NORFOLK

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Credit Suisse | Allison M. Landry | allison.landry@credit-suisse.com |

| Susquehanna Financial Group | Bascome Majors | bascome.majors@sig.com |

| TD Securities | Cherilyn Radbourne | cherilyn.radbourne@tdsecurities.com |

| Bernstein Research | David Vernon | david.vernon@bernstein.com |

| Avondale Partners | Donald Broughton | dbroughton@avondalepartnersllc.com |

| BMO Capital Markets | Fadi Chamoun | fadi.chamoun@bmo.com |

| Cowen & Company | Jason H. Seidl | jason.seidl@cowen.com |

| Buckingham Research | Jeffrey Kauffman | jkauffman@buckresearch.com |

| RBC Capital Markets | John Barnes | john.barnes@rbccm.com |

| Stifel Nicolaus | John G. Larkin | jglarkin@stifel.com |

| Stephens Inc | Justin Long | justin.long@stephens.com |

| BB&T Capital Markets | Mark A. Levin | mlevin@bbandtcm.com |

| Nomura Research | Matt Troy | matt.troy@nomura.com |

| Raymond James | Patrick Tyler Brown | tyler.brown@raymondjames.com |

| Topeka Capital Markets | Rick Paterson | rp@topekacapitalmarkets.com |

| Deutsche Bank Research | Robert Salmon | robert.salmon@db.com |

| Wolfe Research | Scott H. Group | sgroup@wolferesearch.com |

| Scotiabank GBM | Turan Quettawala | turan.quettawala@scotiabank.com |

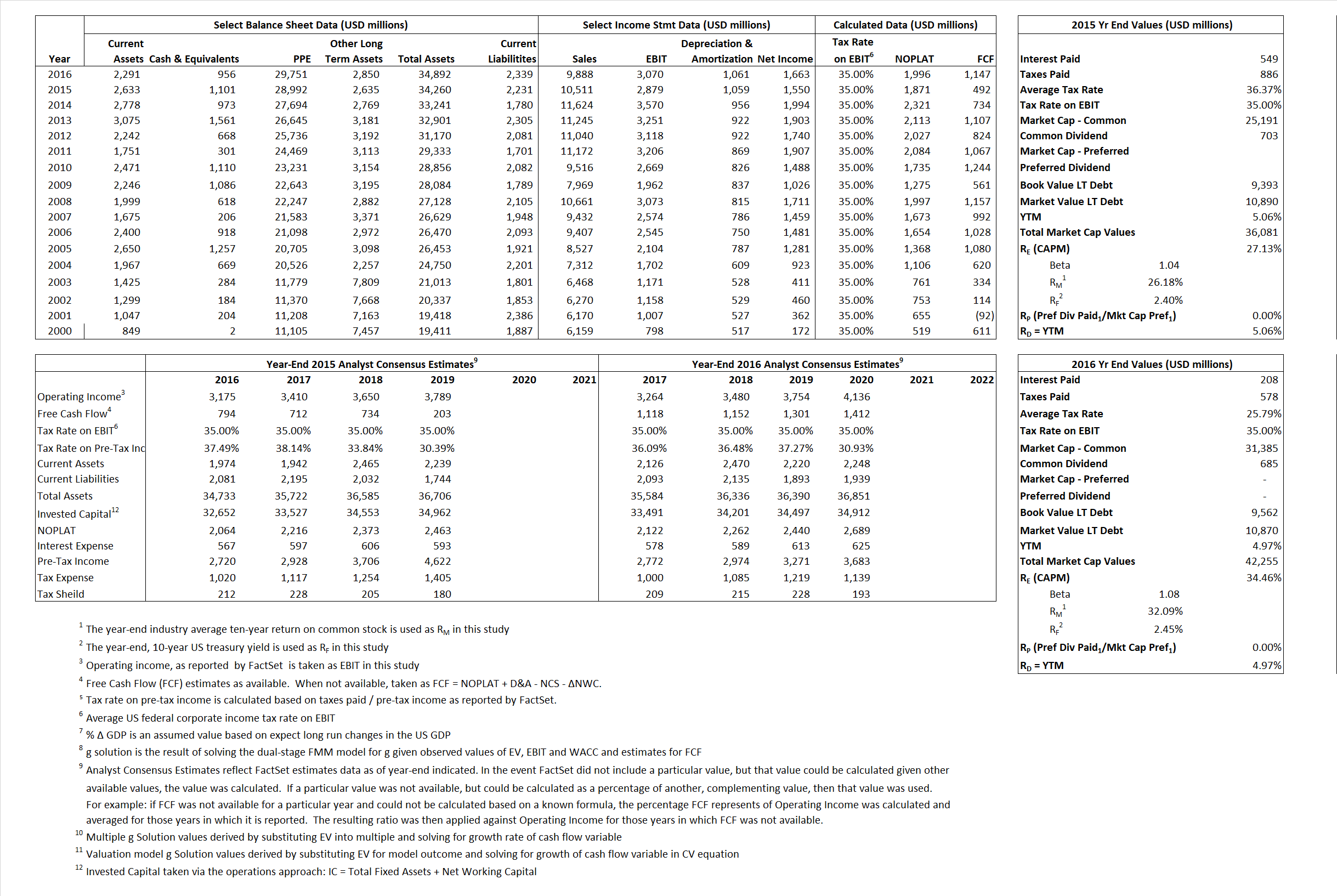

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,871 | 1,996 | |

| Free Cash Flow | FCF | 492 | 1,147 | |

| Tax Shield | TS | 200 | 54 | |

| Invested Capital | IC | 32,029 | 32,553 | |

| Return on Invested Capital | ROIC | 5.84% | 6.13% | |

| Net Investment | NetInv | 1,627 | 1,585 | |

| Investment Rate | IR | 86.94% | 79.43% | |

| Weighted Average Cost of Capital |

WACCMarket | 19.91% | 26.54% | |

| WACCBook | 7.45% | 7.66% | ||

| Enterprise value |

EVMarket | 34,980 | 41,299 | |

| EVBook | 33,628 | 39,991 | ||

| Long-Run Growth |

g = IR x ROIC |

5.08% | 4.87% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 27.39% | 31.05% | |

| Depreciation/Amortization Rate | D | 26.89% | 25.68% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

3.33 | 4.18 | 172.65% | 102.53% | 32.15% | 35.60% |

|

|

8.88 | 10.00 | 172.65% | 102.53% | 32.15% | 35.60% |

|

|

18.69 | 20.70 | 172.65% | 102.53% | 32.15% | 35.60% |

|

|

71.10 | 36.01 | 172.65% | 102.53% | 32.15% | 35.60% |

|

|

12.15 | 13.45 | 172.65% | 102.53% | 32.15% | 35.60% |

|

|

1.09 | 1.27 | 172.65% | 102.53% | 32.15% | 35.60% |