple Inc.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Stifel Nicolaus | Aaron Rakers | rakersa@stifel.com |

| Mizuho Securities USA | Abhey Lamba | abhey.lamba@us.mizuho-sc.com |

| RBC Capital Markets | Amit Daryanani | amit.daryanani@rbccm.com |

| Brean Capital, LLC | Ananda Baruah | abaruah@breancapital.com |

| Oppenheimer | Andrew Uerkwitz | andrew.uerkwitz@opco.com |

| Pacific Crest Securities-KBCM | Andy Hargreaves | ahargreaves@pacific-crest.com |

| Pacific Crest | Andy Hargreaves | ahargreaves@pacific-crest.com |

| William Blair | Anil Doradla | adoradla@williamblair.com |

| Drexel Hamilton | Brian J. White | bwhite@drexelhamilton.com |

| BGC Financial, L.P. | Colin W. Gillis | cgillis@bgcpartners.com |

| Piper Jaffray | Gene Munster | gene.a.munster@pjc.com |

| Atlantic Equities | James Cordwell | j.cordwell@atlantic-equities.com |

| Nomura Research | Jeffrey Kvaal | jeffrey.kvaal@nomura.com |

| Rosenblatt Securities | Jun Zhang | jzhang@rblt.com |

| Credit Suisse | Kulbinder Garcha | kulbinder.garcha@credit-suisse.com |

| Needham | Laura Martin | lmartin@needhamco.com |

| Wells Fargo Securities | Maynard J. Um | maynard.um@wellsfargo.com |

| Maxim Group | Nehal Chokshi | maynard.um@wellsfargo.com |

| CRT Capital Group | Rob Cihra | rcihra@sterneageecrt.com |

| Cross Research | Shannon Cross | shannon@crossresearch.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| Deutsche Bank Research | Sherri Scribner | sherri.scribner@db.com |

