Halliburton

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Piper Jaffray | Bill Herbert | william.a.herbert@simmonspjc.com |

| Scotia Howard Weil | Bill Sanchez | william.sanchez@scotiabank.com |

| Jefferies | Brad Handler | brad.handler@jefferies.com |

| GMP Securities | Brian Uhlmer | buhlmer@gmpsecurities.com |

| Tudor Pickering Holt & Co. | Byron K. Pope | bpope@tudorpickering.com |

| Susquehanna Financial Group | Charles Minervino | charles.minervino@sig.com |

| BMO Capital Markets | Daniel Boyd | daniel.boyd@bmo.com |

| Johnson Rice & Company | Daniel Burke | dburke@jrco.com |

| KLR Group | Darren Gacicia | dfg@klrgroup.com |

| Societe Generale | Edward Muztafago | edward.muztafago@sgcib.com |

| Raymond James | J .Marshall Adkins | marshall.adkins@raymondjames.com |

| Evercore ISI | James West | james.west@evercoreisi.com |

| Credit Suisse | James Wicklund | james.wicklund@credit-suisse.com |

| Wells Fargo Securities | Judson E. Bailey | jud.bailey@wellsfargo.com |

| Seaport Global Securities | Ken Sill | ksill@seaportglobal.com |

| Griffin Securities | Kevin Simpson | ksimpson@griffinsecurities.com |

| RBC Capital Markets | Kurt Hallead | kurt.hallead@rbccm.com |

| Capital One Securities | Luke M. Lemoine | luke.lemoine@capitalone.com |

| Cowen & Company | Marc Bianchi | marc.bianchi@cowen.com |

| Nomura Research | Matthew Johnston | matthew.johnston@nomura.com |

| Stephens Inc | Matthew Marietta | matt.marietta@stephens.com |

| Guggenheim Securities | Michael LaMotte | michael.lamotte@guggenheimpartners.com |

