Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

Return to top of page

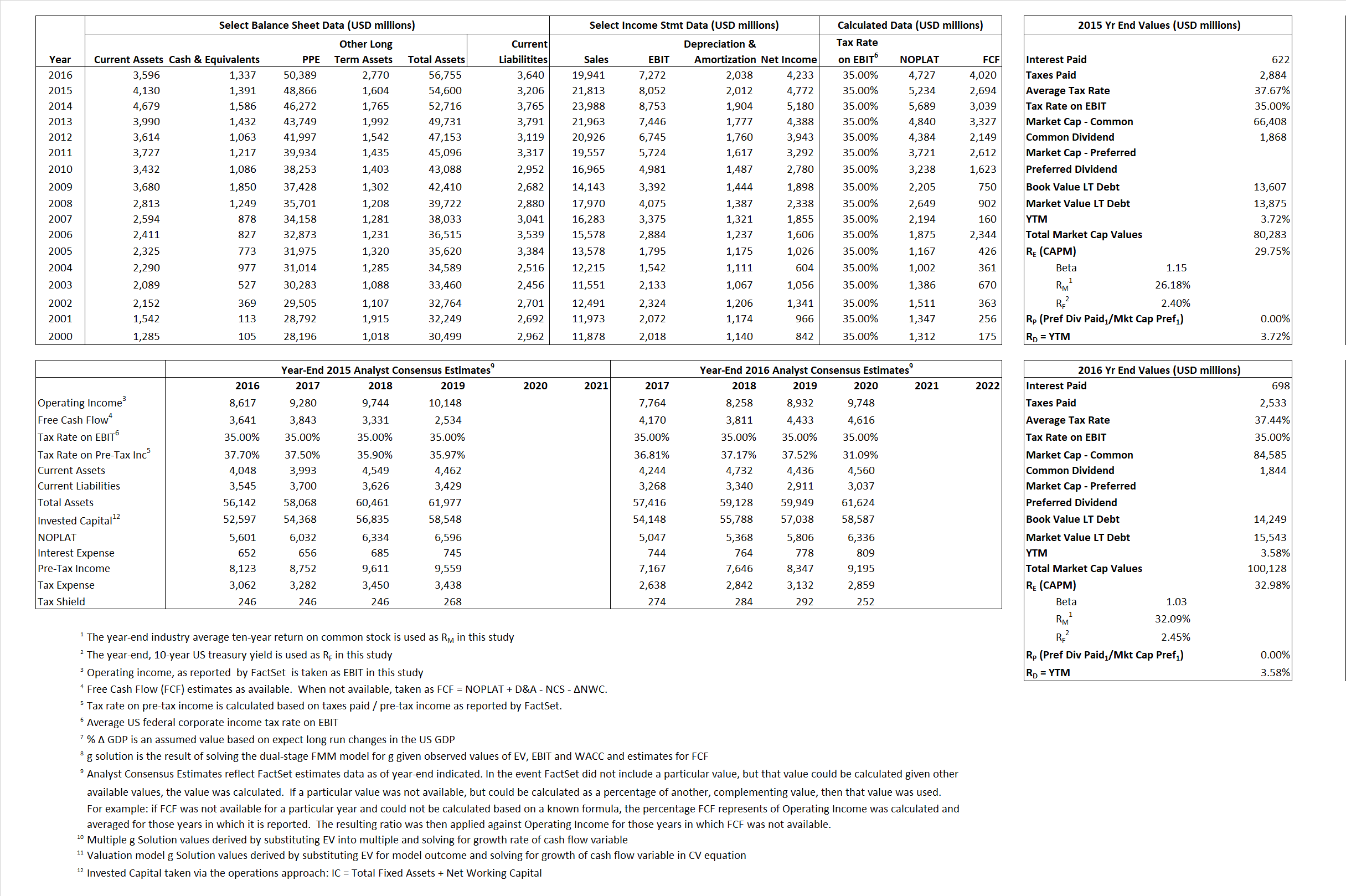

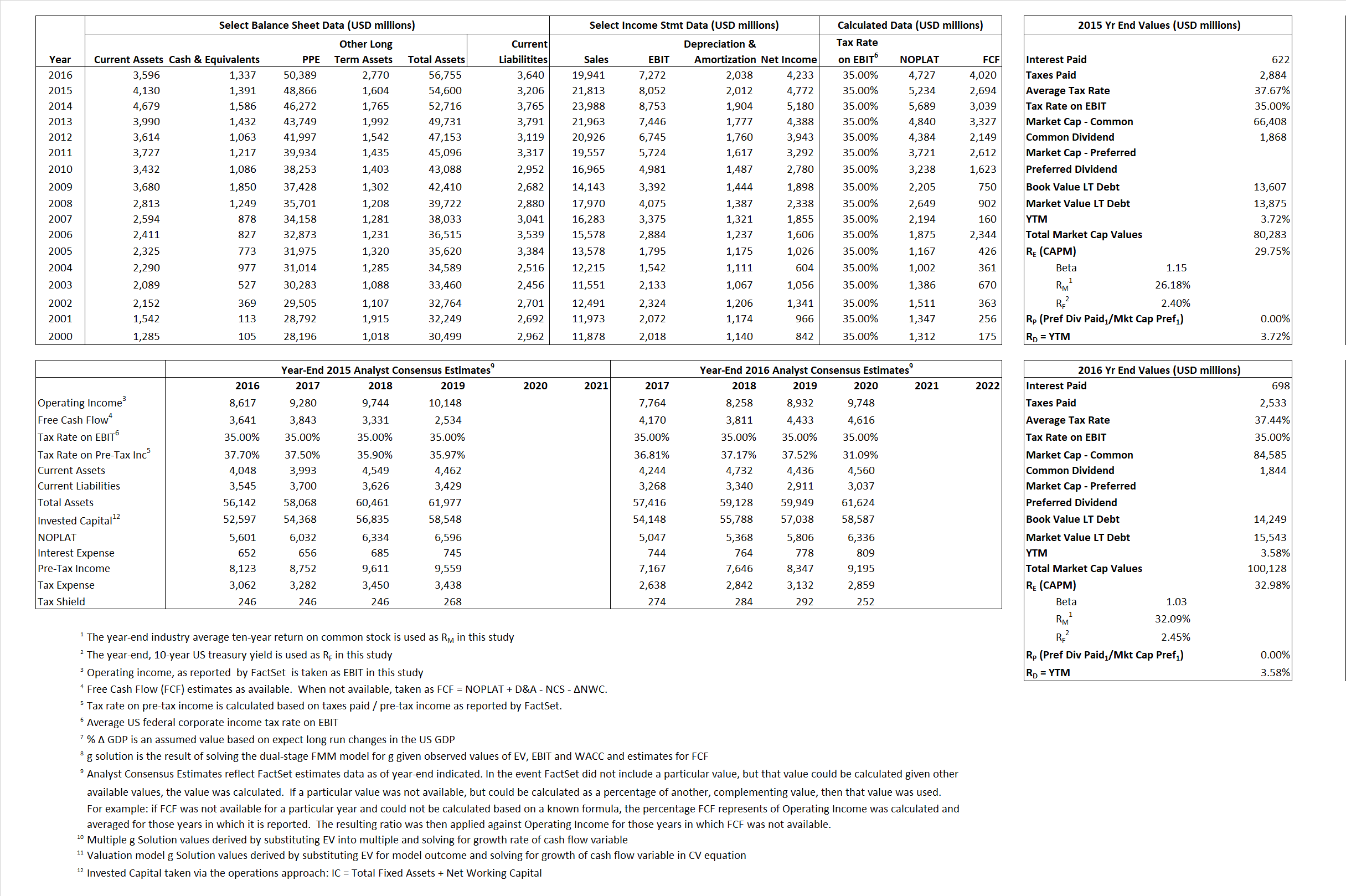

Primary Input Data

Return to top of page

Derived Input Data

Derived Input

|

Label

|

2015 Value

|

2016

Value

|

Equational Form

|

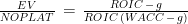

| Net Operating Profit Less Adjusted Taxes |

NOPLAT |

5,234 |

4,727 |

|

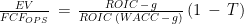

| Free Cash Flow |

FCF |

2,694 |

4,020 |

|

| Tax Shield |

TS |

234 |

261 |

|

| Invested Capital |

IC |

51,394 |

53,115 |

|

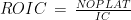

| Return on Invested Capital |

ROIC |

10.18% |

8.90% |

|

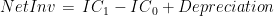

| Net Investment |

NetInv |

4,455 |

3,759 |

|

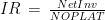

| Investment Rate |

IR |

85.12% |

79.53% |

|

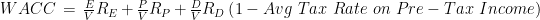

Weighted Average Cost of Capital

|

WACCMarket |

25.01% |

28.21% |

|

| WACCBook |

8.96% |

8.05% |

|

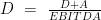

Enterprise value

|

EVMarket |

78,892 |

