Colgate-Palmolive Company

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Bernstein Research | Ali Dibadj | ali.dibadj@bernstein.com |

| CRT Capital Group | April Scee | ascee@sterneageecrt.com |

| Deutsche Bank Research | Bill Schmitz Jr. | william.schmitz@db.com |

| Atlantic Equities | Charles Eden | c.eden@atlantic-equities.com |

| Consumer Edge Research | Javier Escalante | jescalante@consumeredgeresearch.com |

| William Blair | Jon R. Andersen | jandersen@williamblair.com |

| Raymond James | Joseph Altobello | joe.altobello@raymondjames.com |

| First Global Stockbroking | Kavita Thomas | kavita.thomas@fglobal.com |

| B Riley & Co | Linda Bolton Weiser | lweiser@brileyco.com |

| Stifel Nicolaus | Mark S. Astrachan | msastrachan@stifel.com |

| RBC Capital Markets | Nik Modi | nik.modi@rbccm.com |

| SunTrust Robinson Humphrey | William B. Chappell Jr. | bill.chappell@suntrust.com |

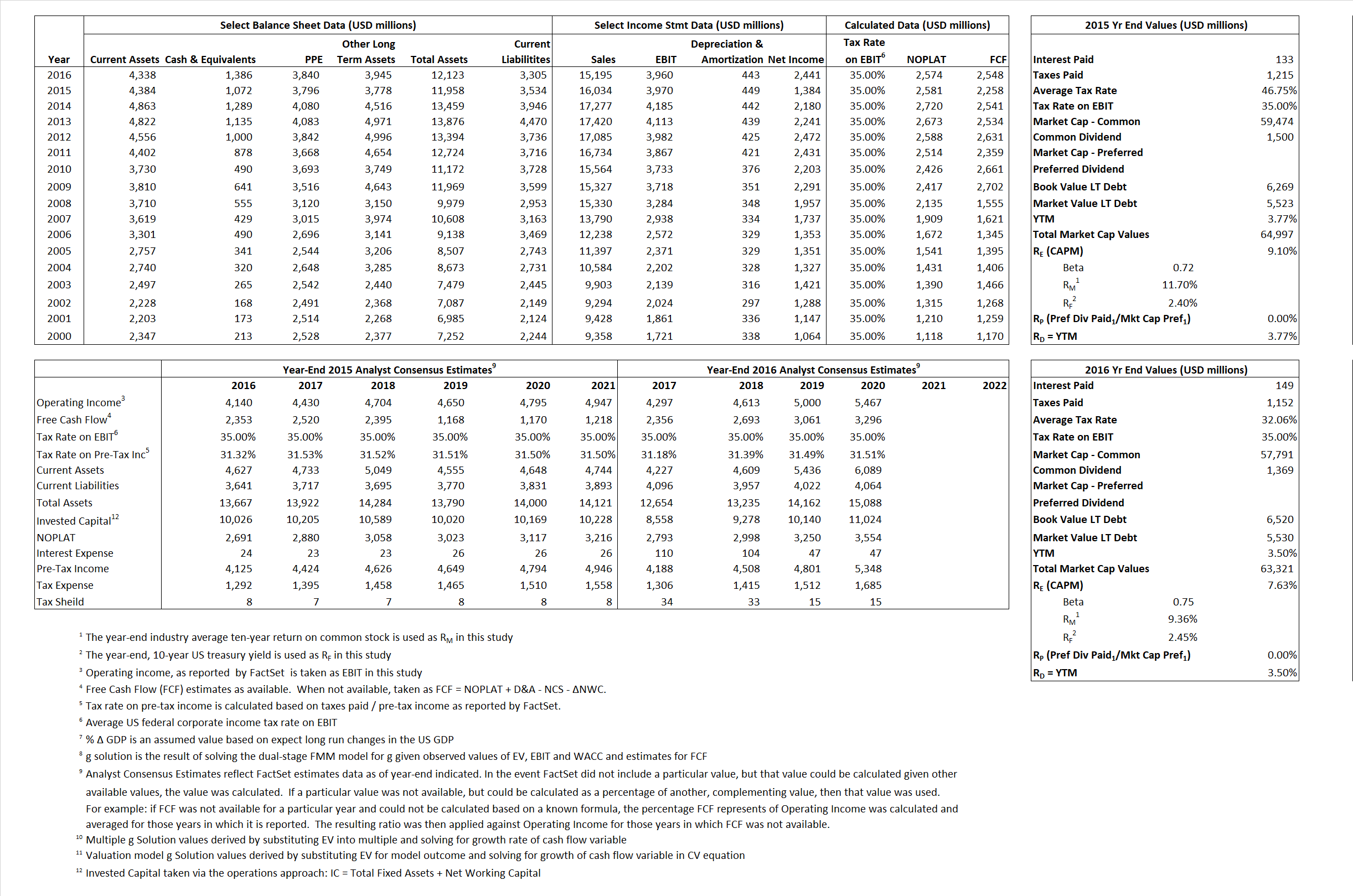

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,581 | 2,574 | |

| Free Cash Flow | FCF | 2,258 | 2,548 | |

| Tax Shield | TS | 62 | 48 | |

| Invested Capital | IC | 8,424 | 8,818 | |

| Return on Invested Capital | ROIC | 30.63% | 29.19% | |

| Net Investment | NetInv | (640) | 837 | |

| Investment Rate | IR | -24.80% | 32.52% | |

| Weighted Average Cost of Capital |

WACCMarket | 8.49% | 7.17% | |

| WACCBook | 6.85% | 6.82% | ||

| Enterprise value |

EVMarket | 63,925 | 61,935 | |

| EVBook | 64,671 | 62,925 | ||

| Long-Run Growth |

g = IR x ROIC |

-7.60% | 9.49% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 24.76% | 26.06% | |

| Depreciation/Amortization Rate | D | 10.16% | 10.06% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

3.99 | 4.08 | 5.13% | 3.52% | 6.04% | 4.51% |

|

|

14.47 | 14.07 | 5.13% | 3.52% | 6.04% | 4.51% |

|

|

24.77 | 24.03 | 5.13% | 3.52% | 6.04% | 4.51% |

|

|

28.31 | 24.31 | 5.13% | 3.52% | 6.04% | 4.51% |

|

|

16.10 | 15.64 | 5.13% | 3.52% | 6.04% | 4.51% |

|

|

7.59 | 7.02 | 5.13% | 3.52% | 6.04% | 4.51% |