METLIFE

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Morningstar | Brett Horn | brett.horn@morningstar.com |

| RBC Capital Markets | Eric N. Berg | eric.berg@rbccm.com |

| Dowling & Partners | Humphrey A. Lee | humphrey@dowling.com |

| Argus Research | Jacob Kilstein | jkilstein@argusresearch.com |

| Sandler O’Neill & Partners | John Barnidge | jbarnidge@sandleroneill.com |

| Atlantic Equities | John Heagerty | j.heagerty@atlantic-equities.com |

| Piper Jaffray | John Nadel | john.m.nadel@pjc.com |

| Daiwa Securities Co. Ltd. | Kazuki Watanabe | kazuki.watanabe@daiwa.co.jp |

| Janney Montgomery Scott | Larry Greenberg | lgreenberg@janney.com |

| FBR Capital Markets & Co | Randy Binner | rbinner@fbr.com |

| Keefe Bruyette & Woods | Ryan Krueger | rkrueger@kbw.com |

| Raymond James | Steven D. Schwartz | steven.schwartz@raymondjames.com |

| Deutsche Bank Research | Yaron Kinar | yaron.kinar@db.com |

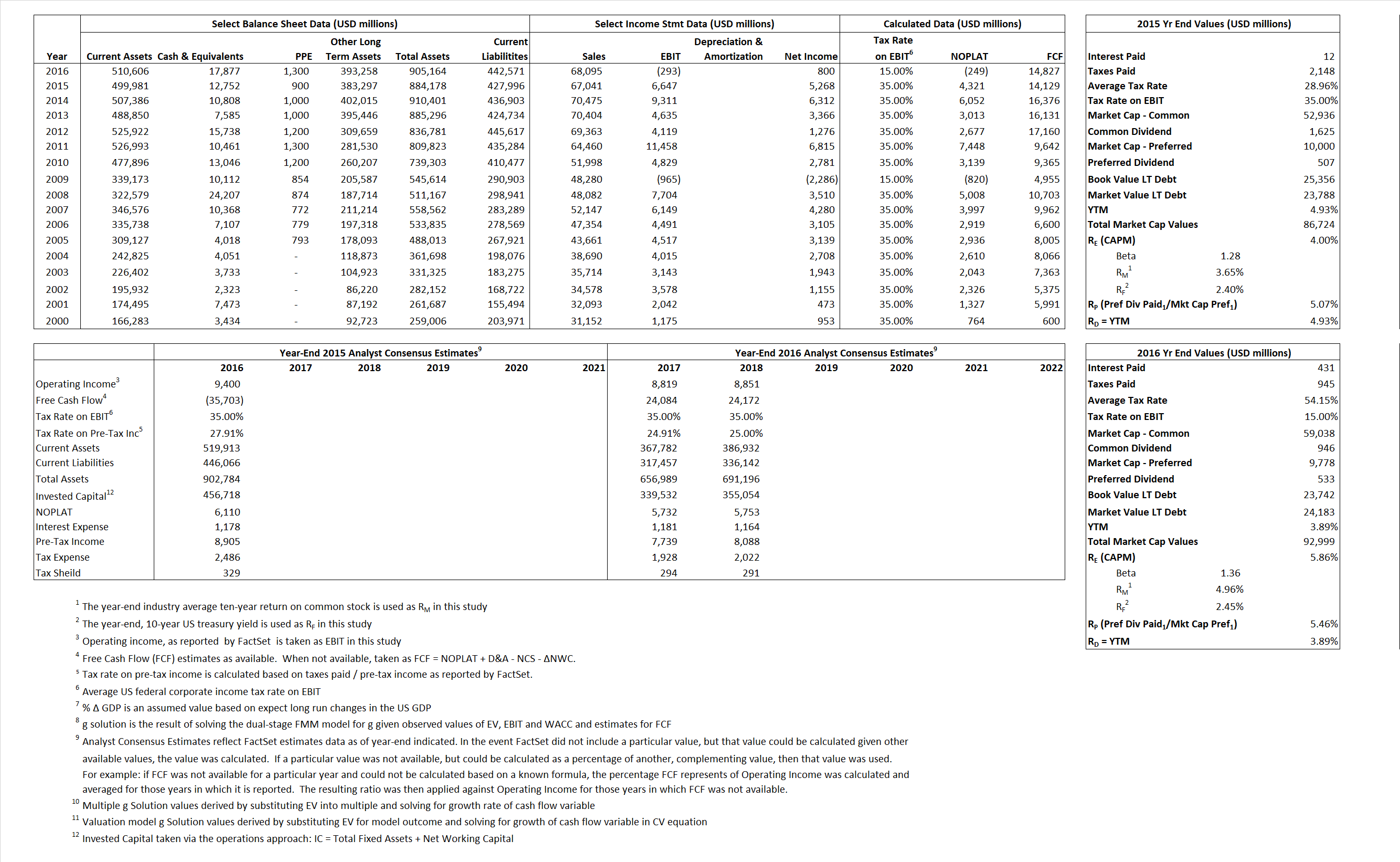

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 4,321 | (249) | |

| Free Cash Flow | FCF | 14,129 | 14,827 | |

| Tax Shield | TS | 3 | 233 | |

| Invested Capital | IC | 456,182 | 462,593 | |

| Return on Invested Capital | ROIC | 0.95% | -0.05% | |

| Net Investment | NetInv | (17,316) | 6,411 | |

| Investment Rate | IR | -400.78% | -2,574.18% | |

| Weighted Average Cost of Capital |

WACCMarket | 3.99% | 4.76% | |

| WACCBook | 8.24% | 1.36% | ||

| Enterprise value |

EVMarket | 73,972 | 75,122 | |

| EVBook | 70,415 | 74,681 | ||

| Long-Run Growth |

g = IR x ROIC |

-3.80% | 1.39% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 9.91% | -0.43% | |

| Depreciation/Amortization Rate | D | 0.00% | 0.00% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.10 | 1.10 | 0.36% | -0.99% | -O.05% | -1.10% |

|

|

11.13 | -256.39 | 0.36% | -0.99% | -O.05% | -1.10% |

|

|

17.12 | -301.63 | 0.36% | -0.99% | -O.05% | -1.10% |

|

|

5.24 | 5.07 | 0.36% | -0.99% | -O.05% | -1.10% |

|

|

11.13 | -256.39 | 0.36% | -0.99% | -O.05% | -1.10% |

|

|

0.16 | 0.16 | 0.36% | -0.99% | -O.05% | -1.10% |