Freeport-Mcmoran

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Clarksons Platou Securities | Jeremy Sussman | jeremy.sussman@clarksons.com |

| RBC Capital Markets | Fraser Phillips | fraser.phillips@rbccm.com |

| Scotiabank GBM | Orest Wowkodaw | orest.wowkodaw@scotiabank.com |

| Deutsche Bank Research | Chris Terry | chris.terry@db.com |

| Stifel Nicolaus | Paul Massoud | pamassoud@stifel.com |

| Jefferies | Christopher LaFemina | clafemina@jefferies.com |

| BMO Capital Markets | David Gagliano | david.gagliano@bmo.com |

| FBR Capital Markets & Co | Lucas Pipes | lpipes@fbr.com |

| BB&T Capital Markets | Garrett S. Nelson | gnelson@bbandtcm.com |

| Cowen & Company | Anthony B. Rizzuto Jr. | anthony.rizzuto@cowen.com |

| Gabelli & Company | Chris Mancini | cmancini@gabelli.com |

| Berenberg | Fawzi Hanano | fawzi.hanano.@berenberg.com |

| Morningstar | Jeffrey Stafford | jeffrey.stafford@morningstar.com |

| Argus Research | William Selesky | bselesky@argusresearch.com |

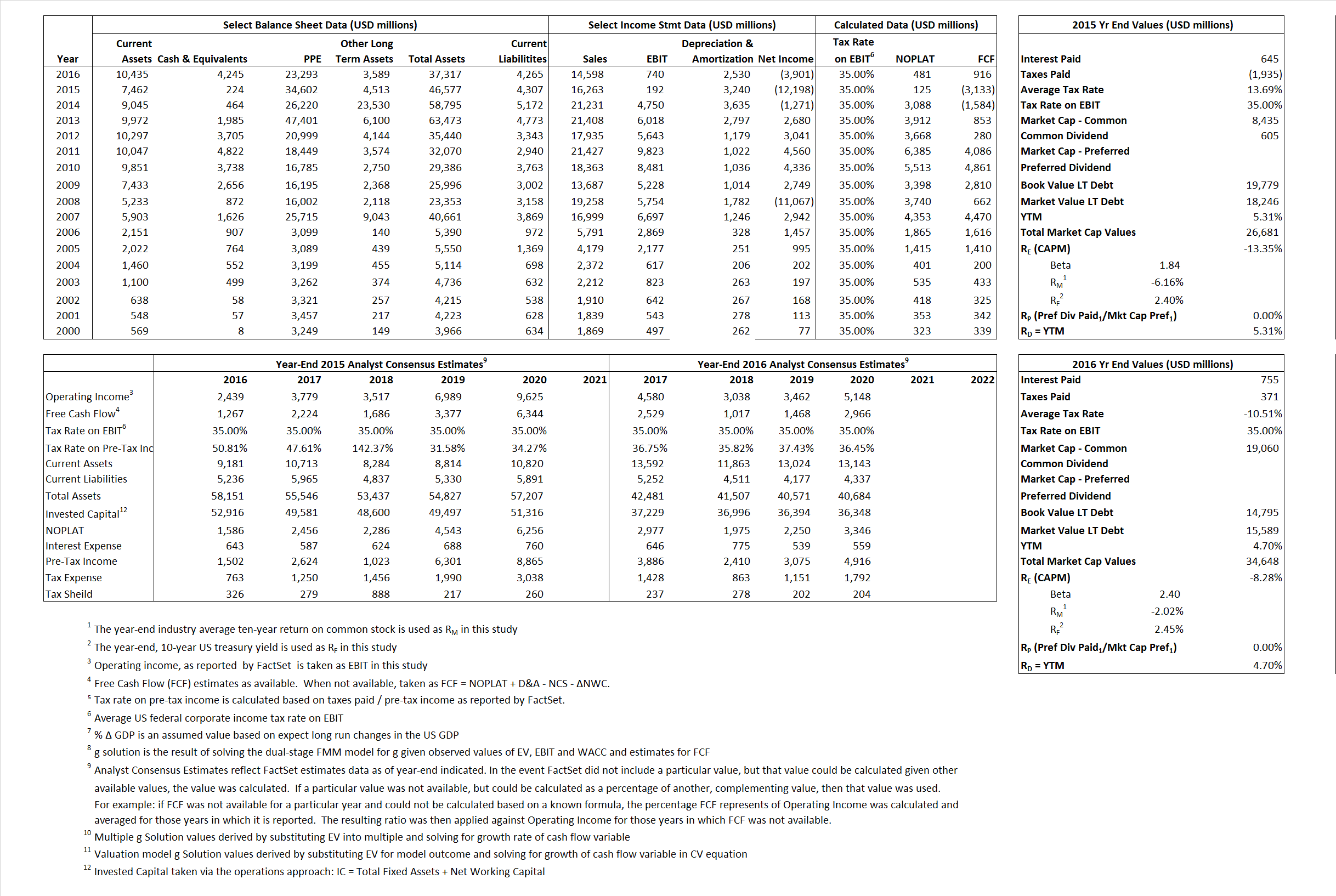

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 125 | 481 | |

| Free Cash Flow | FCF | (3,133) | 916 | |

| Tax Shield | TS | 88 | (79) | |

| Invested Capital | IC | 42,270 | 33,052 | |

| Return on Invested Capital | ROIC | 0.30% | 1.46% | |

| Net Investment | NetInv | (8,113) | (6,688) | |

| Investment Rate | IR | -6,500.80% | -1,390.44% | |

| Weighted Average Cost of Capital |

WACCMarket | -1.09% | -2.22% | |

| WACCBook | 6.85% | 10.53% | ||

| Enterprise value |

EVMarket | 26,457 | 30,403 | |

| EVBook | 27,990 | 29,610 | ||

| Long-Run Growth |

g = IR x ROIC |

-19.19% | -20.23% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 1.18% | 5.07% | |

| Depreciation/Amortization Rate | D | 94.41% | 77.37% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.63 | 2.08 | 2.61% | 43.60% | 0.74% | 20.87% |

|

|

7.71 | 9.30 | 2.61% | 43.60% | 0.74% | 20.87% |

|

|

212.00 | 63.21 | 2.61% | 43.60% | 0.74% | 20.87% |

|

|

-8.44 | 33.19 | 2.61% | 43.60% | 0.74% | 20.87% |

|

|

137.80 | 41.09 | 2.61% | 43.60% | 0.74% | 20.87% |

|

|

0.63 | 0.92 | 2.61% | 43.60% | 0.74% | 20.87% |