Amazon.com

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Raymond James | Aaron Kessler | aaron.kessler@raymondjames.com |

| Jefferies | Brian Pitz | bpitz@jefferies.com |

| Bernstein Research | Carlos Kirjner | carlos.kirjner@bernstein.com |

| Monness Crespi Hardt | Cengiz M. Cakmak | jcakmak@mchny.com |

| BGC Financial, L.P. | Colin W. Gillis | cgillis@bgcpartners.com |

| The Benchmark Company, LLC | Daniel L. Kurnos | dkurnos@benchmarkcompany.com |

| BMO Capital Markets | Daniel Salmon | dan.salmon@bmo.com |

| KeyBanc Capital Markets | Edward Yruma | eyruma@key.com |

| Burke and Quick Partners, LLC | Frederick W. Moran | fmoran@bqpartners.com |

| Piper Jaffray | Gene Munster | gene.a.munster@pjc.com |

| Atlantic Equities | James Cordwell | j.cordwell@atlantic-equities.com |

| Oppenheimer | Jason Helfstein | jason.helfstein@opco.com |

| Cowen & Company | John Blackledge | john.blackledge@cowen.com |

| Daiwa Securities Co. Ltd. | Kazuya Nishimura | kazuya.nishimura@us.daiwacm.com |

| Evercore ISI | Ken Sena | ken.sena@evercoreisi.com |

| Needham | Kerry Rice | krice@needhamco.com |

| RBC Capital Markets | Mark S. Mahaney | mark.mahaney@rbccm.com |

| Canaccord Genuity | Michael Graham | mgraham@canaccordgenuity.com |

| Wedbush Securities | Michael Pachter | michael.pachter@wedbush.com |

| Mizuho Securities USA | Neil A. Doshi | neil.doshi@us.mizuho-sc.com |

| Nomura Research | Robert S. Drbul | robert.drbul@nomura.com |

| SunTrust Robinson Humphrey | Robert S. Peck | robert.peck@suntrust.com |

| JMP Securities | Ronald V. Josey | rjosey@jmpsecurities.com |

| Deutsche Bank Research | Ross Sandler | ross.sandler@db.com |

| Wolfe Research | Scott Mushkin | smushkin@wolferesearch.com |

| Stifel Nicolaus | Scott W. Devitt | swdevitt@stifel.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| Susquehanna Financial Group | Shyam Patil | shyam.patil@sig.com |

