Wells Fargo and Company

Analyst Listings

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Nomura Research | Bill Carcache | bill.carcache@nomura.com |

| Oppenheimer | Chris Kotowski | chris.kotowski@opco.com |

| Keefe Bruyette & Woods | Christopher M. Mutascio | mutascioc@kbw.com |

| Atlantic Equities | Christopher Wheeler | c.wheeler@atlantic-equities.com |

| Drexel Hamilton | David Hilder | dhilder@drexelhamilton.com |

| Raymond James | David Long | david.j.long@raymondjames.com |

| Guggenheim Securities | Eric Wasserstrom | eric.wasserstrom@guggenheimpartners.com |

| Susquehanna Financial Group | Jack Micenko | jack.micenko@sig.com |

| BMO Capital Markets | James Fotheringham | james.fotheringham@bmo.com |

| Buckingham Research | James Mitchell | jmitchell@buckresearch.com |

| RBC Capital Markets | Joe Morford | joe.morford@rbccm.com |

| Bernstein Research | John E. McDonald | john.mcdonald@bernstein.com |

| Evercore ISI | John Pancari | john.pancari@evercoreisi.com |

| Jefferies | Kenneth Usdin | kusdin@jefferies.com |

| Piper Jaffray | Kevin J. Barker | kevin.j.barker@pjc.com |

| Deutsche Bank Research | Matthew O’Connor | matthew.o-connor@db.com |

| Societe Generale | Murali Gopal | murali.gopal@sgcib.com |

| FBR Capital Markets & Co | Paul J. Miller | pmiller@fbr.com |

| Sandler O’Neill & Partners | R. Scott Siefers | ssiefers@sandleroneill.com |

| Credit Suisse | Susan Roth Katzke | susan.katzke@credit-suisse.com |

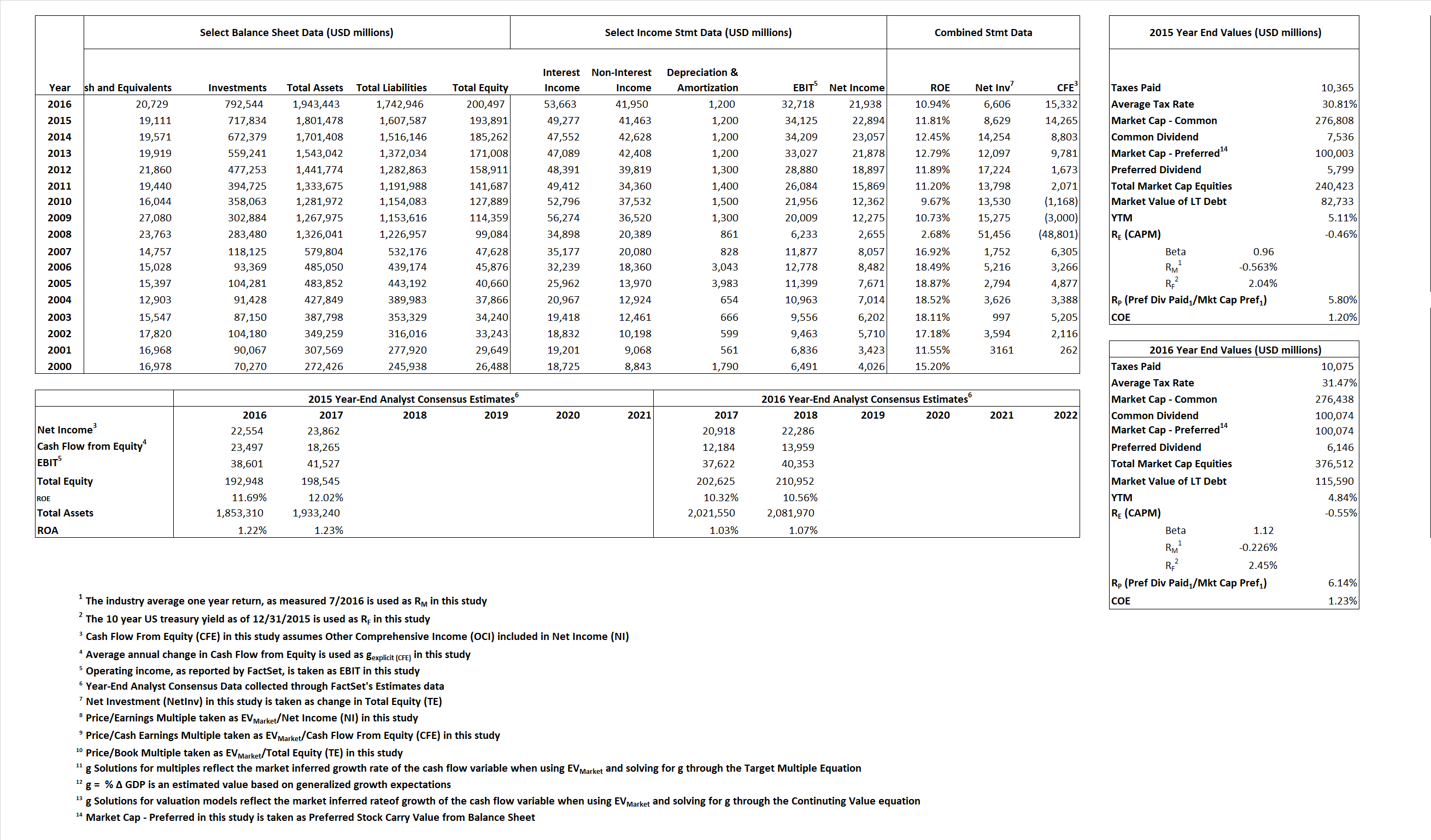

Primary Input Data

Derived Input Data

| Derived Input | Label |

2015 |

2016 |

Equational Form |

| Net Income | NI | 22,894 | 21,938 | |

| Cash Flow From Equity | CFE | 14,265 | 15,332 | |

| Total Equity | TE | 193,891 | 200,497 | |

| Return on Equity | ROE | 11.81% | 10.94% | |

| Net Investment | NetInv | 8,629 | 6,606 | |

| Investment Rate | IR | 37.69% | 30.11% | |

| Cost of Equity |

COE | -0.46% | -0.55% | |

| Enterprise value |

EVMarket | 221,312 | 355,783 | |

| Long-Run Growth |

g = IR x ROIC |

4.45% | 3.29% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

| Equational Form |

Observed Value |

Single-stage multiple g solution |

Two-stage valuation model g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

||||||

|

|

||||||

|

|

||||||