American International Group

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Wells Fargo Securities | Elyse Greenspan | elyse.greenspan@wellsfargo.com |

| FBR Capital Markets & Co | Randy Binner | rbinner@fbr.com |

| RBC Capital Markets | Mark Dwelle | mark.dwelle@rbccm.com |

| Bernstein Research | Josh Stirling | josh.stirling@bernstein.com |

| Atlantic Equities | John Heagerty | j.heagerty@atlantic-equities.com |

| Piper Jaffray | John Nadel | john.m.nadel@pjc.com |

| Sandler O’Neill & Partners | Paul Newsome | pnewsome@sandleroneill.com |

| Janney Montgomery Scott | Larry Greenberg | lgreenber@janney.com |

| Keefe Bruyette & Woods | Meyer Shields | mshields@kbw.com |

| William Blair | Adam Klauber | aklauber@williamblair.com |

| BMO Capital Markets | Charles J. Sebaski | charles.sebaski@bmo.com |

| Deutsche Bank Research | Joshua Shanker | joshua.shanker@db.com |

| Credit Suisse | Ryan Tunis | ryan.tunis@credit-suisse.com |

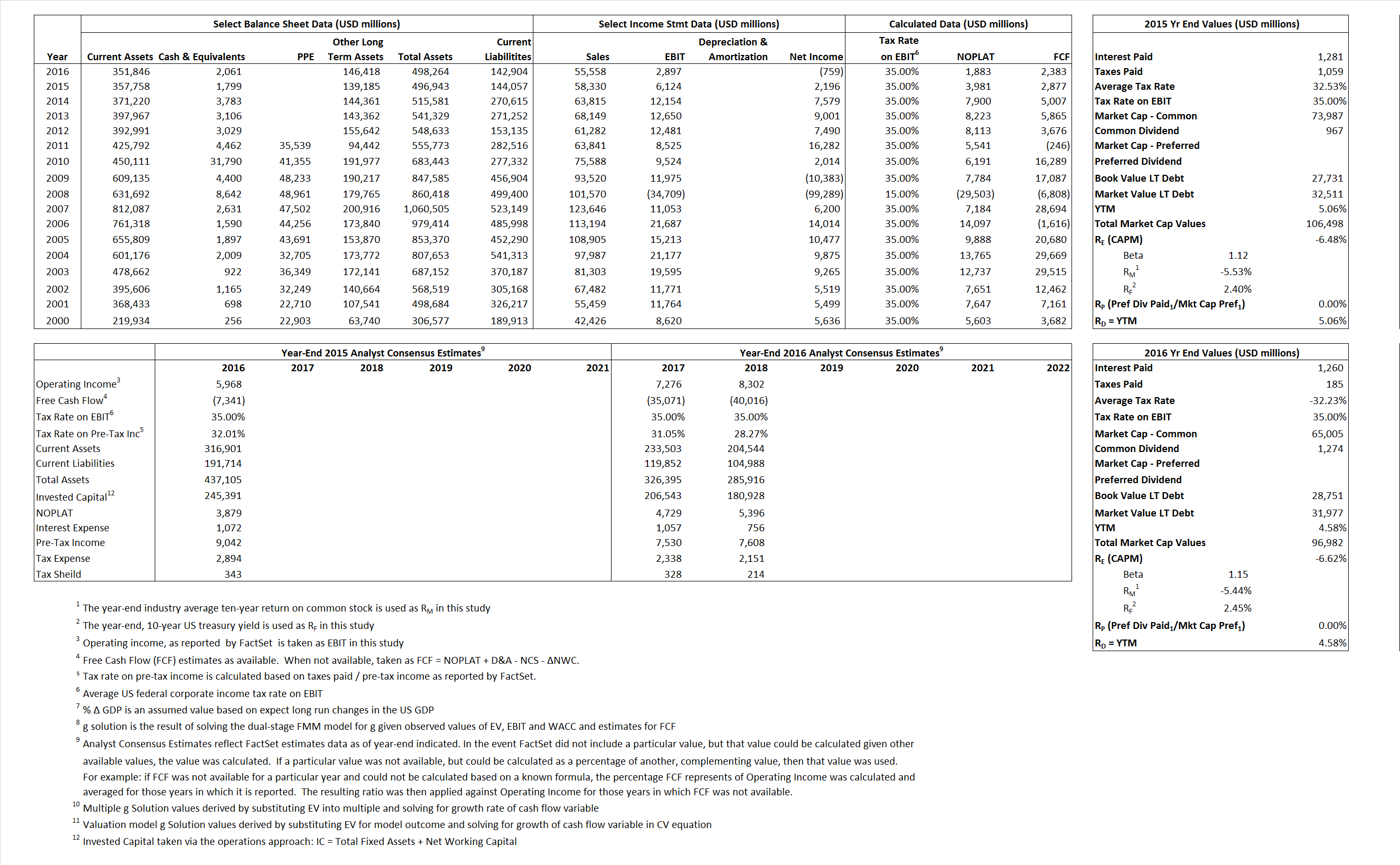

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 3,981 | 1,883 | |

| Free Cash Flow | FCF | 2,877 | 2,383 | |

| Tax Shield | TS | 417 | (406) | |

| Invested Capital | IC | 352,886 | 355,360 | |

| Return on Invested Capital | ROIC | 1.13% | 0.53% | |

| Net Investment | NetInv | 107,920 | 2,474 | |

| Investment Rate | IR | 2,711.15% | 131.38% | |

| Weighted Average Cost of Capital |

WACCMarket | -3.46% | -2.44% | |

| WACCBook | 7.90% | 7.80% | ||

| Enterprise value |

EVMarket | 104,699 | 94,921 | |

| EVBook | 99,919 | 91,695 | ||

| Long-Run Growth |

g = IR x ROIC |

30.58% | 0.70% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 10.50% | 5.21% | |

| Depreciation/Amortization Rate | D | 0.00% | 0.00% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.79 | 1.71 | 3.06% | 1.61% | 3.16% | 1.54% |

|

|

17.10 |

32.77 | 3.06% | 1.61% | 3.16% | 1.54% |

|

|

26.30 | 50.41 | 3.06% | 1.61% | 3.16% | 1.54% |

|

|

36.39 |

39.83 | 3.06% | 1.61% | 3.16% | 1.54% |

|

|

17.10 |

32.77 | 3.06% | 1.61% | 3.16% | 1.54% |

|

|

0.30 |

0.27 | 3.06% | 1.61% | 3.16% | 1.54% |