EMC Corporation

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Stifel Nicolaus | Aaron Rakers | rakersa@stifel.com |

| Mizuho Securities USA | Abhey Lamba | abhey.lamba@us.mizuho-sc.com |

| CRT Capital Group | Alex Kurtz | akurtz@sterneageecrt.com |

| RBC Capital Markets | Amit Daryanani | amit.daryanani@rbccm.com |

| Brean Capital, LLC | Ananda Baruah | abaruah@breancapital.com |

| Piper Jaffray | Andrew J. Nowinski | andrew.j.nowinski@pjc.com |

| Pacific Crest Securities-KBCM | Brent Bracelin | bbracelin@pacific-crest.com |

| Raymond James | Brian G. Alexander | brian.alexander@raymondjames.com |

| Drexel Hamilton | Brian J. White | bwhite@drexelhamilton.com |

| Oppenheimer | Ittai Kidron | ittai.kidron@opco.com |

| Jefferies | James Kisner | jkisner@jefferies.com |

| William Blair | Jason Ader | jader@williamblair.com |

| Longbow Research | Joe Wittine | jwittine@longbowresearch.com |

| Atlantic Equities | Josep Bori | j.bori@atlantic-equities.com |

| Wells Fargo Securities | Maynard J. Um | maynard.um@wellsfargo.com |

| Susquehanna Financial Group | Mehdi Hosseini | mehdi.hosseini@sig.com |

| Maxim Group | Nehal Chokshi | nehalchokshi@techinsightsresearch.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| Deutsche Bank Research | Sherri Scribner | sherri.scribner@db.com |

| Summit Research | Srini Nandury | srini@summitresearchllc.com |

| Hilliard Lyons | Stephen Turner | sturner@hilliard.com |

| Cross Research | Steven Fox | steven@crossresearch.com |

| Bernstein Research | Toni M. Sacconaghi Jr | sacconaghi@bernstein.com |

| Daiwa Securities Co. Ltd. | Yoko Yamada | yoko.yamada@us.daiwacm.com |

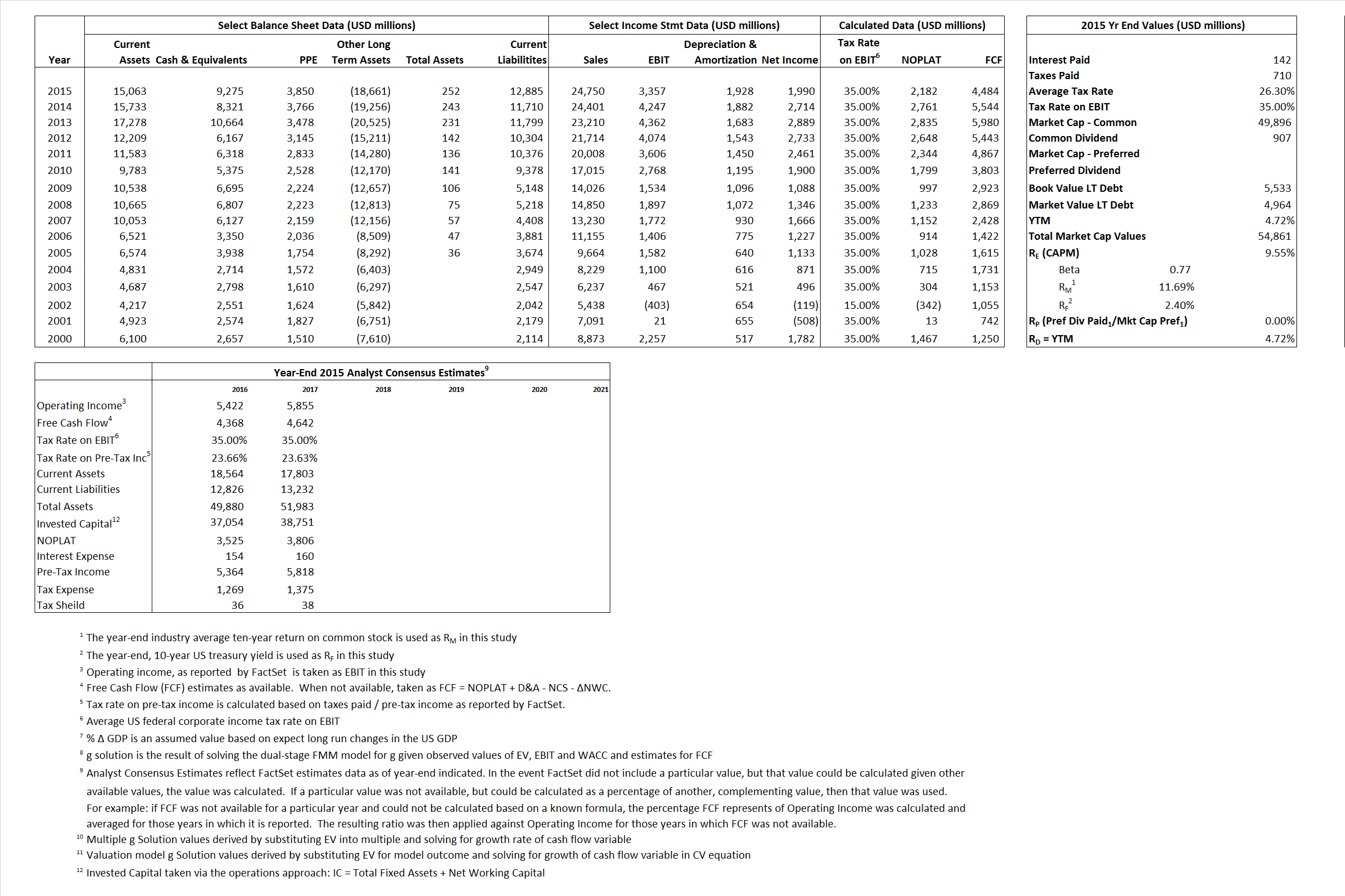

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,182 | ||

| Free Cash Flow | FCF | 4,484 | ||

| Tax Shield | TS | 37 | ||

| Invested Capital | IC | (12,633) | ||

| Return on Invested Capital | ROIC | -17.27% | ||

| Net Investment | NetInv | 763 | ||

| Investment Rate | IR | 34.95% | ||

| Weighted Average Cost of Capital |

WACCMarket | 9.00% | ||

| WACCBook | 8.91% | |||

| Enterprise value |

EVMarket | 45,586 | ||

| EVBook | 46,154 | |||

| Long-Run Growth |

g = IR x ROIC |

-6.04% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. | |

| g = % |

2.50% | |||

| Margin from Operations | M | 13.56% | ||

| Depreciation/Amortization Rate | D | 36.48% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.84 | 3.30% | 3.22% | |||

|

|

8.63 | 3.30% | 3.22% | |||

|

|

20.89 | 3.30% | 3.22% | |||

|

|

10.17 | 3.30% | 3.22% | |||

|

|

13.58 | 3.30% | 3.22% | |||

|

|

-3.61 | 3.30% | 3.22% | |||