General Motors Company

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Buckingham Research | Joseph C. Amaturo | jamaturo@buckresearch.com |

| Susquehanna Financial Group | Matthew T. Stover | matthew.stover@sig.com |

| Deutsche Bank Research | Rod Lache | rod.lache@db.com |

| Evercore ISI | George Galliers | george.galliers@evercoreisi.com |

| RBC Capital Markets | Joseph Spak | joseph.spak@rbccm.com |

| CRT Capital Group | Michael Ward | mward@sterneageecrt.com |

| Craig Hallum Capital Group | Steve L. Dyer | sdyer@craig-hallum.com |

| Daiwa Securities Co. Ltd. | Jairam Nathan | jairam.nathan@us.daiwacm.com |

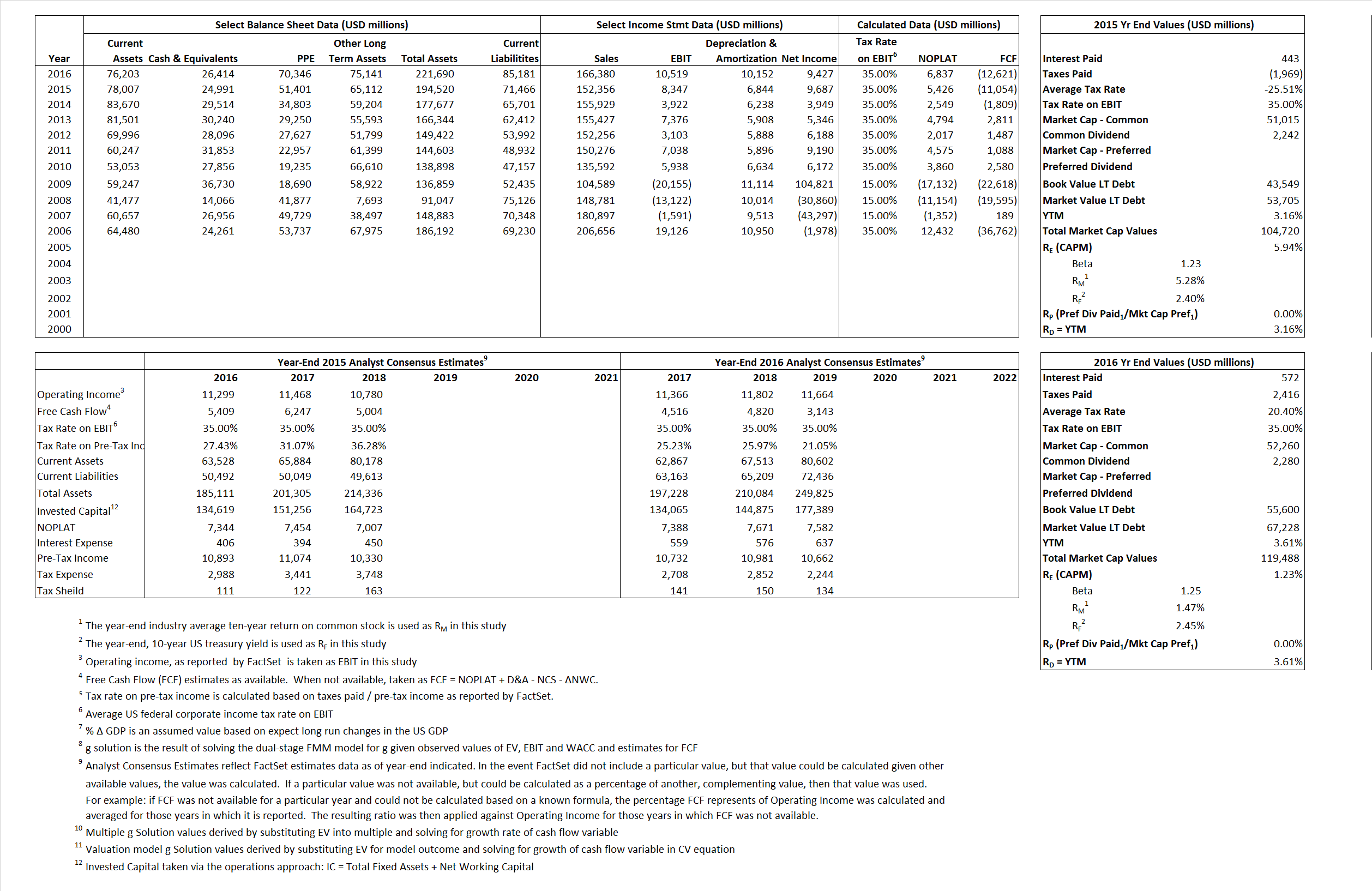

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 5,426 | 6,837 | |

| Free Cash Flow | FCF | (11,054) | (12,621) | |

| Tax Shield | TS | (113) | 117 | |

| Invested Capital | IC | 123,054 | 136,509 | |

| Return on Invested Capital | ROIC | 4.41% | 5.01% | |

| Net Investment | NetInv | 17,922 | 23,607 | |

| Investment Rate | IR | 330.33% | 345.27% | |

| Weighted Average Cost of Capital |

WACCMarket | 4.93% | 2.15% | |

| WACCBook | 6.55% | 5.52% | ||

| Enterprise value |

EVMarket | 79,729 | 93,074 | |

| EVBook | 69,573 | 81,443 | ||

| Long-Run Growth |

g = IR x ROIC |

14.56% | 17.29% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 5.48% | 6.32% | |

| Depreciation/Amortization Rate | D | 45.05% | 49.11% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

0.52 | o.56 | 3.45% | 11.13% | 3.61% | 12.61% |

|

|

5.25 | 4.50 | 3.45% | 11.13% | 3.61% | 12.61% |

|

|

14.70 | 13.61 | 3.45% | 11.13% | 3.61% | 12.61% |

|

|

-7.21 | -7.37 | 3.45% | 11.13% | 3.61% | 12.61% |

|

|

9.55 | 8.85 | 3.45% | 11.13% | 3.61% | 12.61% |

|

|

0.65 | 0.68 | 3.45% | 11.13% | 3.61% | 12.61% |