Intel Corporation

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| BMO Capital Markets | Ambrish Srivastava | ambrish.srivastava@bmo.com |

| RBC Capital Markets | Amit Daryanani | amit.daryanani@rbccm.com |

| Aegis / HIRG Technology | Ashok Kumar | akumar@aegiscap.com |

| Wedbush Securities | Betsy Van Hees | betsy.vanhees@wedbush.com |

| Evercore ISI | C.J. Muse | cj.muse@evercoreisi.com |

| B Riley & Co | Craig A. Ellis | cellis@brileyco.com |

| Wells Fargo Securities | David Wong | david.m.wong@wellsfargo.com |

| CRT Capital Group | Douglas Freedman | dfreedman@sterneageecrt.com |

| Raymond James | Hans Mosesmann | hans.mosesmann@raymondjames.com |

| Credit Suisse | John Pitzer | john.pitzer@credit-suisse.com |

| Stifel Nicolaus | Kevin E Cassidy | kcassidy@stifel.com |

| Roth Capital Partners | Krishna Shankar | kshankar@roth.com |

| Jefferies | Mark Lipacis | mlipacis@jefferies.com |

| Canaccord Genuity | Matthew D. Ramsay | mramsay@canaccordgenuity.com |

| Pacific Crest Securities-KBCM | Michael McConnell | mmcconnell@pacific-crest.com |

| Brean Capital, LLC | Mike Burton | mburton@breancapital.com |

| Oppenheimer | Rick Schafer | rick.schafer@opco.com |

| Nomura Research | Romit Shah | romit.shah@nomura.com |

| Deutsche Bank Research | Ross Seymore | ross.seymore@db.com |

| Bernstein Research | Stacy A. Rasgon | stacy.rasgon@bernstein.com |

| Topeka Capital Markets | Suji De Silva | sd@topekacapitalmarkets.com |

| Northland Securities | Thomas Sepenzis | tsepenzis@northlandcapitalmarkets.com |