| Hilliard Lyons | Stephen Turner | sturner@hilliard.com |

| Canaccord Genuity | T. Michael Walkley | mwalkley@canaccordgenuity.com |

| Raymond James | Tavis C. McCourt | tavis.mccourt@raymondjames.com |

| BMO Capital Markets | Tim Long | tim.long@bmo.com |

| Cowen & Company | Timothy Arcuri | timothy.arcuri@cowen.com |

| Bernstein Research | Toni M. Sacconaghi Jr | sacconaghi@bernstein.com |

| BTIG | Walter Piecyk | wpiecyk@btig.com |

| Daiwa Securities Co. Ltd. | Yoko Yamada | yoko.yamada@us.daiwacm.com |

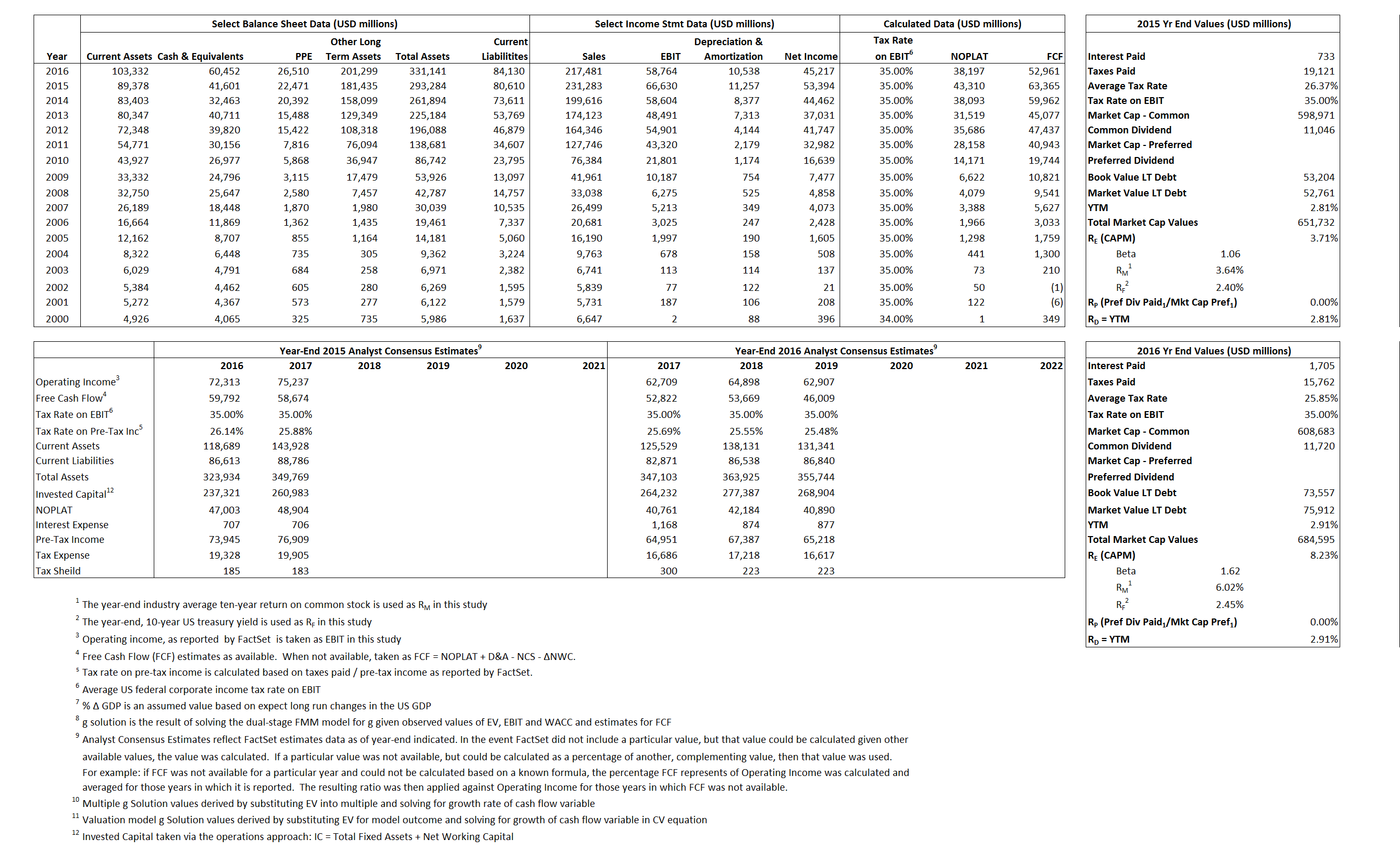

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 43,310 | 38,197 | |

| Free Cash Flow | FCF | 63,365 | 52,961 | |

| Tax Shield | TS | 193 | 441 | |

| Invested Capital | IC | 212,674 | 247,011 | |

| Return on Invested Capital | ROIC | 20.36% | 15.46% | |

| Net Investment | NetInv | 35,648 | 44,875 | |

| Investment Rate | IR | 82.31% | 117.48% | |

| Weighted Average Cost of Capital |

WACCMarket | 3.58% | 7.56% | |

| WACCBook | 9.44% | 9.15% | ||

| Enterprise value |

EVMarket | 610,131 | 624,143 | |

| EVBook | 610,574 | 621,788 | ||

| Long-Run Growth |

g = IR x ROIC |

16.76% | 18.17% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 28.81% | 27.02% | |

| Depreciation/Amortization Rate | D | 14.45% | 15.21% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.64 |

2.87 | -5.40% | 2.38% | -7.53% | 3.87% |

|

|

7.83 | 9.01 | -5.40% | 2.38% | -7.53% | 3.87% |

|

|

14.09 |

16.34 | -5.40% | 2.38% | -7.53% | 3.87% |

|

|

9.63 |

11.78 | -5.40% | 2.38% | -7.53% | 3.87% |

|

|

9.16 | 10.62 | -5.40% | 2.38% | -7.53% | 3.87% |

|

|

2.87 |

2.53 | -5.40% | 2.38% | -7.53% | 3.87% |