Emerson Eletric Co.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Langenberg, LLC | Brian K. Langenberg | brian@langenberg-llc.com |

| Oppenheimer | Christopher glynn | christopher.glynn@opco.com |

| RBC Capital Markets | Deane M. Dray | deane.dray@rbccm.com |

| Longbow Research | Eli Lustgarten | elustgarten@longbowresearch.com |

| Cowen & Company | Gautam Khanna | gautam.khanna@cowen.com |

| Deutsche Bank Research | john g. Inch | john.inch@db.com |

| CRT Capital Group | Josh W. Sullivan | jwsullivan@sterneageecrt.com |

| Buckingham Research | Joshua Pokrzywinski | jpokrzywinski@buckresearch.com |

| Credit Suisse | Julian Mitchell | julian.mitchell@credit-suisse.com |

| William Blair | Nicholas P. Heymann | nheymann@williamblair.com |

| Wells Fargo Securities | Richard M. Kwas | rich.kwas@wellsfargo.com |

| Atlantic Equities | Richard Radbourne | r.radbourne@atlantic-equities.com |

| Stifel Nicolaus | Robert P. McCarthy | mccarthyr@stifel.com |

| Bernstein Research | Steven E. winoker | steven.winoker@bernstein.com |

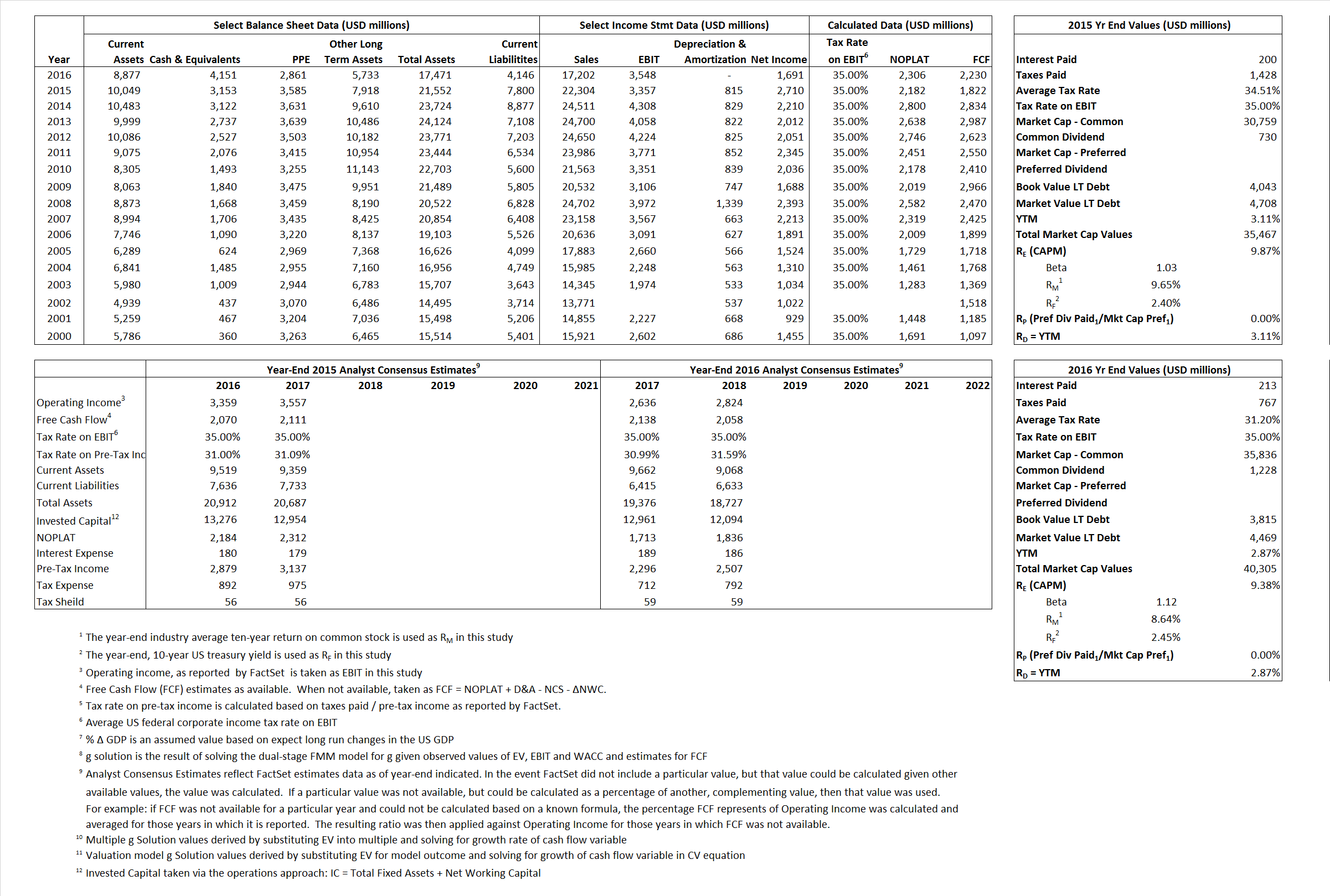

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,182 | 2,306 | |

| Free Cash Flow | FCF | 1,822 | 2,230 | |

| Tax Shield | TS | 69 | 66 | |

| Invested Capital | IC | 13,752 | 13,325 | |

| Return on Invested Capital | ROIC | 15.87% | 17.31% | |

| Net Investment | NetInv | (280) | (427) | |

| Investment Rate | IR | -12.83% | -18.52% | |

| Weighted Average Cost of Capital |

WACCMarket | 8.83% | 8.56% | |

| WACCBook | 8.62% | 9.09% | ||

| Enterprise value |

EVMarket | 32,314 | 36,154 | |

| EVBook | 31,649 | 35,500 | ||

| Long-Run Growth |

g = IR x ROIC |

-2.04% | -3.20% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 15.05% | 20.63% | |

| Depreciation/Amortization Rate | D | 19.53% | 0.00% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.45 | 2.10 | 3.61% | 3.46% | 4.03% | 4.58% |

|

|

7.75 | 10.19 | 3.61% | 3.46% | 4.03% | 4.58% |

|

|

14.81 | 15.68 | 3.61% | 3.46% | 4.03% | 4.58% |

|

|

17.74 | 16.21 | 3.61% | 3.46% | 4.03% | 4.58% |

|

|

9.63 | 10.19 | 3.61% | 3.46% | 4.03% | 4.58% |

|

|

2.35 | 2.71 | 3.61% | 3.46% | 4.03% | 4.58% |