Cisco Systems, Inc.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Needham | Alex Henderson | ahenderson@needhamco.com |

| CRT Capital Group | Alex Kurtz | akurtz@sterneageecrt.com |

| Pacific Crest Securities-KBCM | Brent Bracelin | bbracelin@pacific-crest.com |

| Drexel Hamilton | Brian J. White | bwhite@drexelhamilton.com |

| JMP Securities | Erik Suppiger | esuppiger@jmpsecurities.com |

| Jefferies | George C. Notter | gnotter@jefferies.com |

| Oppenheimer | Ittai Kidron | ittai.kidron@opco.com |

| William Blair | Jason Ader | jader@williamblair.com |

| Nomura Research | Jeffrey Kvaal | jeffrey.kvaal@nomura.com |

| Wells Fargo Securities | Jess Lubert | jess.lubert@wellsfargo.com |

| Atlantic Equities | Josep Bori | j.bori@atlantic-equities.com |

| Credit Suisse | Kulbinder Garcha | kulbinder.garcha@credit-suisse.com |

| Wunderlich Securities | Matthew Robison | mrobison@wundernet.com |

| RBC Capital Markets | Mitch Steves | mitch.steves@rbccm.com |

| Cowen & Company | Paul Silverstein | paul.silverstein@cowen.com |

| Bernstein Research | Pierre Ferragu | pierre.ferragu@bernstein.com |

| Buckingham Research | Rohit Chopra | rchopra@buckresearch.com |

| Guggenheim Securities | Ryan Hutchinson | ryan.hutchinson@guggenheimpartners.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| Raymond James | Simon Leopold | simon.leopold@raymondjames.com |

| BMO Capital Markets | Tim Long | tim.long@bmo.com |

| Piper Jaffray | Troy D. Jensen | troy.d.jensen@pjc.com |

| Deutsche Bank Research | Vijay Bhagavath | vijay.bhagavath@db.com |

| Daiwa Securities Co. Ltd. | Yoko Yamada | yoko.yamada@us.daiwacm.com |

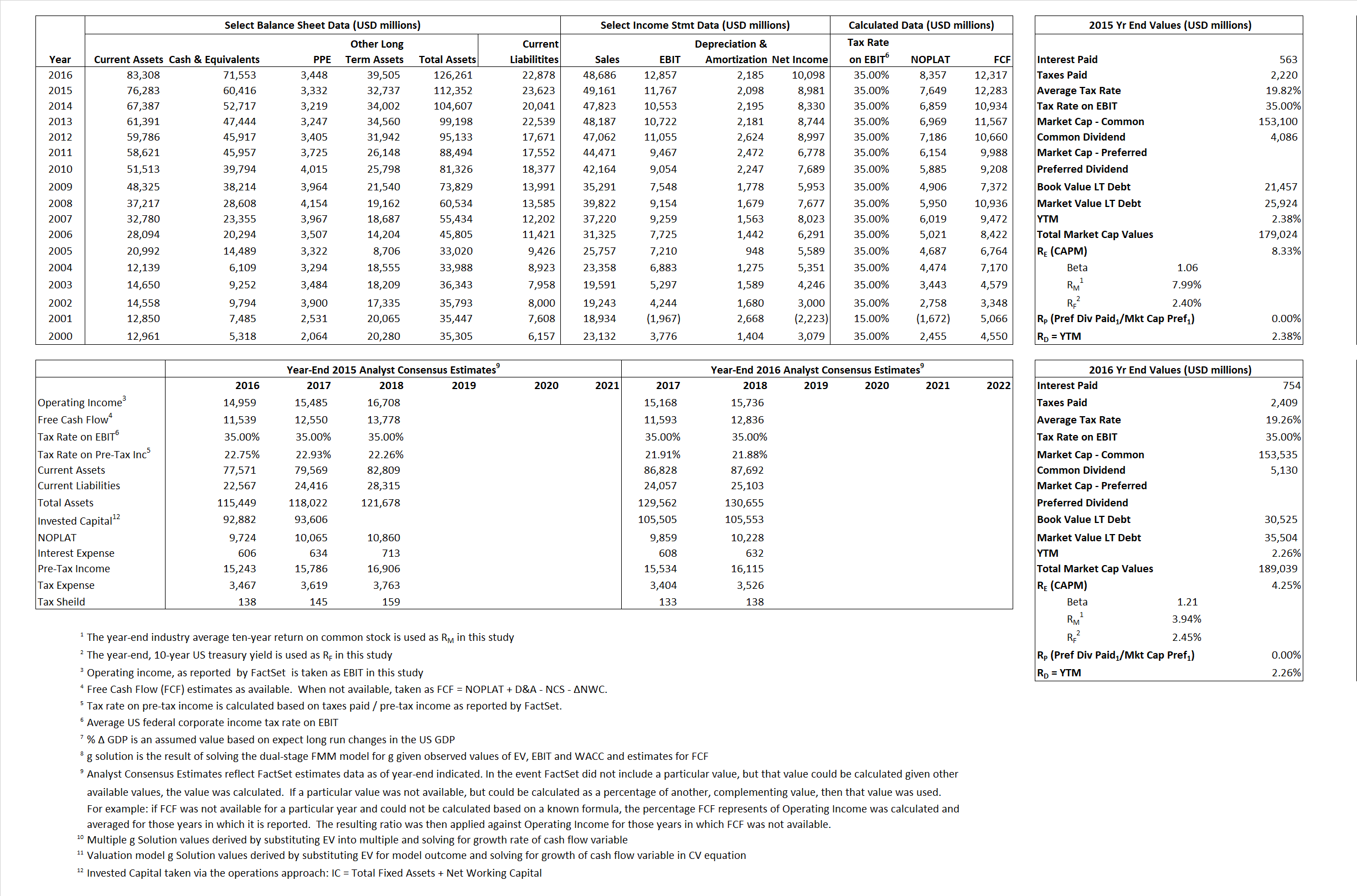

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 7,649 | 8,357 | |

| Free Cash Flow | FCF | 12,283 | 12,317 | |

| Tax Shield | TS | 112 | 145 | |

| Invested Capital | IC | 88,729 | 103,383 | |

| Return on Invested Capital | ROIC | 8.62% | 8.08% | |

| Net Investment | NetInv | 6,261 | 16,839 | |

| Investment Rate | IR | 81.86% | 201.49% | |

| Weighted Average Cost of Capital |

WACCMarket | 7.40% | 3.80% | |

| WACCBook | 8.80% | 9.38% | ||

| Enterprise value |

EVMarket | 118,608 | 117,486 | |

| EVBook | 114,141 | 112,507 | ||

| Long-Run Growth |

g = IR x ROIC |

7.06% | 16.29% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 23.94% | 26.41% | |

| Depreciation/Amortization Rate | D | 15.13% | 14.53% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.41 | 2.41 | 3.76% | -27.63% | 1.23% | -15.31% |

|

|

8.55 | 7.81 | 3.76% | -27.63% | 1.23% | -15.31% |

|

|

15.51 | 14.06 | 3.76% | -27.63% | 1.23% | -15.31% |

|

|

9.66 | 9.54 | 3.76% | -27.63% | 1.23% | -15.31% |

|

|

10.08 | 9.14 | 3.76% | -27.63% | 1.23% | -15.31% |

|

|

1.34 | 1.14 | 3.76% | -27.63% | 1.23% | -15.31% |