ConocoPhillips

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Scotia Howard Weil | Blake Fernandez | blake.fernandez@scotiabank.com |

| Cowen & Company | Charles Robertson | charles.robertson@cowen.com |

| Evercore ISI | Douglas Terreson | doug.terreson@evercoreisi.com |

| Credit Suisse | Edward Westlake | edward.westlake@credit-suisse.com |

| Piper Jaffray | Guy Baber | guy.a.baber@simmonspjc.com |

| Alembic Global Advisors | James Sullivan | james.sullivan@alembicglobal.com |

| Jefferies | Jason Gammel | jason.gammel@jefferies.com |

| Nomura Research | Lloyd Byrne | lloyd.byrne@nomura.com |

| Wolfe Research | Paul Sankey | psankey@wolferesearch.com |

| Raymond James | Pavel Molchanov | pavel.molchanov@raymondjames.com |

| Wells Fargo Securities | Roger D. Read | roger.read@wellsfargo.com |

| Deutsche Bank Research | Ryan Todd | ryan.todd@db.com |

| RBC Capital Markets | Scott Hanold | scott.hanold@rbccm.com |

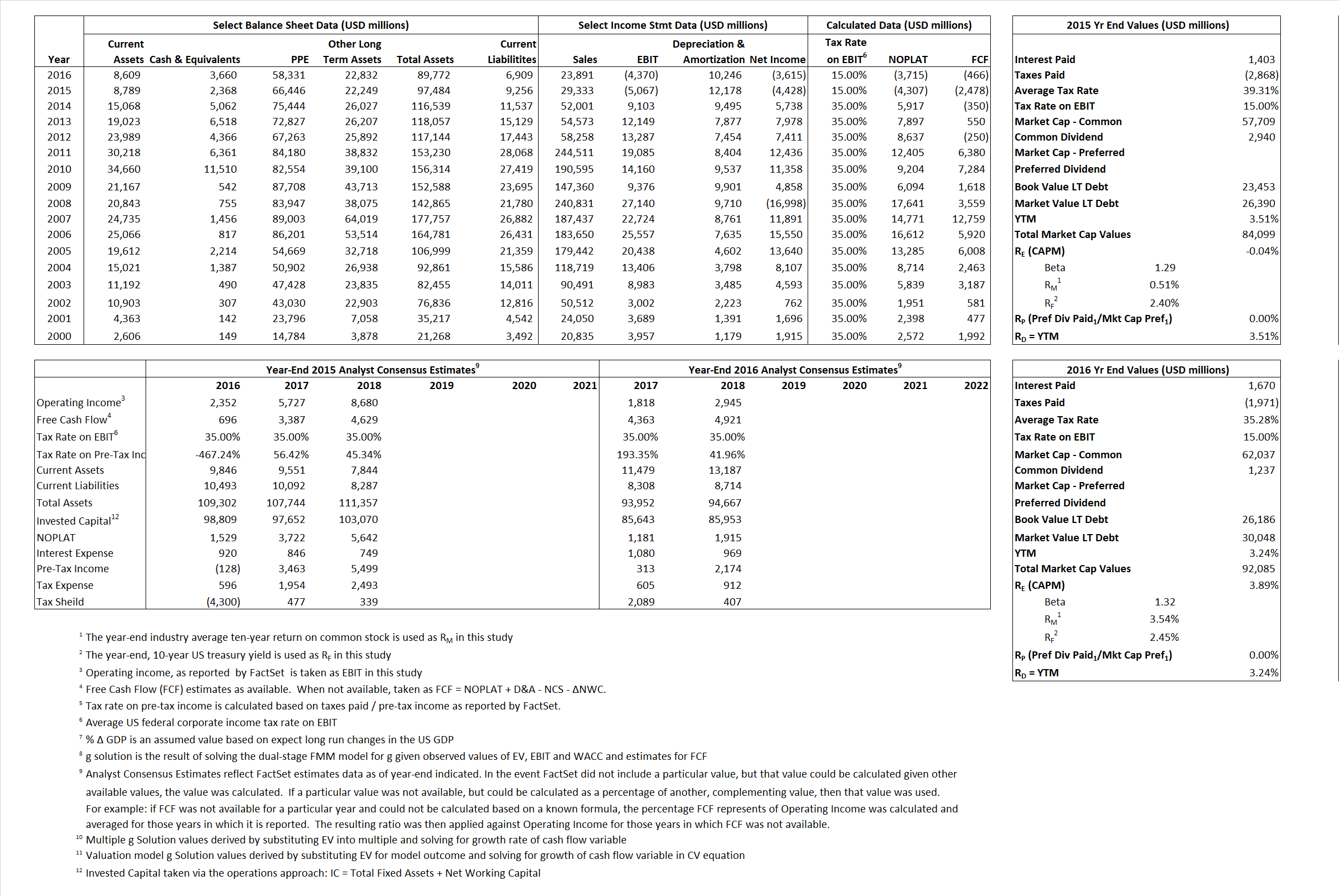

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | (4,307) | (3,715) | |

| Free Cash Flow | FCF | (2,478) | (466) | |

| Tax Shield | TS | 552 | 589 | |

| Invested Capital | IC | 88,228 | 82,863 | |

| Return on Invested Capital | ROIC | -4.88% | -4.48% | |

| Net Investment | NetInv | (4,596) | 4,881 | |

| Investment Rate | IR | 106.71% | -131.40% | |

| Weighted Average Cost of Capital |

WACCMarket | 0.64% | 3.30% | |

| WACCBook | 8.85% | 8.64% | ||

| Enterprise value |

EVMarket | 81,731 | 88,425 | |

| EVBook | 78,794 | 84,563 | ||

| Long-Run Growth |

g = IR x ROIC |

-5.21% | 5.89% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | -17.27% | -18.29% | |

| Depreciation/Amortization Rate | D | 171.26% | 174.37% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.79 | 3.70 | -74.37% | 119.32% | -35.05% | 59.40% |

|

|

11.49 | 15.05 | -74.37% | 119.32% | -35.05% | 59.40% |

|

|

-18.98 | -23.81 | -74.37% | 119.32% | -35.05% | 59.40% |

|

|

-32.98 | -189.75 | -74.37% | 119.32% | -35.05% | 59.40% |

|

|

-16.13 | -20.23 | -74.37% | 119.32% | -35.05% | 59.40% |

|

|

0.93 | 1.07 | -74.37% | 119.32% | -35.05% | 59.40% |