McDonald’s Corporation

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Longbow Research | Alton K. Stump | astump@longbowresearch.com |

| Cowen & Company | Andrew M. Charles | andrew.charles@cowen.com |

| Jefferies | Andy Barish | abarish@jefferies.com |

| Deutsche Bank Research | Brett Levy | brett.levy@db.com |

| Oppenheimer | Brian Bittner | brian.bittner@opco.com |

| Raymond James | Brian Vaccaro | brian.vaccaro@raymondjames.com |

| RBC Capital Markets | David Palmer | david.palmer@rbccm.com |

| SunTrust Robinson Humphrey | Jake Bartlett | jake.bartlett@suntrust.com |

| Credit Suisse | Jason West | jason.west@credit-suisse.com |

| Wells Fargo Securities | Jeff Farmer | jeff.farmer@wellsfargo.com |

| CRT Capital Group | Lynne Collier | lcollier@sterneageecrt.com |

| Nomura Research | Mark Kalinowski | mark.kalinowski@nomura.com |

| Evercore ISI | Matt McGinley | matt.mcginley@evercoreisi.com |

| Guggenheim Securities | Matthew J. Difrisco | matthew.difrisco@guggenheimpartners.com |

| Piper Jaffray | Nicole Miller Regan | nmr@pjc.com |

| Stifel Nicolaus | Paul Westra | paul.westra@stifel.com |

| BTIG | Peter Saleh | psaleh@btig.com |

| Stephens Inc | Will Slabaugh | will.slabaugh@stephens.com |

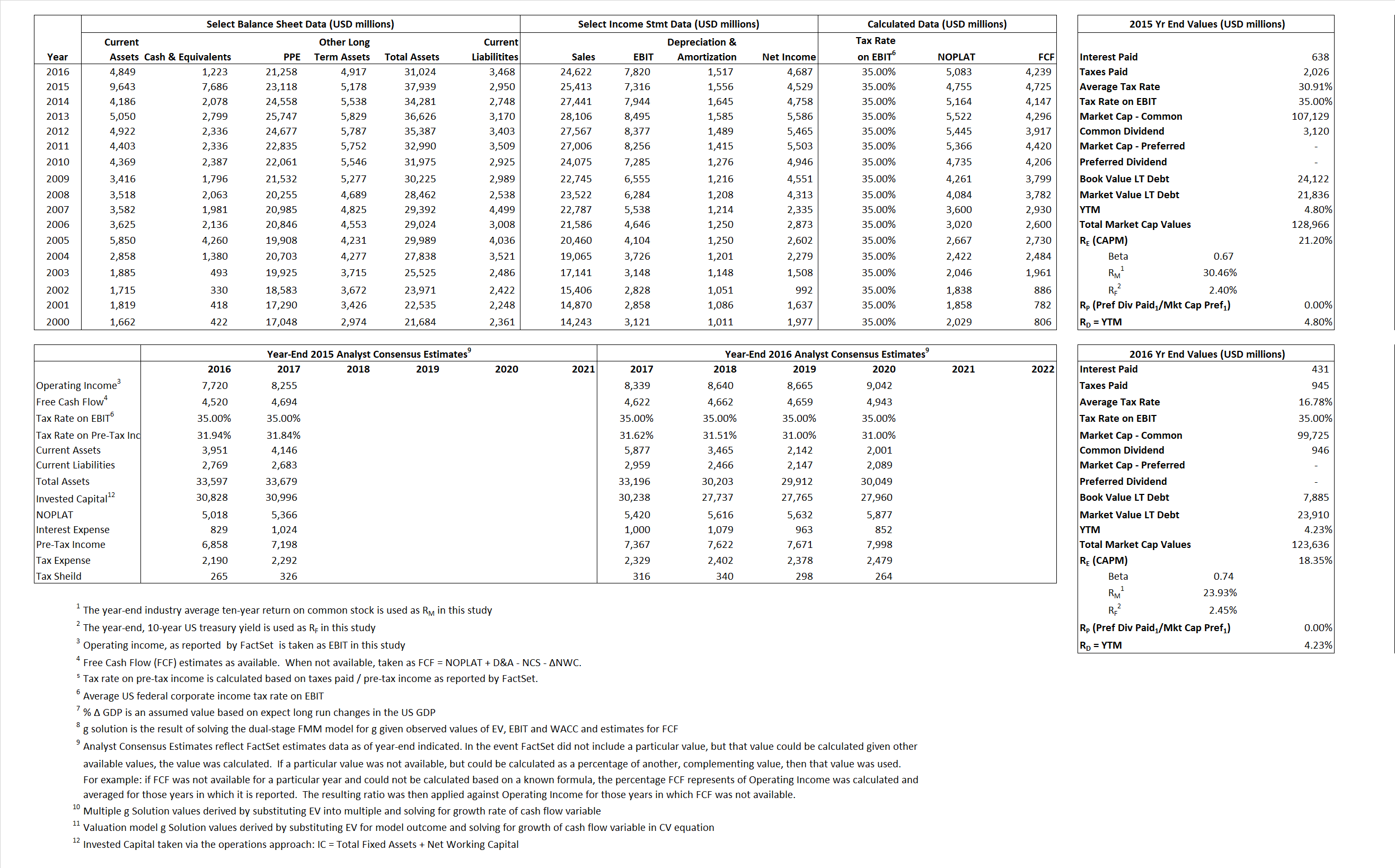

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 4,755 | 5,083 | |

| Free Cash Flow | FCF | 4,725 | 4,239 | |

| Tax Shield | TS | 197 | 72 | |

| Invested Capital | IC | 34,988 | 27,556 | |

| Return on Invested Capital | ROIC | 13.59% | 18.45% | |

| Net Investment | NetInv | 5,011 | (5,915) | |

| Investment Rate | IR | 105.36% | -116.38% | |

| Weighted Average Cost of Capital |

WACCMarket | 18.17% | 15.48% | |

| WACCBook | 6.18% | 6.27% | ||

| Enterprise value |

EVMarket | 121,280 | 122,413 | |

| EVBook | 130,028 | 106,387 | ||

| Long-Run Growth |

g = IR x ROIC |

14.32% | -21.47% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 28.79% | 31.76% | |

| Depreciation/Amortization Rate | D | 17.54% | 16.25% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

4.77 | 4.97 | 20.03% | 14.62% | 19.46% | 15.05% |

|

|

13.67 | 13.11 | 20.03% | 14.62% | 19.46% | 15.05% |

|

|

25.50 | 24.08 | 20.03% | 14.62% | 19.46% | 15.05% |

|

|

25.67 | 28.88 | 20.03% | 14.62% | 19.46% | 15.05% |

|

|

16.58 | 15.65 | 20.03% | 14.62% | 19.46% | 15.05% |

|

|

3.47 | 4.44 | 20.03% | 14.62% | 19.46% | 15.05% |