98,791 |

|

| EVBook |

78,678 |

97,497 |

|

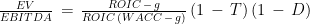

Long-Run Growth

|

g = IR x ROIC

|

8.67% |

7.08% |

Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

g = %  GDP GDP |

2.50% |

2.50% |

|

| Margin from Operations |

M |

36.91% |

36.47% |

|

| Depreciation/Amortization Rate |

D |

19.99% |

21.89% |

|

Return to top of page

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form

|

Observed Value

|

Single-stage

multiple g solution

|

Two-stage valuation

model g solution

|

| 12/31/2015 |

12/31/2016 |

12/31/2015 |

12/31/2016 |

12/31/2015 |

12/31/2016 |

|

EV/SALES

|

3.62 |

4.95 |

52.71% |

50.66% |

31.28% |

33.00% |

|

EV/EBITDA

|

7.84 |

10.61 |

52.71% |

50.66% |

31.28% |

33.00% |

|

EV/NOPLAT

|

15.07 |

20.90 |

52.71% |

50.66% |

31.28% |

33.00% |

|

EV/FCFOPS

|

29.28 |

24.57 |

52.71% |

50.66% |

31.28% |

33.00% |

|

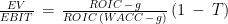

EV/EBIT

|

9.80 |

13.59 |

52.71% |

50.66% |

31.28% |

33.00% |

|

EV/IC

|

1.54 |

1.86 |

52.71% |

50.66% |

31.28% |

33.00% |

Return to top of page