Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

Return to top of page

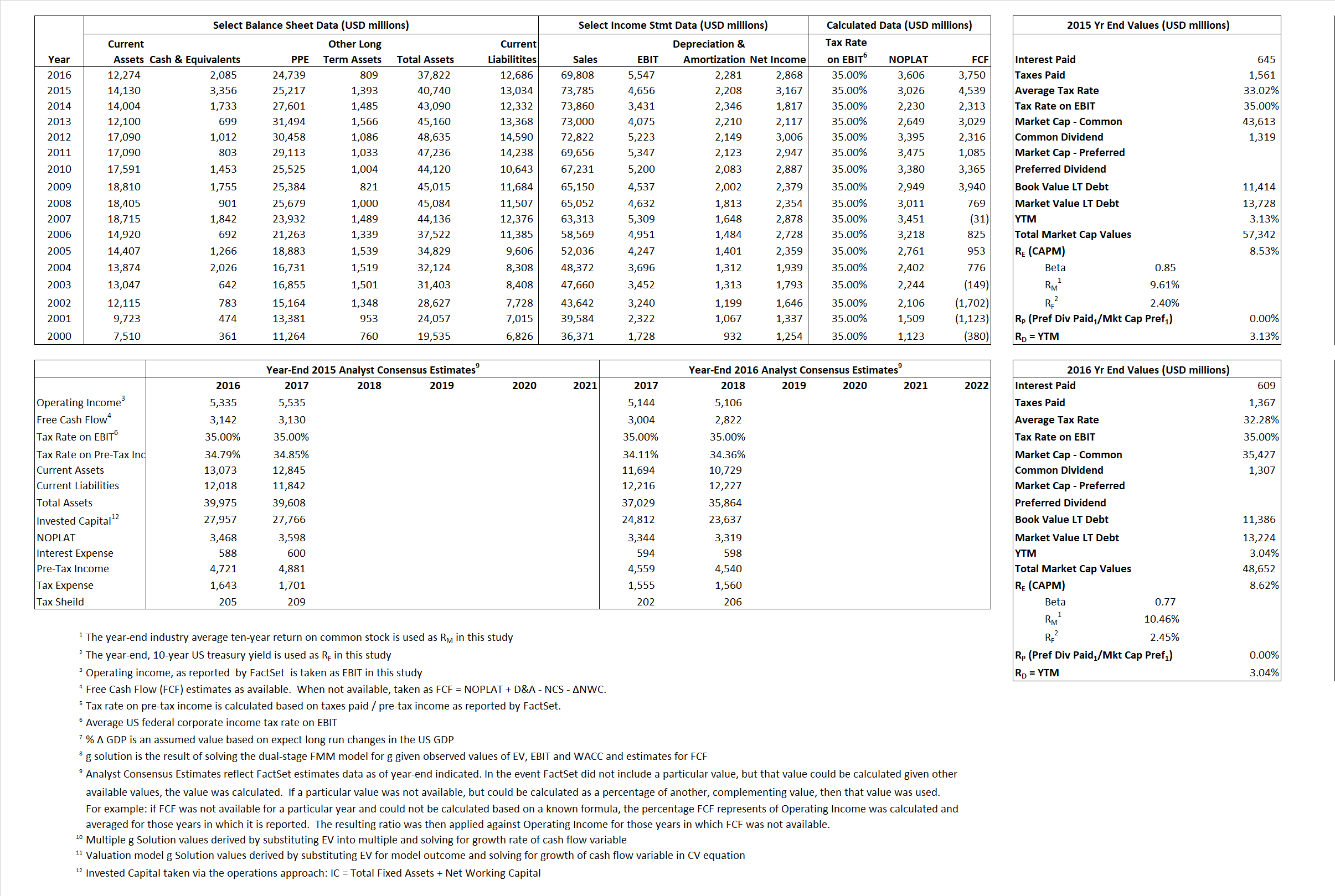

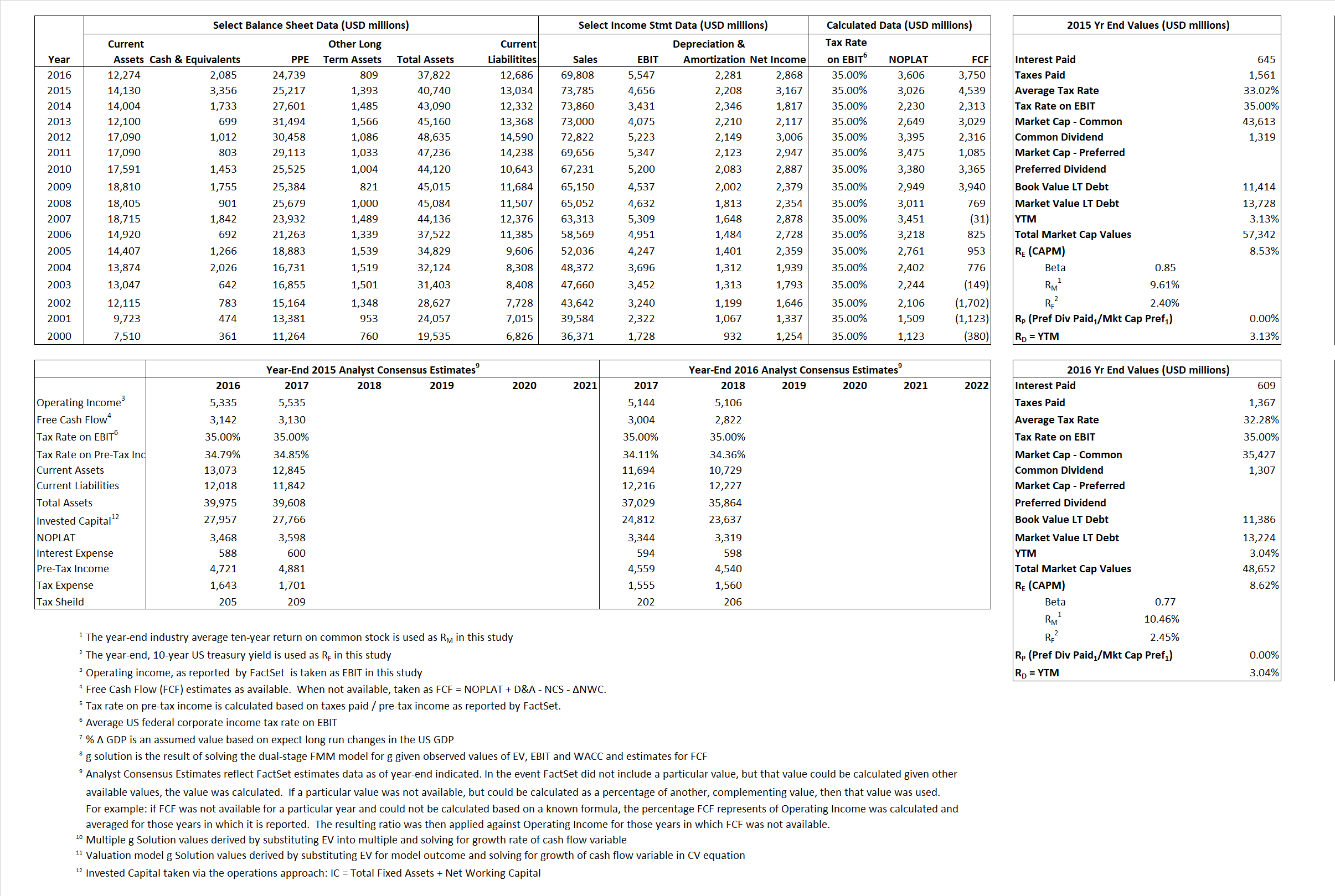

Primary Input Data

Return to top of page

Derived Input Data

Derived Input

|

Label

|

2015 Value

|

2016

Value

|

Equational Form

|

| Net Operating Profit Less Adjusted Taxes |

NOPLAT |

3,026 |

3,606 |

|

| Free Cash Flow |

FCF |

4,539 |

3,750 |

|

| Tax Shield |

TS |

213 |

197 |

|

| Invested Capital |

IC |

27,706 |

25,136 |

|

| Return on Invested Capital |

ROIC |

10.92% |

14.34% |

|

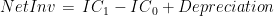

| Net Investment |

NetInv |

(843) |

(289) |

|

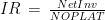

| Investment Rate |

IR |

-27.87% |

-8.02% |

|

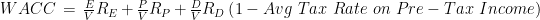

Weighted Average Cost of Capital

|

WACCMarket |

6.99% |

6.83% |

|

| WACCBook |

6.42% |

6.17% |

|

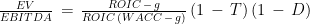

Enterprise value

|

EVMarket |

53,986 |

46,567 |

|

| EVBook |

52,942 |

44,728 |

|

Long-Run Growth

|

