Lockheed Martin Corp.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Cowen & Company | Cai von Rumohr | cai.von-rumohr@cowen.com |

| Bernstein Research | Douglas S. Harned | douglas.harned@bernstein.com |

| Jefferies | Howard A. Rubel | hrubel@jefferies.com |

| Wolfe Research | Hunter K. Keay | hkeay@wolferesearch.com |

| Stifel Nicolaus | Joseph W. DeNardi | denardij@stifel.com |

| Deutsche Bank Research | Myles Walton | myles.walton@db.com |

| CRT Capital Group | Peter Arment | parment@sterneageecrt.com |

| Drexel Hamilton | Peter Skibitski | pskibitski@drexelhamilton.com |

| Buckingham Research | Richard Safran | rsafran@buckresearch.com |

| Credit Suisse | Robert Spingarn | robert.spingarn@credit-suisse.com |

| RBC Capital Markets | Robert Stallard | robert.stallard@rbccm.com |

| Guggenheim Securities | Roman Schweizer | roman.schweizer@guggenheimpartners.com |

| Wells Fargo Securities | Sam J. Pearlstein | sam.pearlstein@wellsfargo.com |

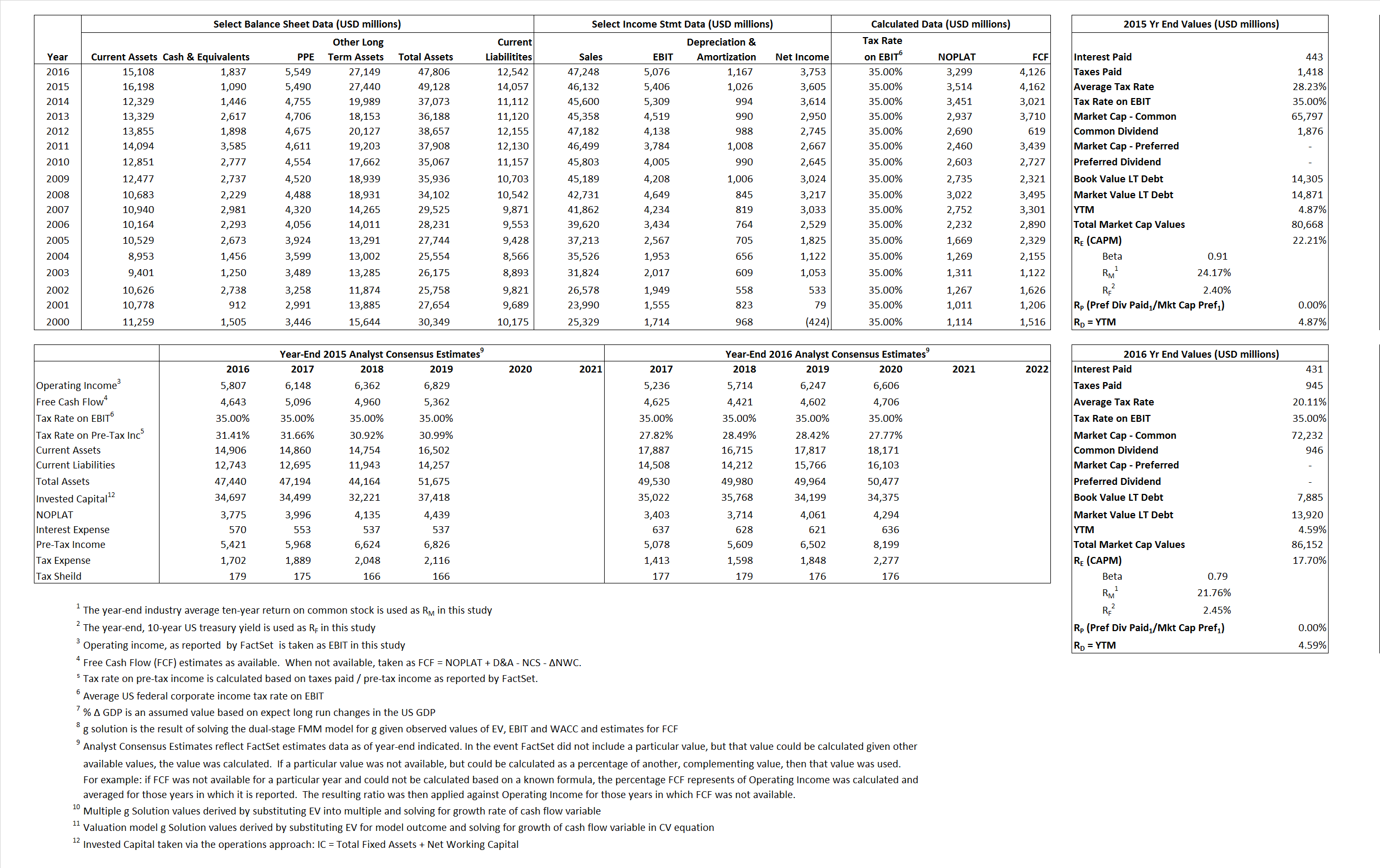

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 3,514 | 3,299 | |

| Free Cash Flow | FCF | 4,162 | 4,126 | |

| Tax Shield | TS | 125 | 87 | |

| Invested Capital | IC | 35,071 | 35,264 | |

| Return on Invested Capital | ROIC | 10.02% | 9.36% | |

| Net Investment | NetInv | 10,136 | 1,360 | |

| Investment Rate | IR | 288.45% | 41.22% | |

| Weighted Average Cost of Capital |

WACCMarket | 18.76% | 15.44% | |

| WACCBook | 7.52% | 6.77% | ||

| Enterprise value |

EVMarket | 79,578 | 84,315 | |

| EVBook | 78,265 | 78,280 | ||

| Long-Run Growth |

g = IR x ROIC |

28.90% | 3.86% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 11.72% | 10.74% | |

| Depreciation/Amortization Rate | D | 15.95% | 18.69% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.73 | 1.78 | 25.65% | 19.81% | 21.92% | 17.31% |

|

|

12.37 | 13.52 | 25.65% | 19.81% | 21.92% | 17.31% |

|

|

22.65 | 25.55 | 25.65% | 19.81% | 21.92% | 17.31% |

|

|

19.12 | 20.44 | 25.65% | 19.81% | 21.92% | 17.31% |

|

|

14.72 | 16.61 | 25.65% | 19.81% | 21.92% | 17.31% |

|

|

2.27 | 2.39 | 25.65% | 19.81% | 21.92% | 17.31% |