Walt Disney Company

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| JBL Advisors | Jeffrey B. Logsdon | jeff@jbladvisors.com |

| Topeka Capital Markets | David W. Miller | dwm@topekacapitalmarkets.com |

| Drexel Hamilton | Tony Wible | twible@drexelhamilton.com |

| Evercore ISI | Vijay Jayant | vijay.jayant@evercoreisi.com |

| Pivotal Research Group | Brian Wieser | brian@pvtl.com |

| Guggenheim Securities | Michael C. Morris | michael.morris@guggenheimpartners.com |

| RBC Capital Markets | Steven Cahall | steven.cahall@rbccm.com |

| Atlantic Equities | Hamiton Faber | h.faber@altantic-equities.com |

| Cowen & Company | Doug Creutz | doug.creutz@cowen.com |

| Wells Fargo Securities | Marci Ryvicker | marci.ryvicker@wellsfargo.com |

| Piper Jaffray | Stan Meyers | stan.x.meyers@pjc.com |

| Stifel Nicolaus | Benjamin E. Mogil | bmogil@stifel.com |

| FBR Capital Markets & Co | Barton Crockett | bcrockett@fbr.com |

| Jefferies | John Janedis | jjanedis@jefferies.com |

| Needham | Laura Martin | lmartin@needhamco.com |

| BMO Capital Markets | Daniel Salmon | dan.salmon@bmo.com |

| Nomura Research | Anthony DiClemente | anthony.diclemente@nomura.com |

| Credit Suisse | Omar Sheikh | omar.sheikh@credit-suisse.com |

| Deutsche Bank Research | Bryan Kraft | bryan.kraft@db.com |

| Bernstein Research | Todd Juenger | todd.juenger@bernstein.com |

| Hilliard Lyons | Jeffrey S. Thomison | jthomison@hilliard.com |

| Rosenblatt Securities | Martin Pyykkonen | mpyykkonen@rbit.com |

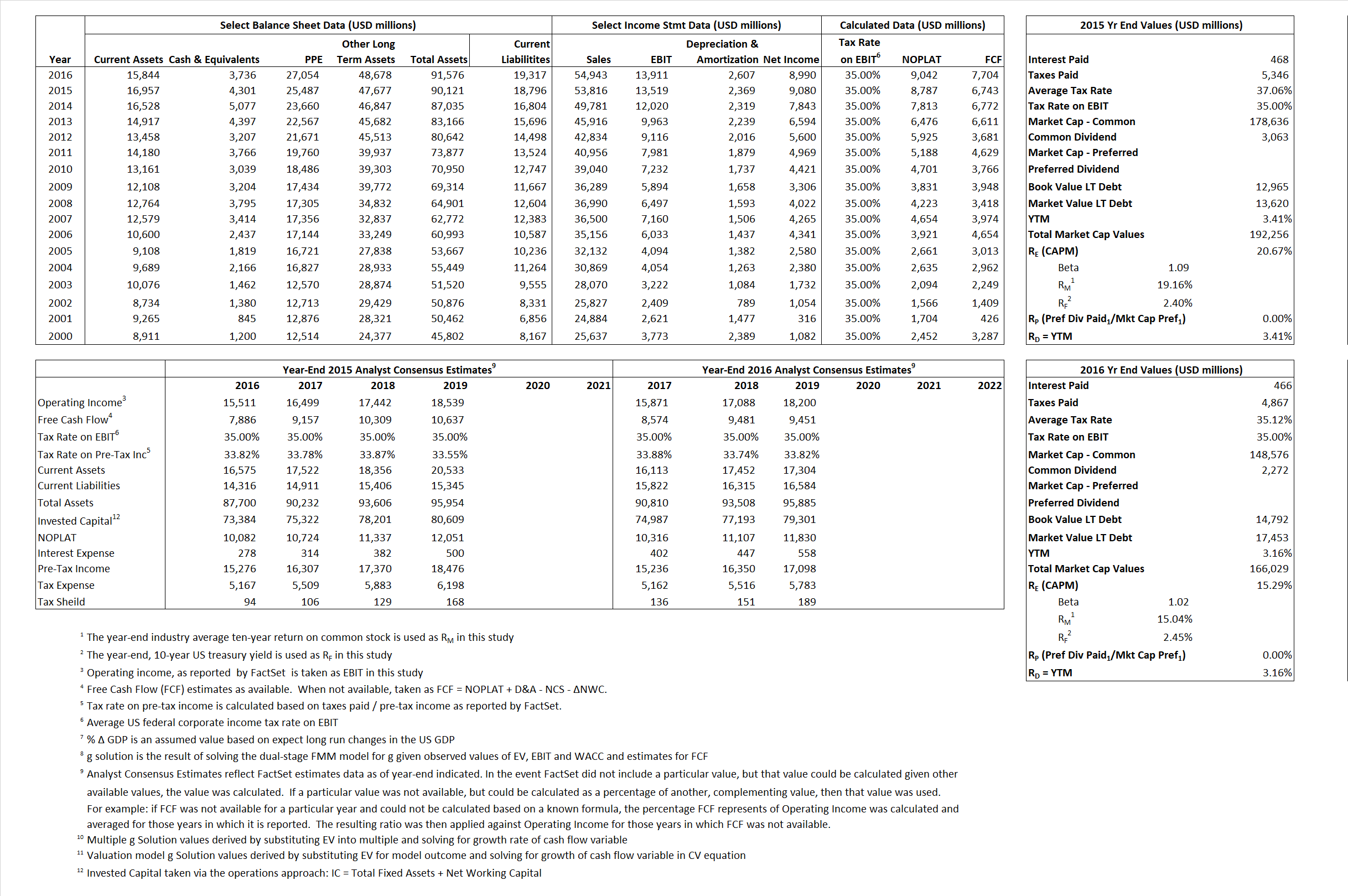

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 8,787 | 9,042 | |

| Free Cash Flow | FCF | 6,743 | 7,704 | |

| Tax Shield | TS | 173 | 164 | |

| Invested Capital | IC | 71,325 | 72,259 | |

| Return on Invested Capital | ROIC | 12.32% | 12.51% | |

| Net Investment | NetInv | 3,463 | 3,541 | |

| Investment Rate | IR | 39.41% | 39.16% | |

| Weighted Average Cost of Capital |

WACCMarket | 19.36% | 13.90% | |

| WACCBook | 8.99% | 8.55% | ||

| Enterprise value |

EVMarket | 187,955 | 162,293 | |

| EVBook | 187,300 | 159,632 | ||

| Long-Run Growth |

g = IR x ROIC |

4.86% | 4.90% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 25.12% | 25.32% | |

| Depreciation/Amortization Rate | D | 14.91% | 15.78% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

3.49 | 2.95 | 23.66% | 15.01% | 21.28% | 14.50% |

|

|

11.83 | 9.83 | 23.66% | 15.01% | 21.28% | 14.50% |

|

|

21.39 | 17.95 | 23.66% | 15.01% | 21.28% | 14.50% |

|

|

27.87 | 21.07 | 23.66% | 15.01% | 21.28% | 14.50% |

|

|

13.90 | 11.67 | 23.66% | 15.01% | 21.28% | 14.50% |

|

|

2.64 | 2.25 | 23.66% | 15.01% | 21.28% | 14.50% |