FedEx

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Credit Suisse | Allison M. Landry | allison.landry@credit-suisse.com |

| Raymond James | Arthur W. Hatfield | art.hatfield@raymondjames.com |

| Susquehanna Financial Group | Bascome Majors | bascome.majors@sig.com |

| Thompson Davis & Co | David Campbell | dcampbell@thompsondavis.com |

| Stifel Nicolaus | David G. Ross | dross@stifel.com |

| Bernstein Research | David Vernon | david.vernon@bernstein.com |

| Avondale Partners | Donald Broughton | dbroughton@avondalepartnersllc.com |

| Cowen & Company | Helane Becker | helane.becker@cowen.com |

| Stephens Inc | Jack Atkins | jack.atkins@stephens.com |

| Buckingham Research | Jeffrey Kauffman | jkauffman@buckresearch.com |

| RBC Capital Markets | John Barnes | john.barnes@rbccm.com |

| BB&T Capital Markets | Kevin W. Sterling | ksterling@bbandtcm.com |

| Nomura Research | Matt Troy | matt.troy@nomura.com |

| William Blair | Nathan Brochmann | nbrochmann@williamblair.com |

| Deutsche Bank Research | Robert Salmon | robert.salmon@db.com |

| Wolfe Research | Scott H. Group | sgroup@wolferesearch.com |

| Oppenheimer | Scott Schneeberger | scott.schneeberger@opco.com |

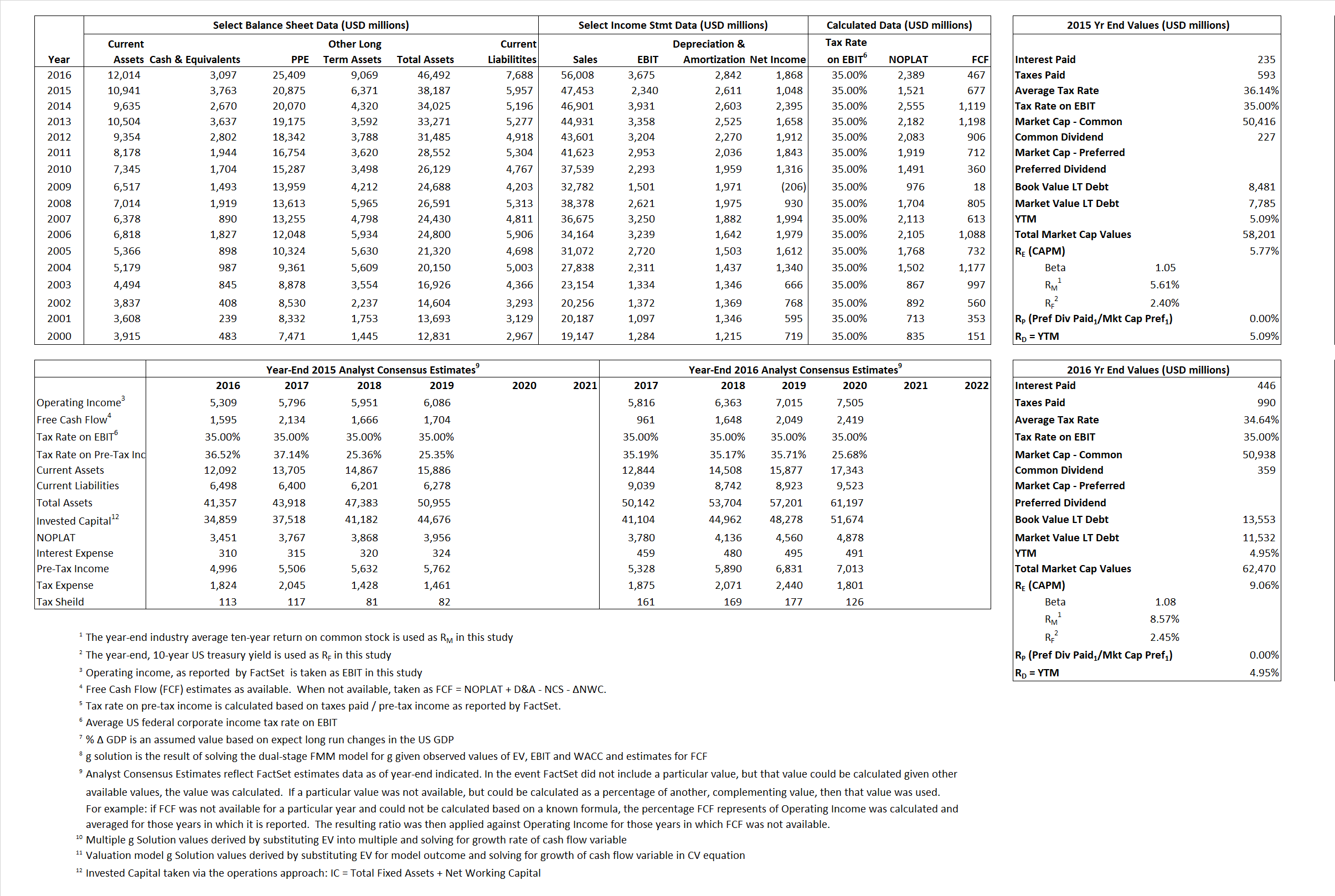

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,521 | 2,389 | |

| Free Cash Flow | FCF | 677 | 467 | |

| Tax Shield | TS | 85 | 154 | |

| Invested Capital | IC | 32,230 | 38,804 | |

| Return on Invested Capital | ROIC | 4.72% | 6.16% | |

| Net Investment | NetInv | 6,012 | 9,416 | |

| Investment Rate | IR | 395.27% | 394.20% | |

| Weighted Average Cost of Capital |

WACCMarket | 5.43% | 7.98% | |

| WACCBook | 8.06% | 8.27% | ||

| Enterprise value |

EVMarket | 54,438 | 59,373 | |

| EVBook | 55,134 | 61,394 | ||

| Long-Run Growth |

g = IR x ROIC |

18.65% | 24.27% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 4.93% | 6.56% | |

| Depreciation/Amortization Rate | D | 52.74% | 43.61% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.15 | 1.06 | 6.47% | 11.43% | 6.28% | 9.68% |

|

|

11.00 | 9.11 | 6.47% | 11.43% | 6.28% | 9.68% |

|

|

35.79 | 24.86 | 6.47% | 11.43% | 6.28% | 9.68% |

|

|

80.37 | 127.05 | 6.47% | 11.43% | 6.28% | 9.68% |

|

|

23.26 | 16.16 | 6.47% | 11.43% | 6.28% | 9.68% |

|

|

1.69 | .53 | 6.47% | 11.43% | 6.28% | 9.68% |