g = IR x ROIC

|

-3.04% |

-1.15% |

Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

g = %  GDP GDP |

2.50% |

2.50% |

|

| Margin from Operations |

M |

6.31% |

7.95% |

|

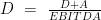

| Depreciation/Amortization Rate |

D |

32.17% |

29.14% |

|

Return to top of page

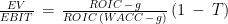

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form

|

Observed Value

|

Single-stage

multiple g solution

|

Two-stage valuation

model g solution

|

| 12/31/2015 |

12/31/2016 |

12/31/2015 |

12/31/2016 |

12/31/2015 |

12/31/2016 |

|

EV/SALES

|

0.73 |

0.67 |

2.84% |

-1.97% |

3.04% |

0.10% |

|

EV/EBITDA

|

7.87 |

5.95 |

2.84% |

-1.97% |

3.04% |

0.10% |

|

EV/NOPLAT

|

17.84 |

12.92 |

2.84% |

-1.97% |

3.04% |

0.10% |

|

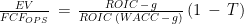

EV/FCFOPS

|

11.89 |

12.42 |

2.84% |

-1.97% |

3.04% |

0.10% |

|

EV/EBIT

|

11.59 |

8.39 |

2.84% |

-1.97% |

3.04% |

0.10% |

|

EV/IC

|

1.95 |

1.85 |

2.84% |

-1.97% |

3.04% |

0.10% |

Return to top of page