Caterpillar

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Wells Fargo Securities | Andrew M. Casey | andrew.casey@wellsfargo.com |

| Evercore ISI | David Raso | david.raso@evercoreisi.com |

| Longbow Research | Eli Lustgarten | elustgarten@longbowresearch.com |

| Credit Suisse | Jamie Cook | jamie.cook@credit-suisse.com |

| BMO Capital Markets | Joel Tiss | joel.tiss@bmo.com |

| William Blair | Lawrence T. De Maria | ldemaria@williamblair.com |

| Atlantic Equities | Richard Radbourne | r.radbourne@atlantic-equities.com |

| RBC Capital Markets | Seth Weber | seth.weber@rbccm.com |

| Jefferies | Stephen Volkmann | svolkmann@jefferies.com |

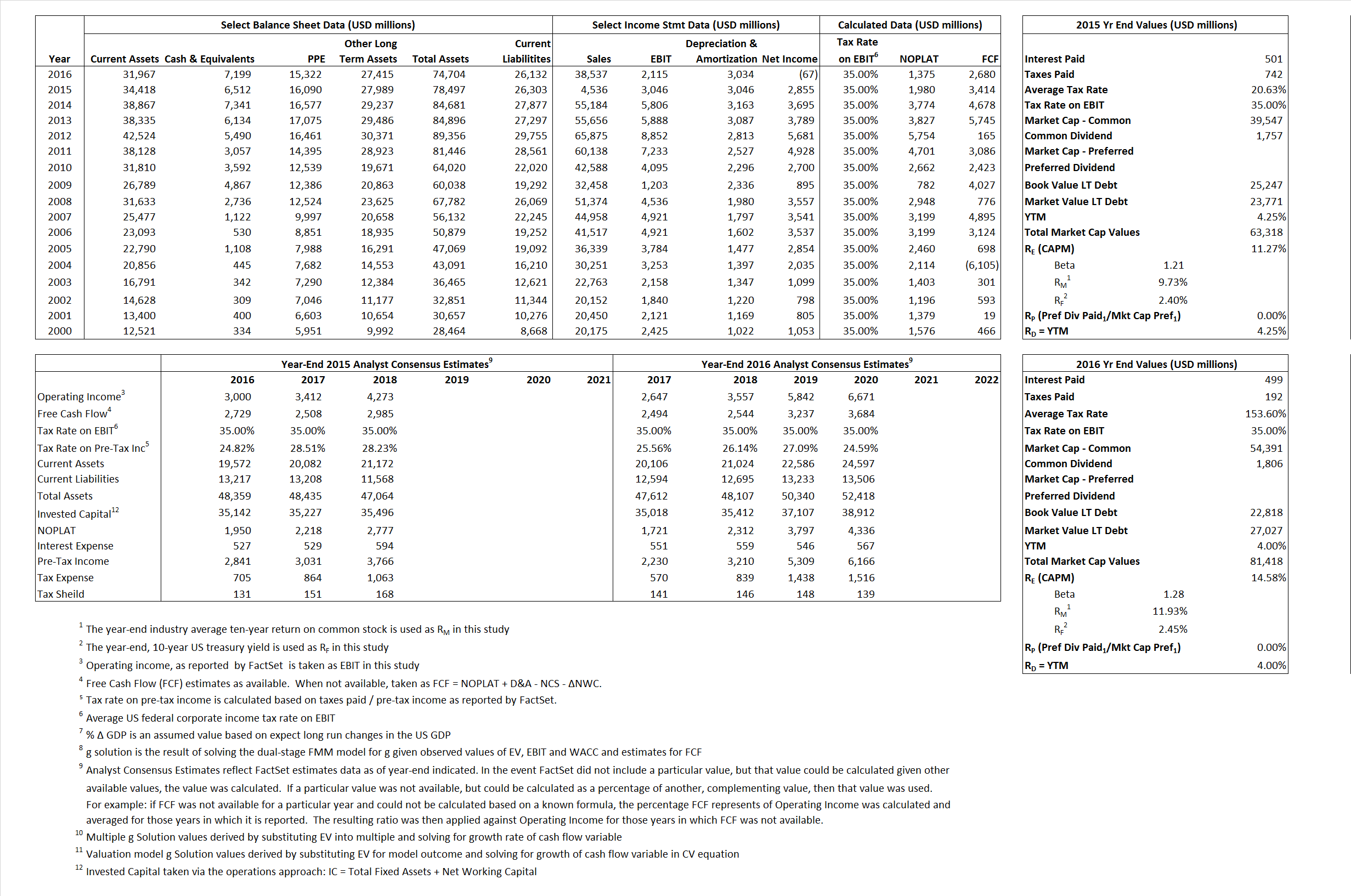

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,980 | 1,375 | |

| Free Cash Flow | FCF | 3,414 | 2.680 | |

| Tax Shield | TS | 103 | 766 | |

| Invested Capital | IC | 52,194 | 48.572 | |

| Return on Invested Capital | ROIC | 3.79% | 2.83% | |

| Net Investment | NetInv | (1,564) | (588) | |

| Investment Rate | IR | -78.99% | -42.77% | |

| Weighted Average Cost of Capital |

WACCMarket | 8.30% | 9.03% | |

| WACCBook | 6.43% | 6.86% | ||

| Enterprise value |

EVMarket | 56,806 | 74,219 | |

| EVBook | 58,282 | 70,010 | ||

| Long-Run Growth |

g = IR x ROIC |

-3.00% | -1.21% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 67.15% | 5.49% | |

| Depreciation/Amortization Rate | D | 50.00% | 58.92% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

12.52 | 1.93 | 59.36% | 20.78% | 29.58% | 14.28% |

|

|

9.32 | 14.41 | 59.36% | 20.78% | 29.58% | 14.28% |

|

|

28.69 | 53.99 | 59.36% | 20.78% | 29.58% | 14.28% |

|

|

16.64 | 27.69 | 59.36% | 20.78% | 29.58% | 14.28% |

|

|

18.65 | 35.09 | 59.36% | 20.78% | 29.58% | 14.28% |

|

|

1.09 | 1.53 | 59.36% | 20.78% | 29.58% | 14.28% |