AT&T

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Drexel Hamilton | Barry M. Sine | bsine@drexelhamilton.com |

| Cowen & Company | Colby Synesael | colby.synesael@cowen.com |

| FBR Capital Markets & Co | David Dixon | ddixon@fbr.com |

| Raymond James | Frank G. Louthan IV | frank.louthan@raymondjames.com |

| William Blair | James D. Breen | jbreen@williamblair.com |

| DA Davidson | James Moorman | jmoorman@dadco.com |

| Buckingham Research | James Ratcliffe | jratcliffe@buckresearch.com |

| Scotiabank GBM | Jeffrey Fan | jeff.fan@scotiabank.com |

| Nomura Research | Jeffrey Kvaal | jeffrey.kvaal@nomura.com |

| Wells Fargo Securities | Jennifer M. Fritzsche | jennifer.fritzsche@wellsfargo.com |

| RBC Capital Markets | Jonathan Atkin | jonathan.atkin@rbccm.com |

| Evercore ISI | Jonathan Schildkraut | schildkraut@evercoreisi.com |

| Credit Suisse | Joseph Mastrogiovanni | joseph.mastrogiovanni@credit-suisse.com |

| Deutsche Bank Research | Matthew Niknam | matthew.niknam@db.com |

| Pacific Crest Securities-KBCM | Michael G. Bowen | mbowen@pacific-crest.com |

| Jefferies | Mike McCormack | mmccormack@jefferies.com |

| Bernstein Research | Paul de Sa | paul.desa@bernstein.com |

| Oppenheimer | Timothy Horan | tim.horan@opco.com |

| BTIG | Walter Piecyk | wpiecyk@btig.com |

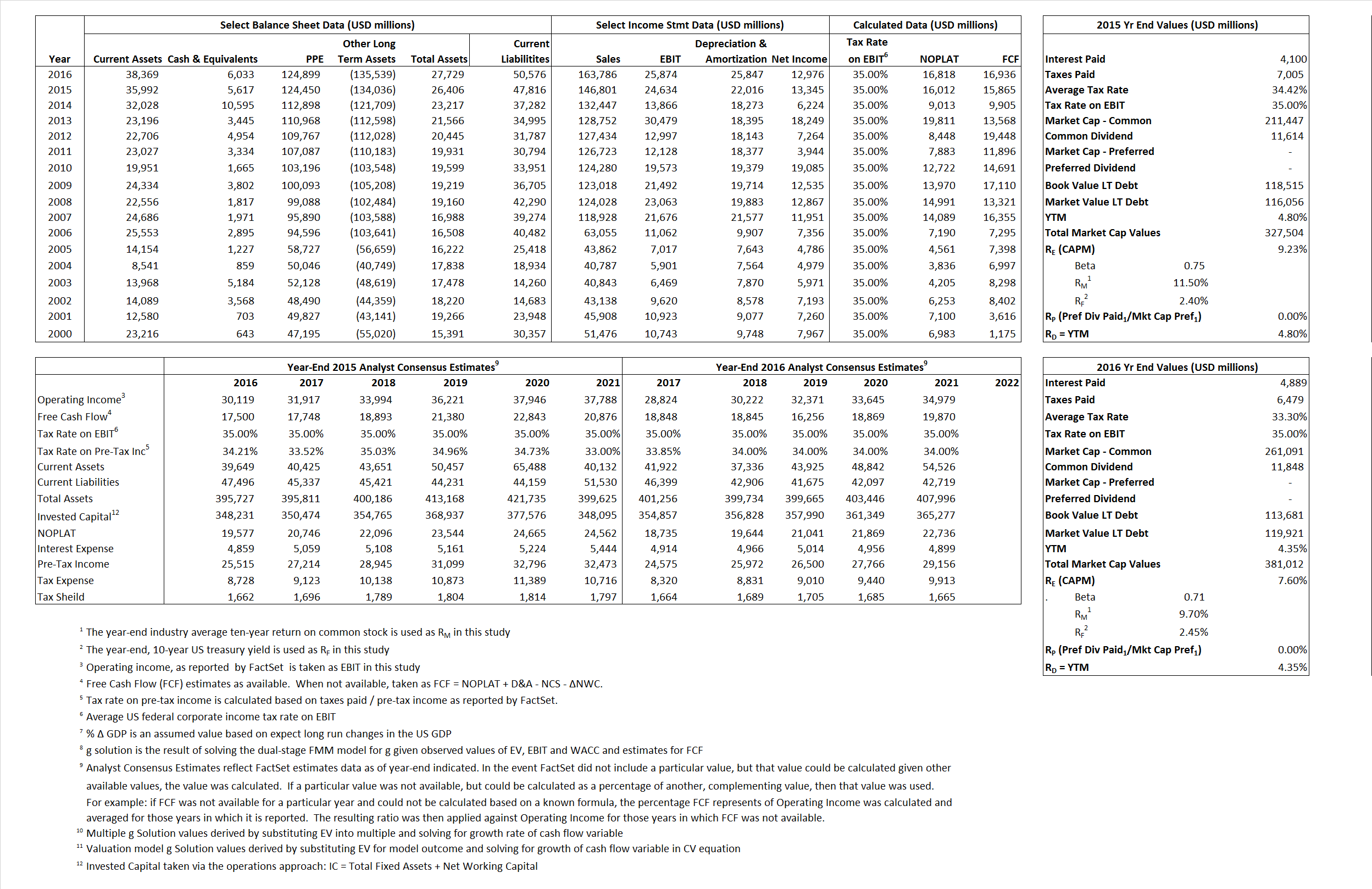

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 16,012 | 16,818 | |

| Free Cash Flow | FCF | 15,865 | 16,936 | |

| Tax Shield | TS | 1,411 | 1,628 | |

| Invested Capital | IC | (21,410) | (22,847) | |

| Return on Invested Capital | ROIC | -74.79% | -73.61% | |

| Net Investment | NetInv | 14,671 | 24,410 | |

| Investment Rate | IR | 91.62% | 145.14% | |

| Weighted Average Cost of Capital |

WACCMarket | 7.07% | 6.12% | |

| WACCBook | 5.53% | 5.52% | ||

| Enterprise value |

EVMarket | 321,887 | 374,979 | |

| EVBook | 323,929 | 368,739 | ||

| Long-Run Growth |

g = IR x ROIC |

-68.52% | -106.84% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 16.78% | 15.80% | |

| Depreciation/Amortization Rate | D | 47.19% | 49.97% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.19 | 2.29 | 1.97% | 1.54% | 2.23% | 2.67% |

|

|

6.90 | 7.25 | 1.97% | 1.54% | 2.23% | 2.67% |

|

|

20.10 | 22.30 | 1.97% | 1.54% | 2.23% | 2.67% |

|

|

20.29 | 22.14 | 1.97% | 1.54% | 2.23% | 2.67% |

|

|

13.07 | 14.49 | 1.97% | 1.54% | 2.23% | 2.67% |

|

|

-15.03 | -16.41 | 1.97% | 1.54% | 2.23% | 2.67% |