Allstate

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| William Blair | Adam Klauber | aklauber@williamblair.com |

| Morningstar | Brett Horn | brett.horn@morningstar.com |

| Raymond James | C. Gregory Peters | greg.peters@raymondjames.com |

| Piper Jaffray | Daniel D. Farrell | daniel.d.farrell@pjc.com |

| Wells Fargo Securities | Elyse Greenspan | elyse.greenspan@wellsfargo.com |

| Dowling & Partners | Gary Ransom | ransom@dowling.com |

| Argus Research | Jacob Kilstein | jkilstein@argusresearch.com |

| Bernstein Research | Josh Stirling | josh.stirling@bernstein.com |

| Deutsche Bank Research | Joshua Shanker | joshua.shanker@db.com |

| Compass Point Research | Ken Billingsley | kbillingsley@compasspointllc.com |

| RBC Capital Markets | Mark Dwelle | mark.dwelle@rbccm.com |

| JMP Securities | Matthew J. Carletti | mcarletti@jmpsecurities.com |

| Keefe Bruyette & Woods | Meyer Shields | mshields@kbw.com |

| Sandler O’Neill & Partners | Paul Newsome | pnewsome@sandleroneill.com |

| FBR Capital Markets & Co | Randy Binner | rbinner@fbr.com |

| Credit Suisse | Ryan Tunis | ryan.tunis@credit-suisse.com |

| Sterne Agee CRT | Vinay Misquith | vmisquith@sterneageecrt.com |

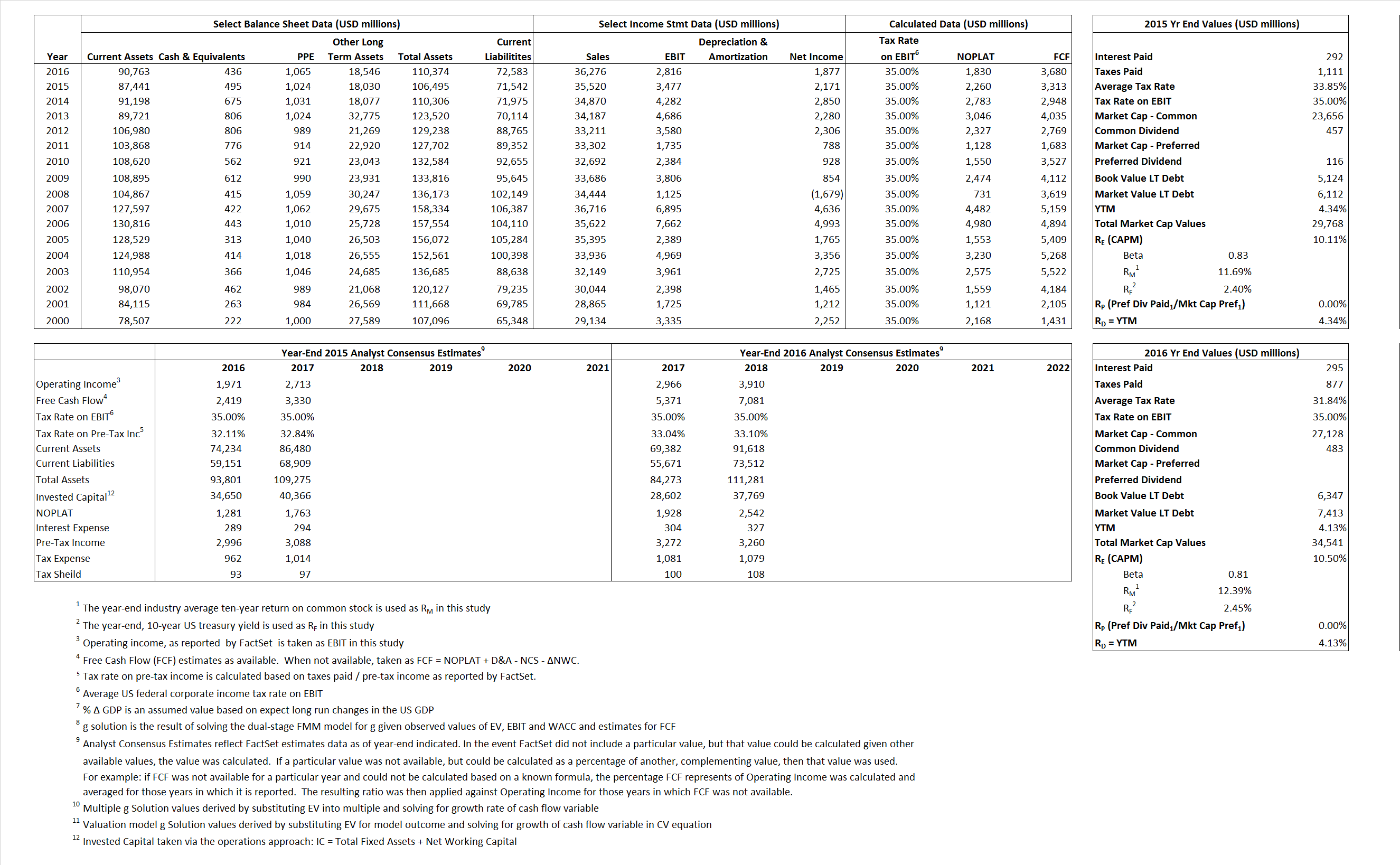

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,260 | 1,830 | |

| Free Cash Flow | FCF | 3,313 | 3,680 | |

| Tax Shield | TS | 99 | 94 | |

| Invested Capital | IC | 34,953 | 37,791 | |

| Return on Invested Capital | ROIC | 6.47% | 4.84% | |

| Net Investment | NetInv | (3,378) | 2,838 | |

| Investment Rate | IR | -149.47% | 155.05% | |

| Weighted Average Cost of Capital |

WACCMarket | 8.62% | 8.85% | |

| WACCBook | 7.05% | 6.70% | ||

| Enterprise value |

EVMarket | 29,273 | 34,105 | |

| EVBook | 28,285 | 33,039 | ||

| Long-Run Growth |

g = IR x ROIC |

-9.66% | 7.51% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 9.79% | 7.76% | |

| Depreciation/Amortization Rate | D | 0.00% | 0.00% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

.82 | .94 | -4.66% | -32.24% | -3.22% | 66.69% |

|

|

8.42 | 12.11 | -4.66% | -32.24% | -3.22% | 66.69% |

|

|

12.95 | 18.63 | -4.66% | -32.24% | -3.22% | 66.69% |

|

|

8.84 | 9.27 | -4.66% | -32.24% | -3.22% | 66.69% |

|

|

8.42 | 12.11 | -4.66% | -32.24% | -3.22% | 66.69% |

|

|

.84 | .90 | -4.66% | -32.24% | -3.22% | 66.69% |