| Cowen & Company | Timothy Arcuri | timothy.arcuri@cowen.com |

| Mizuho Securities USA | Vijay Rakesh | vijay.rakesh@us.mizuho-sc.com |

| SunTrust Robinson Humphrey | William Stein | william.stein@suntrust.com |

| Needham | Y. Edwin Mok | emok@needhamco.com |

| Daiwa Securities Co. Ltd. | Yoko Yamada | yoko.yamada@us.daiwacm.com |

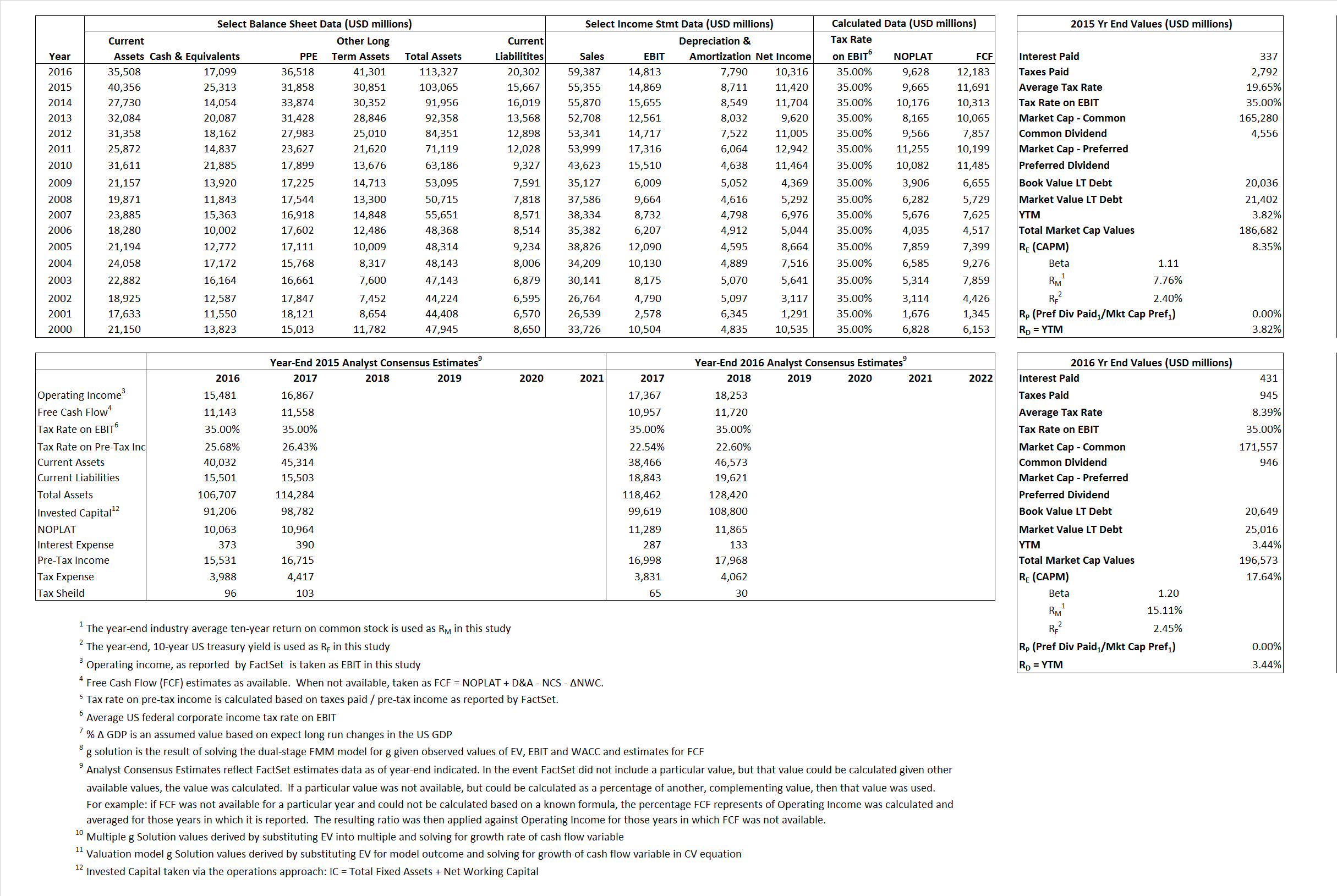

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 9,665 | 9,628 | |

| Free Cash Flow | FCF | 11,691 | 12,183 | |

| Tax Shield | TS | 66 | 36 | |

| Invested Capital | IC | 87,398 | 93,025 | |

| Return on Invested Capital | ROIC | 11.06% | 10.35% | |

| Net Investment | NetInv | 20,172 | 13,417 | |

| Investment Rate | IR | 208.72% | 139.35% | |

| Weighted Average Cost of Capital |

WACCMarket | 7.74% | 15.80% | |

| WACCBook | 9.18% | 9.22% | ||

| Enterprise value |

EVMarket | 161,369 | 179,474 | |

| EVBook | 168,217 | 175,107 | ||

| Long-Run Growth |

g = IR x ROIC |

23.08% | 14.42% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 26.86% | 24.94% | |

| Depreciation/Amortization Rate | D | 36.94% | 34.46% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.92 | 3.02 | 3.83% | 21.66% | 3.95% | 19.23% |

|

|

6.84 | 7.94 | 3.83% | 21.66% | 3.95% | 19.23% |

|

|

16.70 | 18.64 | 3.83% | 21.66% | 3.95% | 19.23% |

|

|

13.80 | 14.73 | 3.83% | 21.66% | 3.95% | 19.23% |

|

|

10.85 | 12.12 | 3.83% | 21.66% | 3.95% | 19.23% |

|

|

1.85 | 1.93 | 3.83% | 21.66% | 3.95% | 19.23% |