| Credit Suisse | Stephen Ju | stephen.ju@credit-suisse.com |

| Axiom Capital | Victor Anthony | vanthony@axiomcapital.com |

| Cantor Fitzgerald | Youssef H. Squali | ysquali@cantor.com |

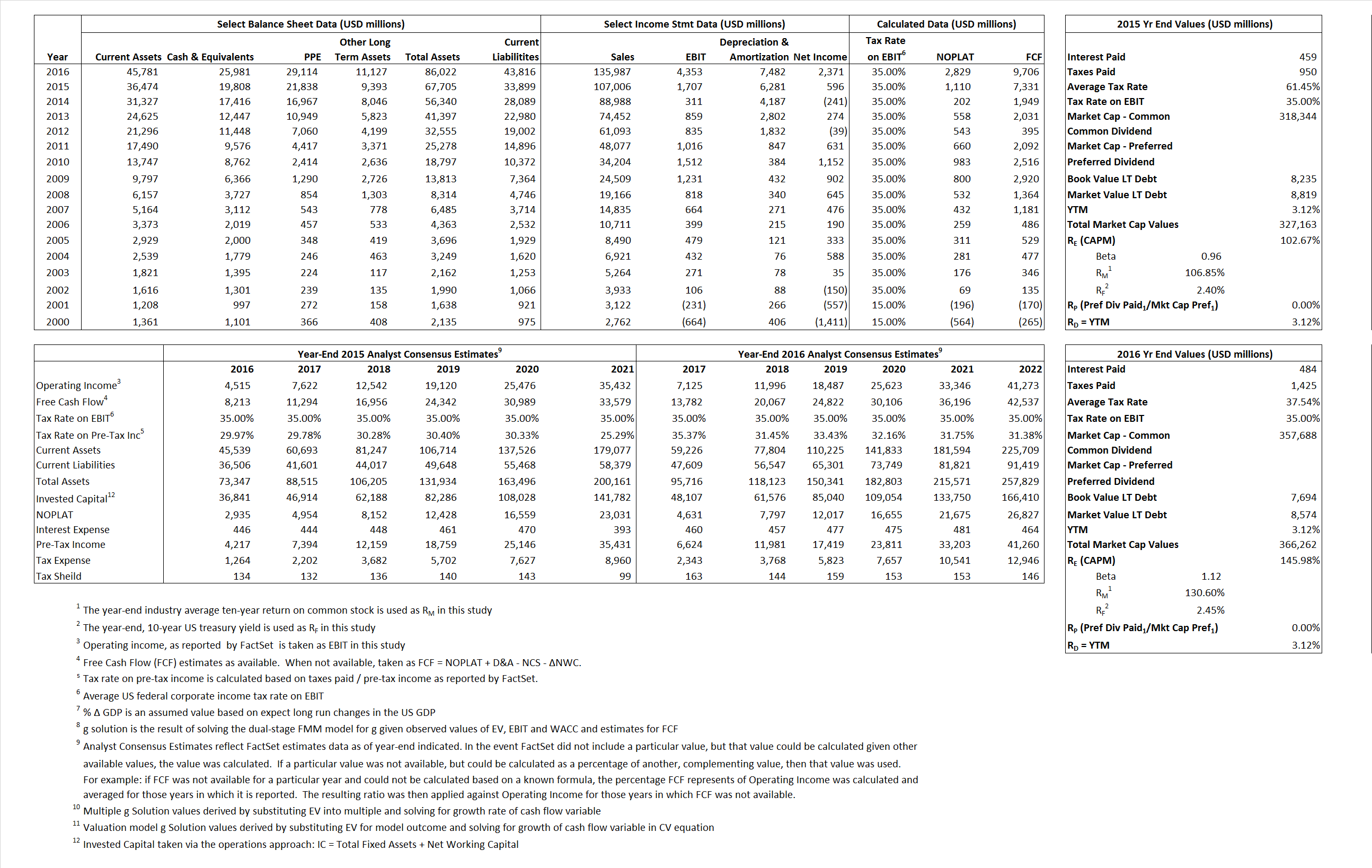

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 1,100 | 2,829 | |

| Free Cash Flow | FCF | 7,331 | 9,706 | |

| Tax Shield | TS | 282 | 182 | |

| Invested Capital | IC | 33,806 | 42,206 | |

| Return on Invested Capital | ROIC | 3.28% | 6.70% | |

| Net Investment | NetInv | 11,836 | 15,882 | |

| Investment Rate | IR | 1,066.74% | 561.31% | |

| Weighted Average Cost of Capital |

WACCMarket | 99.94% | 142.61% | |

| WACCBook | 8.69% | 9.31% | ||

| Enterprise value |

EVMarket | 307,355 | 340,281 | |

| EVBook | 306,771 | 339,401 | ||

| Long-Run Growth |

g = IR x ROIC |

35.01% | 37.63% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 1.60% | 3.20% | |

| Depreciation/Amortization Rate | D | 78.63% | 63.22% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.87 | 2.50 | 111.88% | 161.85% | 110.28% | 142.81% |

|

|

38.48 | 28.75 | 111.88% | 161.85% | 110.28% | 142.81% |

|

|

277.01 | 120.26 | 111.88% | 161.85% | 110.28% | 142.81% |

|

|

41.93 | 35.06 | 111.88% | 161.85% | 110.28% | 142.81% |

|

|

180.06 | 78.17 | 111.88% | 161.85% | 110.28% | 142.81% |

|

|

9.09 | 8.06 | 111.88% | 161.85% | 110.28% | 142.81% |