| Deutsche Bank Research | Mike Urban | michael.urban@db.com |

| Clarksons Platou Securities | Nokta Haithum | haithum.nokta@clarksons.com |

| IBERIA Capital Partners | Robert Mackenzie | robert.mackenzie@iberiabank.com |

| KeyBanc Capital Markets | Robin Shoemaker | robin_shoemaker@key.com |

| DA Davidson | Sonny Randhawa | srandhawa@dadco.com |

| FBR Capital Markets & Co | Thomas Curran | tcurran@fbr.com |

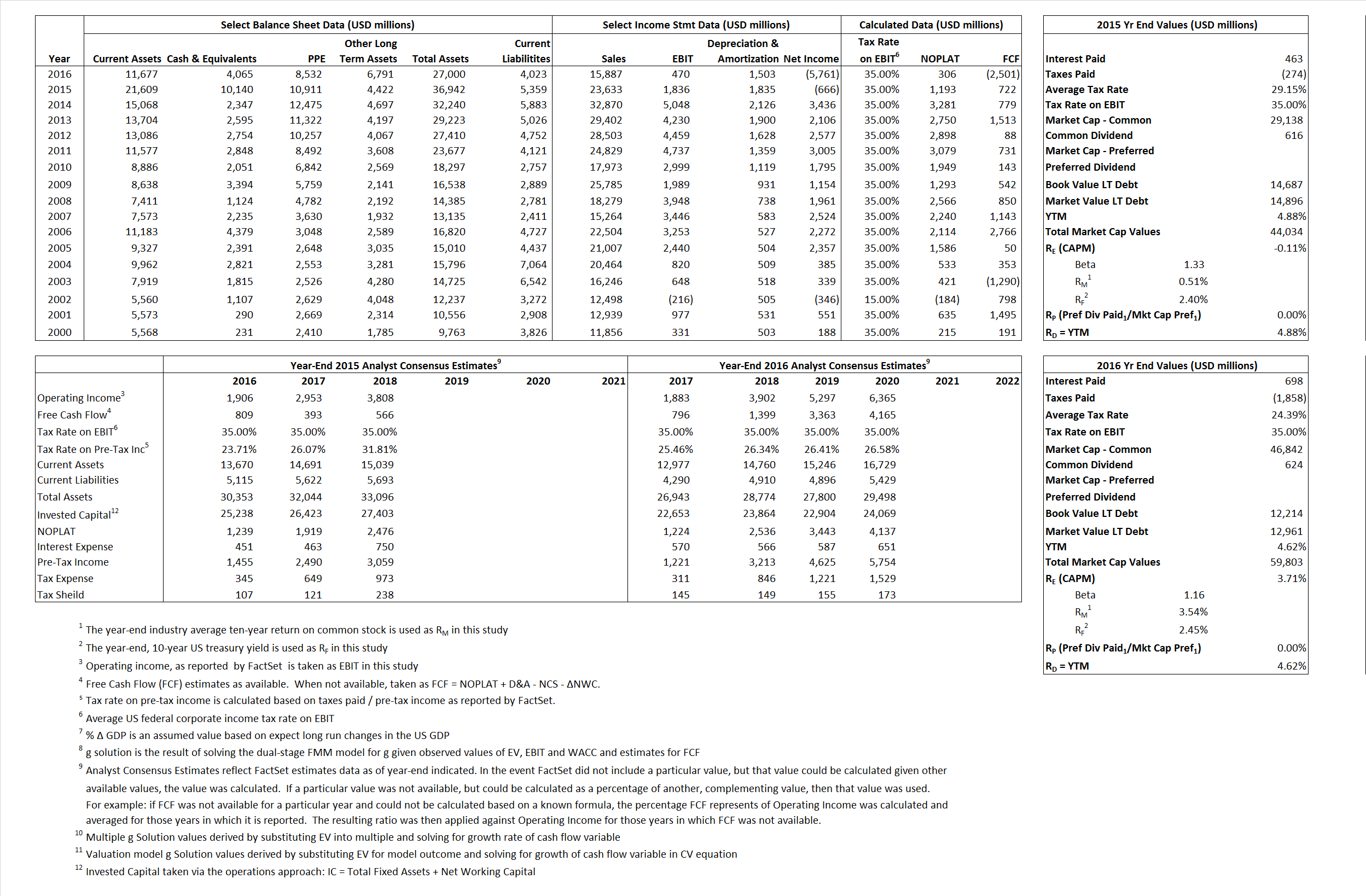

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,193 | 306 | |

| Free Cash Flow | FCF | 722 | (2,501) | |

| Tax Shield | TS | 135 | 170 | |

| Invested Capital | IC | 31,583 | 22,977 | |

| Return on Invested Capital | ROIC | 3.78% | 1.33% | |

| Net Investment | NetInv | 7,061 | (7,103) | |

| Investment Rate | IR | 591.67% | -2,325.04% | |

| Weighted Average Cost of Capital |

WACCMarket | 1.09% | 3.67% | |

| WACCBook | 8.67% | 8.61% | ||

| Enterprise value |

EVMarket | 33,894 | 55,738 | |

| EVBook | 33,685 | 54,991 | ||

| Long-Run Growth |

g = IR x ROIC |

22.36% | -30.91% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 7.77% | 2.96% | |

| Depreciation/Amortization Rate | D | 49.99% | 76.18% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.43 | 3.51 | -35.58% | 5.31% | -50.40% | 4.96% |

|

|

9.23 | 28.25 | 35.58% | 5.31% | -50.40% | 4.96% |

|

|

28.40 | 182.45 | 35.58% | 5.31% | -50.40% | 4.96% |

|

|

46.95 | -22.29 | 35.58% | 5.31% | -50.40% | 4.96% |

|

|

18.46 | 118.59 | 35.58% | 5.31% | -50.40% | 4.96% |

|

|

1.07 | 2.43 | 35.58% | 5.31% | -50.40% | 4.96% |