Allergan plc

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

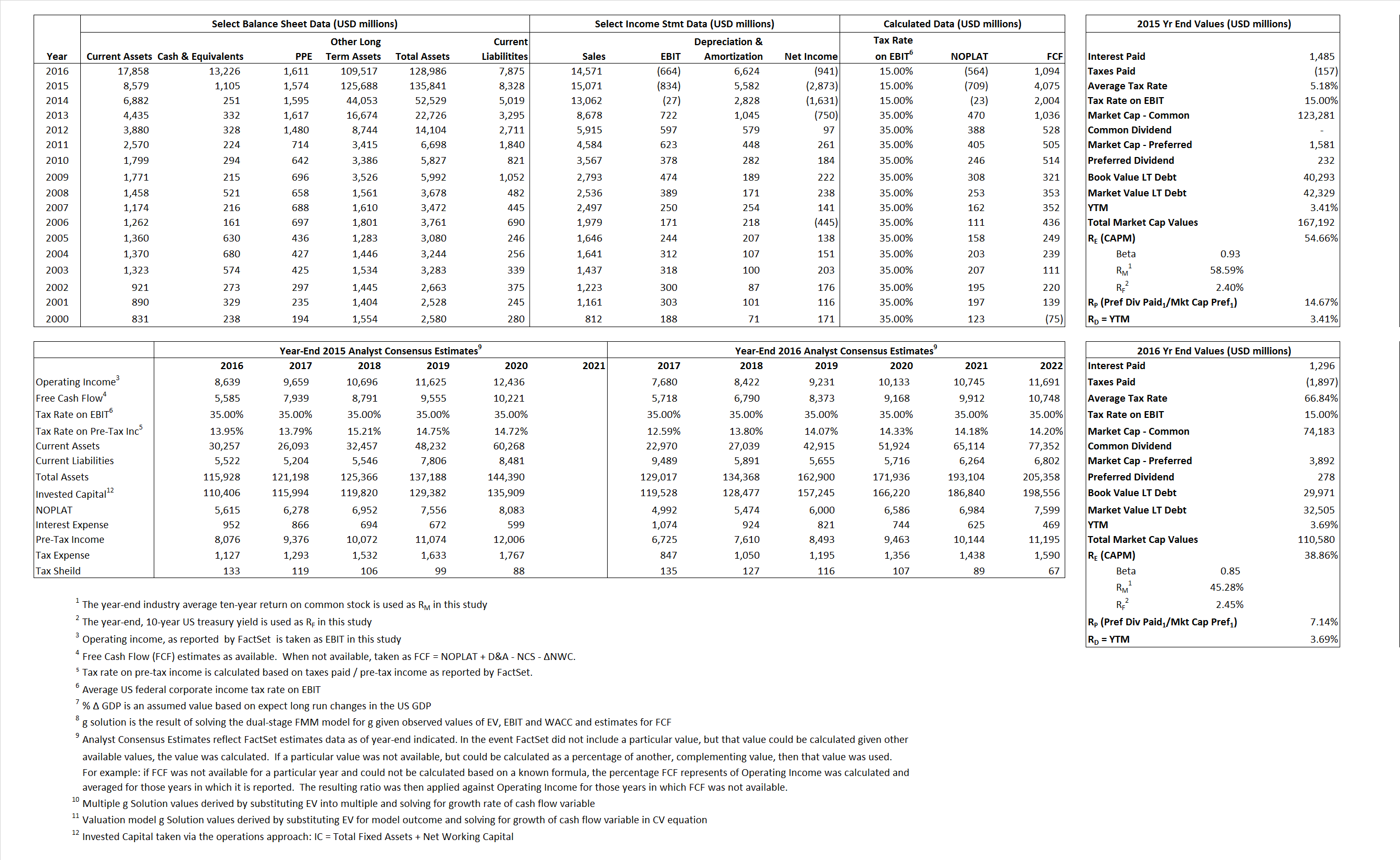

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | (709) | (564) | |

| Free Cash Flow | FCF | 4,075 | 1,094 | |

| Tax Shield | TS | 77 | 866 | |

| Invested Capital | IC | 127,512 | 121,111 | |

| Return on Invested Capital | ROIC | -0.56% | -0.47% | |

| Net Investment | NetInv | 85,584 | 223 | |

| Investment Rate | IR | -12,068.43% | -39.49% | |

| Weighted Average Cost of Capital |

WACCMarket | 41.26% | 26.68% | |

| WACCBook | 7.37% | 6.45% | ||

| Enterprise value |

EVMarket | 166,087 | 97,354 | |

| EVBook | 164,050 | 94,820 | ||

| Long-Run Growth |

g = IR x ROIC |

67.12% | 0.18% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | -5.54% | -4.56% | |

| Depreciation/Amortization Rate | D | 117.57% | 111.14% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

11.02 |

6.68 | 179.49% | -111.69% | 48.66% | 43.41% |

|

|

34.98 |

16.33 | 179.49% | -111.69% | 48.66% | 43.41% |

|

|

-234.20 |

-172.49 | 179.49% | -111.69% | 48.66% | 43.41% |

|

|

40.76 |

89.00 | 179.49% | -111.69% | 48.66% | 43.41% |

|

|

-199.07 |

-146.62 | 179.49% | -111.69% | 48.66% | 43.41% |

|

|

1.30 |

0.80 | 179.49% | -111.69% | 48.66% | 43.41% |