Monsanto

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Piper Jaffray | Brett Wong | brett.ws.wong@pjc.com |

| Monness Crespi Hardt | Chris L. Shaw | cshaw@mchny.com |

| BB&T Capital Markets | Christopher J. Kapsch | ckapsch@bbandtcm.com |

| Credit Suisse | Christopher S. Parkinson | christopher.parkinson@credit-suisse.com |

| Atlantic Equities | Colin Isaac | c.isaac@atlantic-equities.com |

| Deutsche Bank Research | David Begleiter | david.begleiter@db.com |

| Susquehanna Financial Group | Don Carson | don.carson@sig.com |

| Wells Fargo Securities | Frank J. Mitsch | frank.mitsch@wellsfargo.com |

| BMO Capital Markets | Joel Jackson | joel.jackson@bmo.com |

| Bernstein Research | Jonas Oxgaard | jonas.oxgaard@bernstein.com |

| Jefferies | Laurence Alexander | lalexander@jefferies.com |

| Stifel Nicolaus | Paul Massoud | pamassoud@stifel.com |

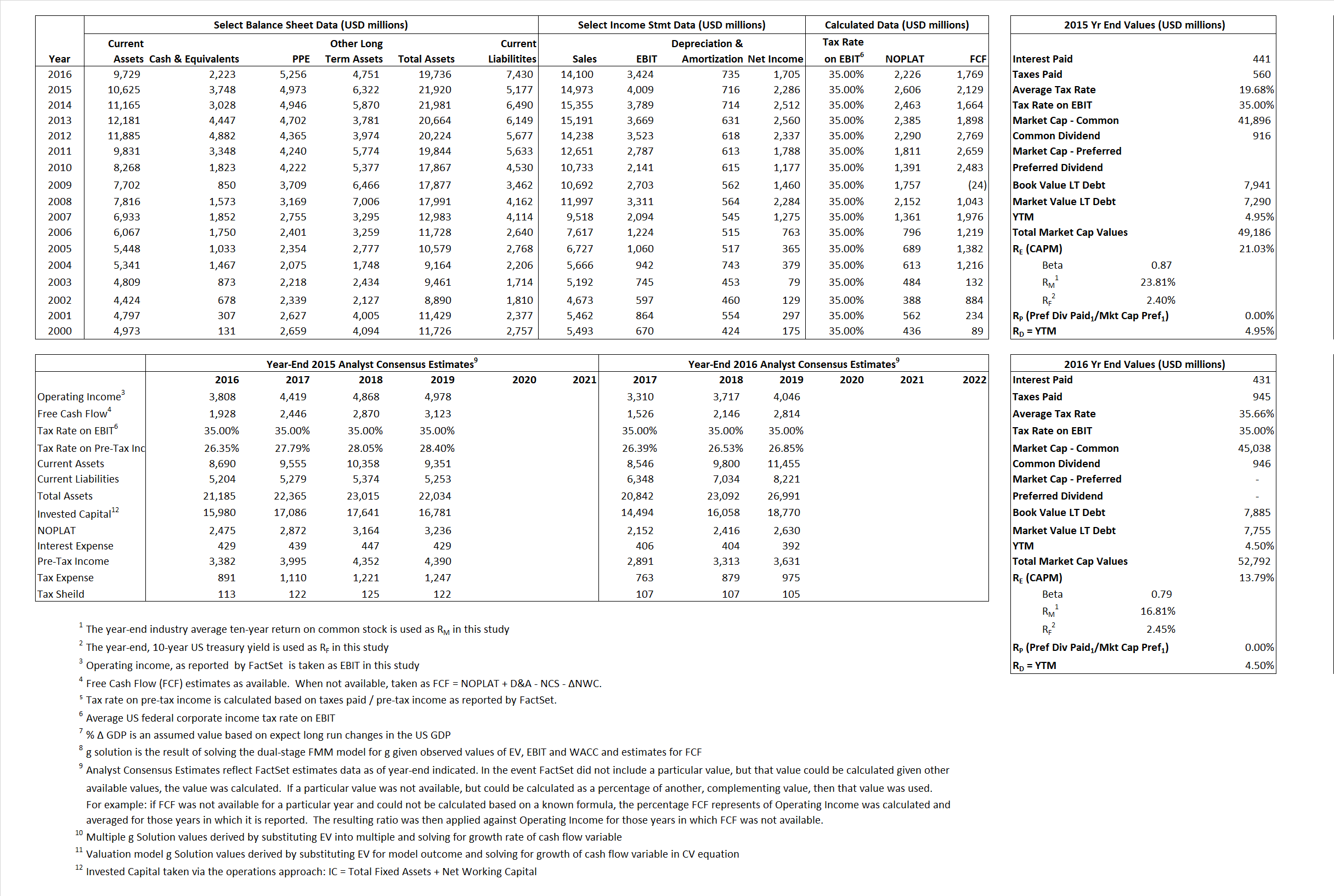

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,606 | 2,226 | |

| Free Cash Flow | FCF | 2,129 | 1,769 | |

| Tax Shield | TS | 87 | 154 | |

| Invested Capital | IC | 16,743 | 12,306 | |

| Return on Invested Capital | ROIC | 15.56% | 18.09% | |

| Net Investment | NetInv | 1,968 | (3,702) | |

| Investment Rate | IR | 75.52% | -166.34% | |

| Weighted Average Cost of Capital |

WACCMarket | 18.50% | 12.19% | |

| WACCBook | 6.97% | 6.71% | ||

| Enterprise value |

EVMarket | 45,438 | 50,569 | |

| EVBook | 47,614 | 50,700 | ||

| Long-Run Growth |

g = IR x ROIC |

11.75% | -30.08% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 26.77% | 24.28% | |

| Depreciation/Amortization Rate | D | 15.15% | 17.67% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

3.03 | 3.59 | 20.21% | 10.30% | 19.32% | 10.97% |

|

|

9.62 | 12.16 | 20.21% | 10.30% | 19.32% | 10.97% |

|

|

17.44 | 22.72 | 20.21% | 10.30% | 19.32% | 10.97% |

|

|

21.35 | 28.59 | 20.21% | 10.30% | 19.32% | 10.97% |

|

|

11.33 | 14.77 | 20.21% | 10.30% | 19.32% | 10.97% |

|

|

2.71 | 4.11 | 20.21% | 10.30% | 19.32% | 10.97% |