Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Bernstein Research | Carlos Kirjner | carlos.kirjner@bernstein.com |

| Mizuho Securities USA | Neil A. Doshi | neil.doshi@us.mizuho-sc.com |

| Monness Crespi Hardt | Cengiz M. Cakmak | jcakmak@mchny.com |

| Nomura Research | Anthony DiClemente | anthony.diclemente@nomura.com |

| Canaccord Genuity | Michael Graham | mgraham@canaccordgenuity.com |

| Axiom Capital | Victor Anthony | vanthony@axiomcapital.com |

| Piper Jaffray | Gene Munster | gene.a.munster@pjc.com |

| Jefferies | Brian Pitz | bpitz@jefferies.com |

| Pacific Crest Securities-KBCM | Evan Wilson | ewilson@key.com |

| Evercore ISI | Ken Sena | ken.sena@evercoreisi.com |

| Pivotal Research Group | Brian Wieser | brian@pvtl.com |

| Guggenheim Securities | Jake Fuller | james.fuller@guggenheimpartners.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| RBC Capital Markets | Mark S. Mahaney | mark.mahaney@rbccm.com |

| Cantor Fitzgerald | Youssef H. Squali | ysquali@cantor.com |

| Atlantic Equities | James Cordwell | j.cordwell@atlantic-equities.com |

| Susquehanna Financial Group | Shyam Patil | shyam.patil@sig.com |

| Cowen & Company | John Blackledge | john.blackledge@cowen.com |

| SunTrust Robinson Humphrey | Robert S. Peck | robert.peck@suntrust.com |

| JMP Securities | Ronald V. Josey | rjosey@jmpsecurities.com |

| B Riley & Co | Sameet Sinha | ssinha@brileyco.com |

| Wells Fargo Securities | Peter Stabler | peter.stabler@wellsfargo.com |

| Wedbush Securities | James Dix | james.dix@wedbush.com |

| Hilliard Lyons | Stephen Turner | sturner@hilliard.com |

| Stifel Nicolaus | Scott W. Devitt | swdevitt@stifel.com |

| Oppenheimer | Jason Helfstein | jason.helfstein@opco.com |

| Needham | Kerry Rice | krice@needhamco.com |

| Daiwa Securities Co. Ltd. | Kazuya Nishimura | kazuya.nishimura@us.daiwacm.com |

