International Business Machines Corporation

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| RBC Capital Markets | Amit Daryanani | amit.daryanani@rbccm.com |

| Drexel Hamilton | Brian J. White | bwhite@drexelhamilton.com |

| Stifel Nicolaus | David Grossman | dgrossman@stifel.com |

| JMP Securities | Greg Mcdowell | gmcdowell@jmpsecurities.com |

| Jefferies | James Kisner | jkisner@jefferies.com |

| Atlantic Equities | Josep Bori | j.bori@atlantic-equities.com |

| Cantor Fitzgerald | Joseph D. Foresi | jforesi@cantor.com |

| Daiwa Securities Co. Ltd. | Kazuya Nishimura | kazuya.nishimura@us.daiwacm.com |

| BMO Capital Markets | Keith Bachman | keith.bachman@bmo.com |

| Credit Suisse | Kulbinder Garcha | kulbinder.garcha@credit-suisse.com |

| Wells Fargo Securities | Maynard J. Um | maynard.um@wellsfargo.com |

| Societe Generale | Richard Nguyen | richard.nguyen@sgcib.com |

| Deutsche Bank Research | Sherri Scribner | sherri.scribner@db.com |

| Bernstein Research | Toni M. Sacconaghi Jr | sacconaghi@bernstein.com |

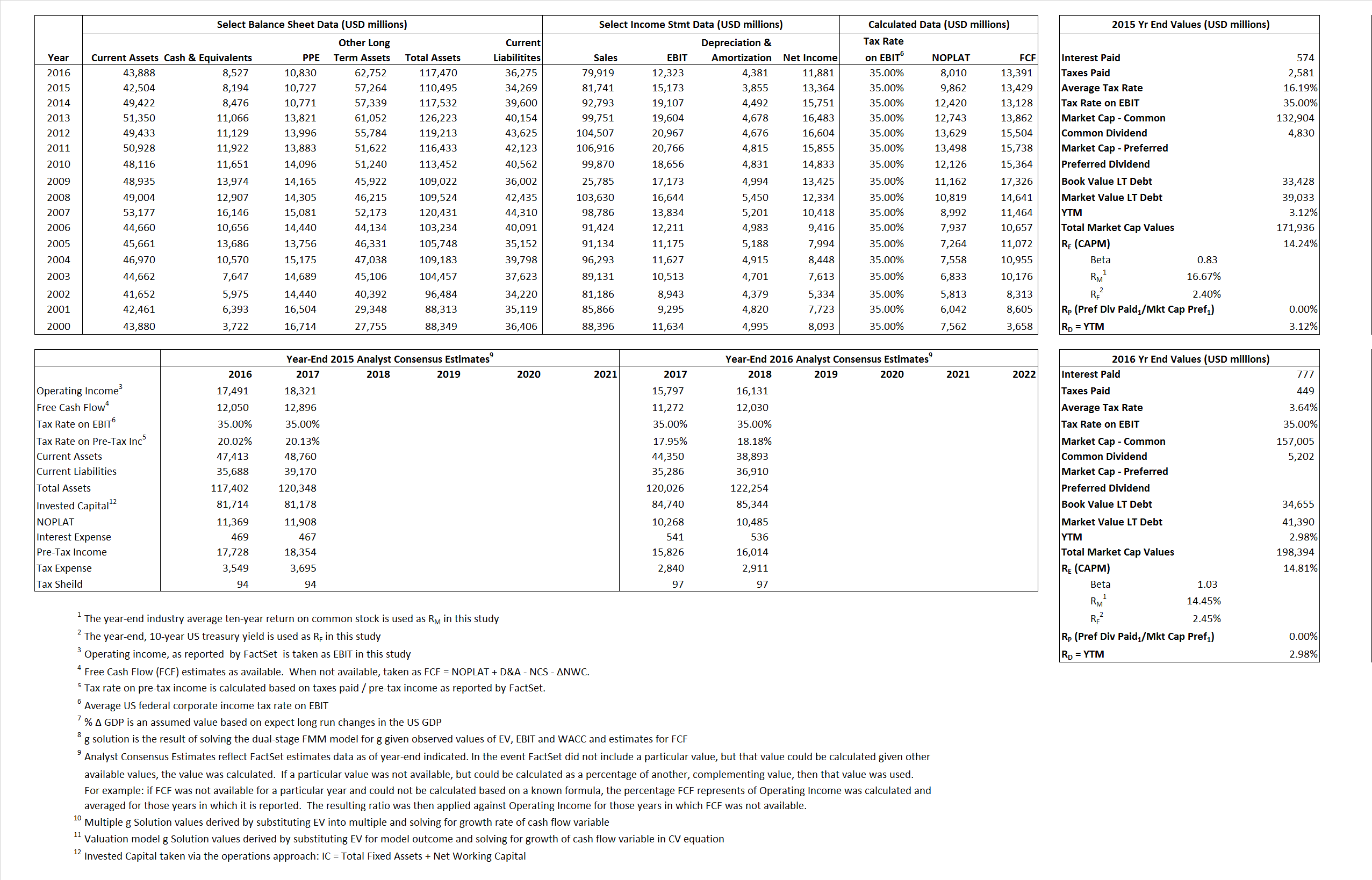

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 9,862 | 8,010 | |

| Free Cash Flow | FCF | 13,429 | 13,391 | |

| Tax Shield | TS | 93 | 28 | |

| Invested Capital | IC | 76,226 | 81,195 | |

| Return on Invested Capital | ROIC | 12.94% | 9.87% | |

| Net Investment | NetInv | 2,149 | 9,350 | |

| Investment Rate | IR | 21.79% | 116.73% | |

| Weighted Average Cost of Capital |

WACCMarket | 11.60% | 12.32% | |

| WACCBook | 6.79% | 7.77% | ||

| Enterprise value |

EVMarket | 163,742 | 189,867 | |

| EVBook | 158,138 | 183,133 | ||

| Long-Run Growth |

g = IR x ROIC |

2.82% | 11.52% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 18.56% | 15.42% | |

| Depreciation/Amortization Rate | D | 20.26% | 26.23% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.00 | 2.38 | 10.44% | 14.15% | 10.60% | 13.58% |

|

|

8.61 | 11.37 | 10.44% | 14.15% | 10.60% | 13.58% |

|

|

16.60 | 23.70 | 10.44% | 14.15% | 10.60% | 13.58% |

|

|

12.19 | 14.18 | 10.44% | 14.15% | 10.60% | 13.58% |

|

|

10.79 | 15.41 | 10.44% | 14.15% | 10.60% | 13.58% |

|

|

2.15 | 2.34 | 10.44% | 14.15% | 10.60% | 13.58% |