Twenty-First Century Fox Inc

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Pacific Crest Securities-KBCM | Andy Hargreaves | ahargreaves@pacific-crest.com |

| Nomura Research | Anthony DiClemente | anthony.diclemente@nomura.com |

| FBR Capital Markets & Co | Barton Crockett | bcrockett@fbr.com |

| Stifel Nicolaus | Benjamin E. Mogil | bmogil@stifel.com |

| Pivotal Research Group | Brian Wieser | brian@pvtl.com |

| Deutsche Bank Research | Bryan Kraft | bryan.kraft@db.com |

| BMO Capital Markets | Daniel Salmon | dan.salmon@bmo.com |

| Topeka Capital Markets | David W. Miller | teagan@telseygroup.com |

| Cowen & Company | Doug Creutz | doug.creutz@cowen.com |

| Atlantic Equities | Hamiton Faber | h.faber@atlantic-equities.com |

| Wedbush Securities | James Dix | james.dix@wedbush.com |

| JBL Advisors | Jeffrey B. Logsdon | jeff@jbladvisors.com |

| Jefferies | John Janedis | jjanedis@jefferies.com |

| Needham | Laura Martin | lmartin@needhamco.com |

| Wells Fargo Securities | Marci Ryvicker | marci.ryvicker@wellsfargo.com |

| Guggenheim Securities | Michael C. Morris | michael.morris@guggenheimpartners.com |

| Credit Suisse | Omar Sheikh | omar.sheikh@credit-suisse.com |

| BTIG | Richard Greenfield | rgreenfield@btig.com |

| RBC Capital Markets | Steven Cahall | steven.cahall@rbccm.com |

| Bernstein Research | Todd Juenger | todd.juenger@bernstein.com |

| Telsey Advisory Group | Tom Eagan | teagan@telseygroup.com |

| Evercore ISI | Vijay Jayant | vijay.jayant@evercoreisi.com |

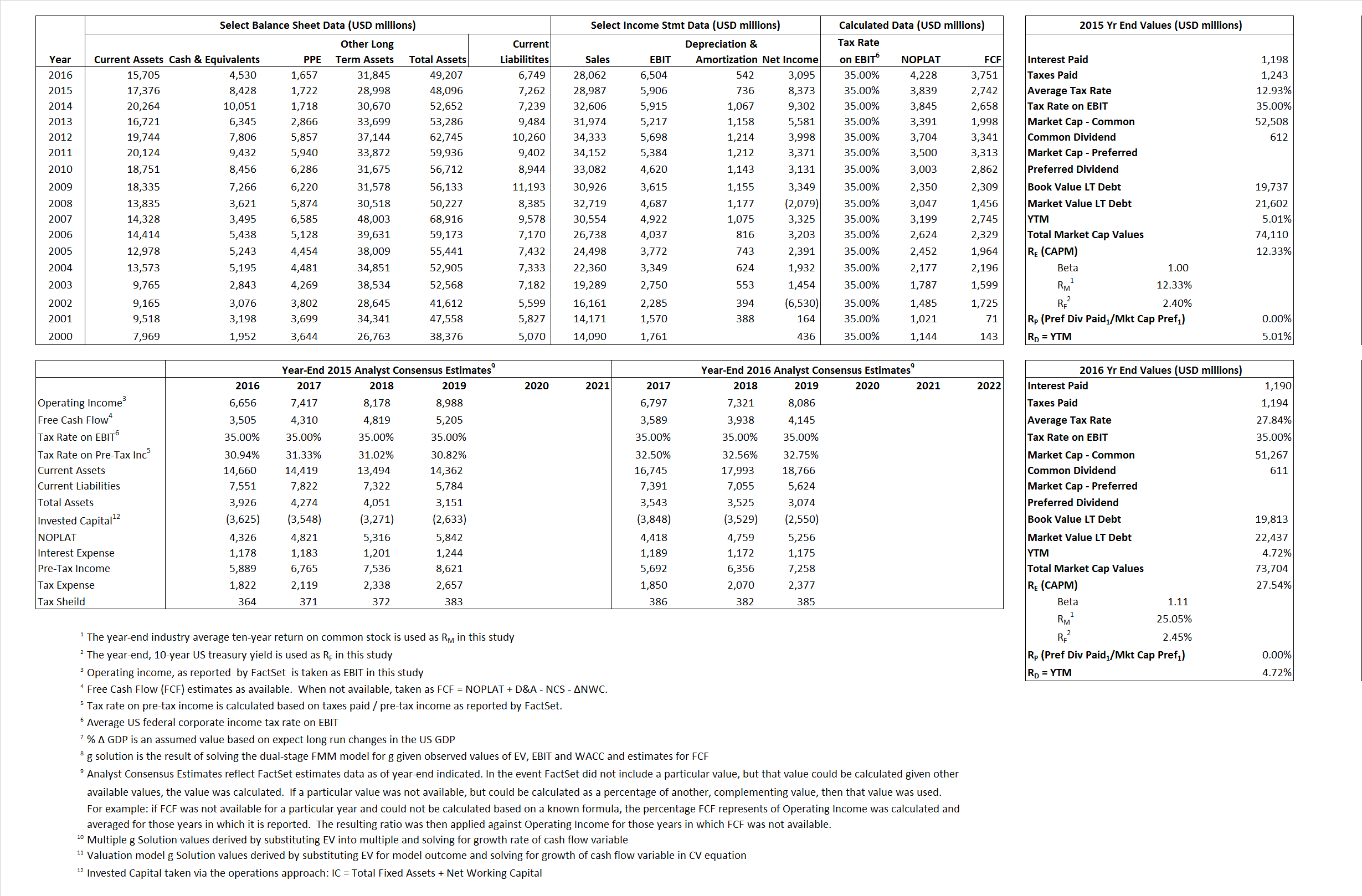

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 3,839 | 4,228 | |

| Free Cash Flow | FCF | 2,742 | 3,751 | |

| Tax Shield | TS | 155 | 331 | |

| Invested Capital | IC | 40,834 | 42,458 | |

| Return on Invested Capital | ROIC | 9.40% | 9.96% | |

| Net Investment | NetInv | (3,843) | 2,166 | |

| Investment Rate | IR | -100.11% | 51.23% | |

| Weighted Average Cost of Capital |

WACCMarket | 10.01% | 20.19% | |

| WACCBook | 7.70% | 7.51% | ||

| Enterprise value |

EVMarket | 65,682 | 69,174 | |

| EVBook | 63,817 | 66,550 | ||

| Long-Run Growth |

g = IR x ROIC |

-9.41% | 5.10% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 20.37% | 23.18% | |

| Depreciation/Amortization Rate | D | 11.08% | 7.69% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2,27 | 2.47 | 11.00% | 36.45% | 10.72% | 25.79% |

|

|

9.89 | 9.82 | 11.00% | 36.45% | 10.72% | 25.79% |

|

|

17.11 | 16.36 | 11.00% | 36.45% | 10.72% | 25.79% |

|

|

23.95 | 18.44 | 11.00% | 36.45% | 10.72% | 25.79% |

|

|

11.12 | 10.64 | 11.00% | 36.45% | 10.72% | 25.79% |

|

|

1.61 | 1.63 | 11.00% | 36.45% | 10.72% | 25.79% |