| Raymond James | Aaron Kessler | aaron.kessler@raymondjames.com |

| William Blair | Ralph Schackart | rschackart@williamblair.com |

| BMO Capital Markets | Daniel Salmon | dan.salmon@bmo.com |

| Credit Suisse | Stephen Ju | stephen.ju@credit-suisse.com |

| Deutsche Bank Research | Ross Sandler | ross.sandler@db.com |

| BGC Financial, L.P. | Colin W. Gillis | cgillis@bgcpartners.com |

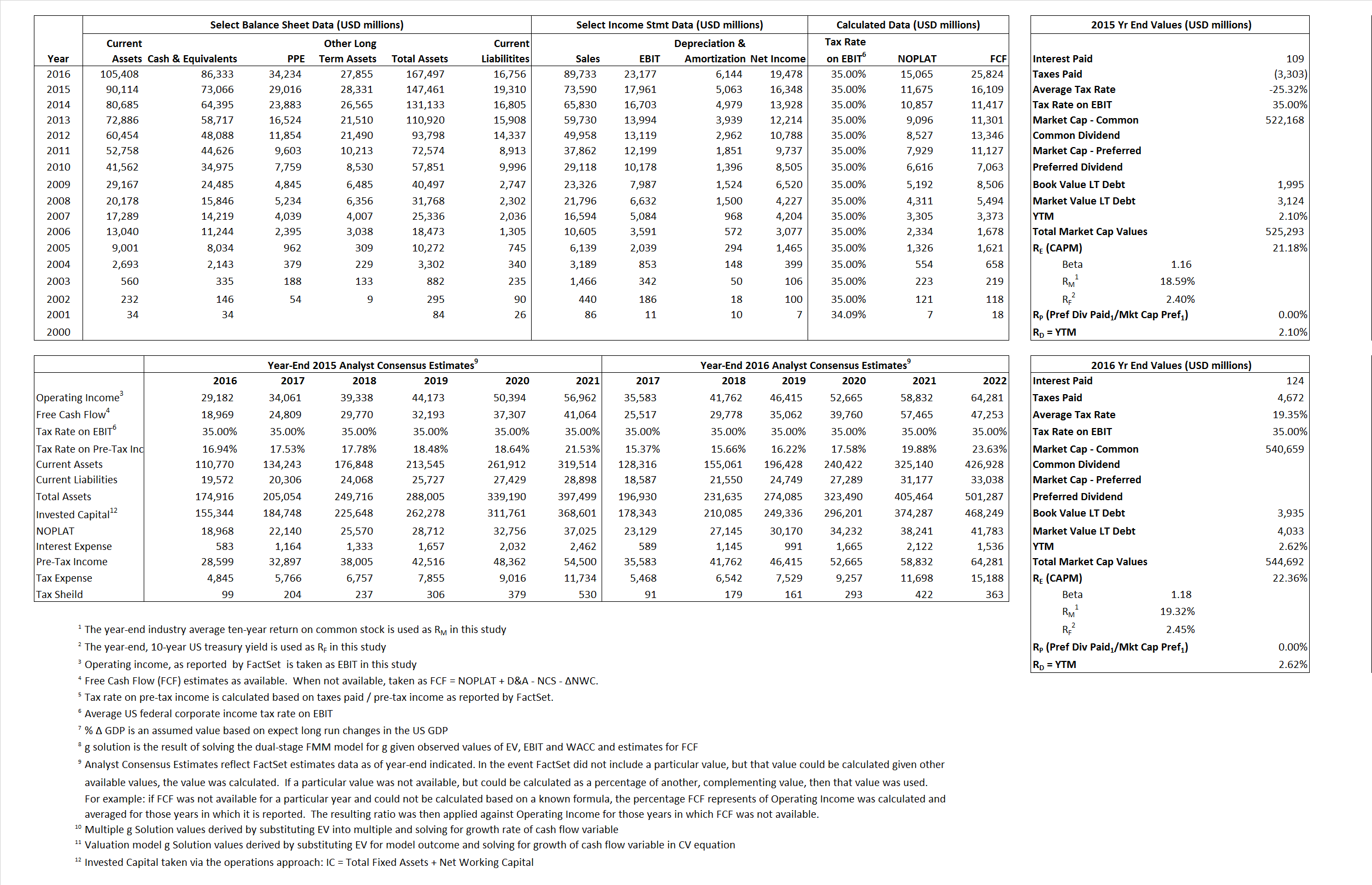

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 11,675 | 15,065 | |

| Free Cash Flow | FCF | 16,109 | 25,824 | |

| Tax Shield | TS | (28) | 24 | |

| Invested Capital | IC | 128,151 | 150,741 | |

| Return on Invested Capital | ROIC | 9.11% | 9.99% | |

| Net Investment | NetInv | 18,886 | 28,734 | |

| Investment Rate | IR | 161.77% | 190.73% | |

| Weighted Average Cost of Capital |

WACCMarket | 21.07% | 22.21% | |

| WACCBook | 10.46% | 10.12% | ||

| Enterprise value |

EVMarket | 452,227 | 458,359 | |

| EVBook | 451,097 | 458,261 | ||

| Long-Run Growth |

g = IR x ROIC |

14.74% | 19.06% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 24.41% | 25.83% | |

| Depreciation/Amortization Rate | D | 21.99% | 20.95% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

6.15 | 5.11 | 25.80% | 28.19% | 22.89% | 23.88% |

|

|

19.64 | 15.63 | 25.80% | 28.19% | 22.89% | 23.88% |

|

|

38.74 | 30.43 | 25.80% | 28.19% | 22.89% | 23.88% |

|

|

28.07 | 17.75 | 25.80% | 28.19% | 22.89% | 23.88% |

|

|

25.18 | 19.78 | 25.80% | 28.19% | 22.89% | 23.88% |

|

|

3.53 | 3.04 | 25.80% | 28.19% | 22.89% | 23.88% |