Accenture

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Raymond James | Brian A. Gesuale | brian.gesuale@raymondjames.com |

| Cowen & Company | Bryan C. Bergin | bryan.bergin@cowen.com |

| Deutsche Bank Research | Bryan Keane | bryan.keane@db.com |

| Credit Suisse | Charles Brennan | charles.brennan@credit-suisse.com |

| RBC Capital Markets | Daniel Perlin | daniel.perlin@rbccm.com |

| Stifel Nicolaus | David Grossman | dgrossman@stifel.com |

| Evercore ISI | David Togut | david.togut@evercoreisi.com |

| Wells Fargo Securities | Edward S. Caso | edward.caso@wellsfargo.com |

| SunTrust Robinson Humphrey | Frank Atkins | frank.atkins@suntrust.com |

| Susquehanna Financial Group | James Friedman | james.friedman@sig.com |

| Jefferies | Jason Kupferberg | jkupferberg@jefferies.com |

| Cantor Fitzgerald | Joseph D. Foresi | jforesi@cantor.com |

| BMO Capital Markets | Keith Bachman | keith.bachman@bmo.com |

| Bernstein Research | Lisa D. Ellis | lisa.ellis@bernstein.com |

| CRT Capital Group | Moshe Katri | mkatri@sterneageecrt.com |

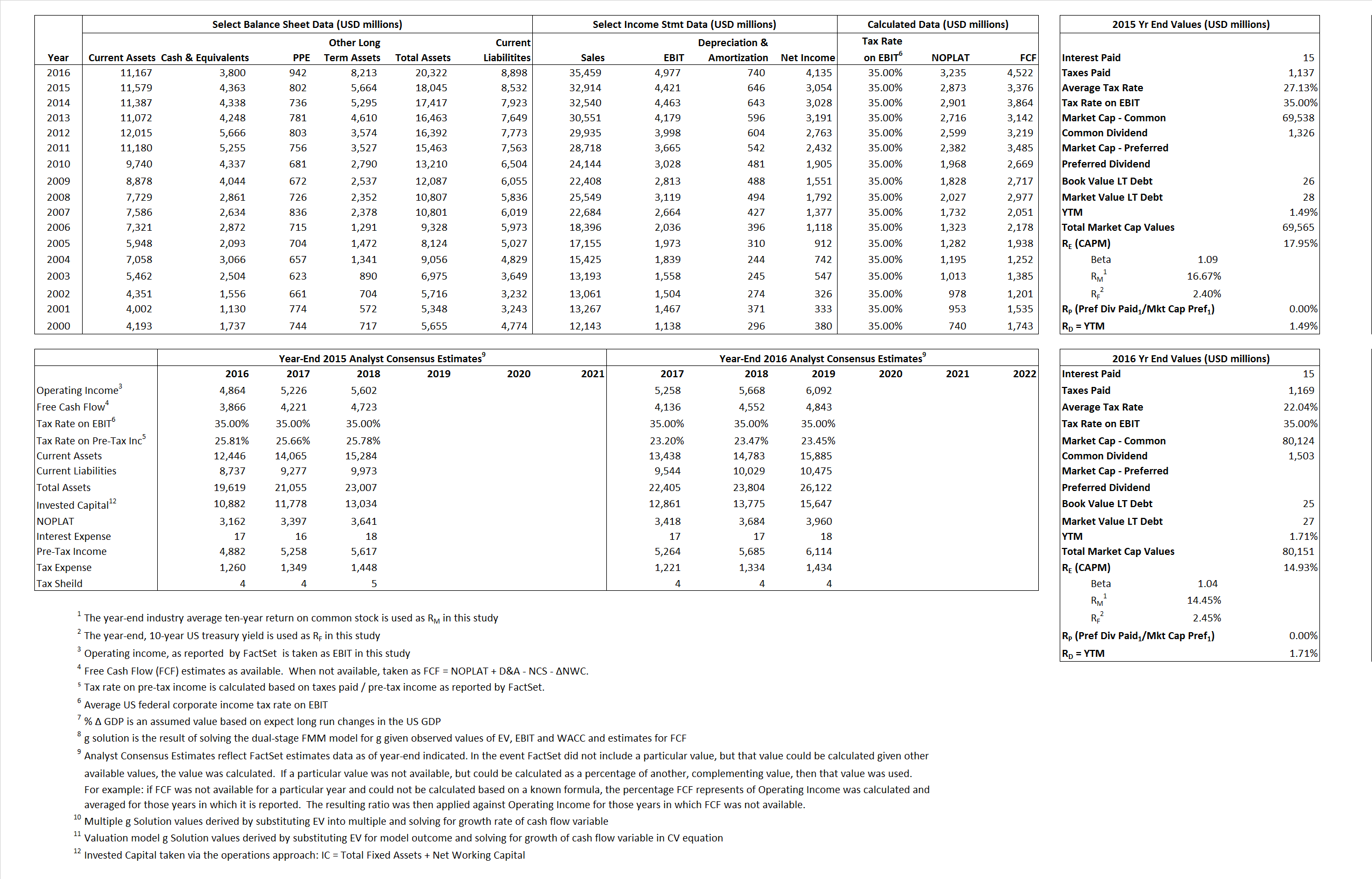

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,873 | 3,235 | |

| Free Cash Flow | FCF | 3,376 | 4,522 | |

| Tax Shield | TS | 4 | 3 | |

| Invested Capital | IC | 9,513 | 11,424 | |

| Return on Invested Capital | ROIC | 30.21% | 28.32% | |

| Net Investment | NetInv | 665 | 2,651 | |

| Investment Rate | IR | 23.13% | 81.95% | |

| Weighted Average Cost of Capital |

WACCMarket | 17.95% | 14.93% | |

| WACCBook | 9.86% | 9.44% | ||

| Enterprise value |

EVMarket | 65,202 | 76,351 | |

| EVBook | 65,200 | 76,349 | ||

| Long-Run Growth |

g = IR x ROIC |

6.99% | 23.21% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 13.43% | 14.04% | |

| Depreciation/Amortization Rate | D | 12.75% | 12.94% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.98 |

2.15 |

15.85% |

12.57% | 16.53% |

13.46% |

|

|

12.87 |

13.36 |

15.85% |

12.57% | 16.53% |

13.46% |

|

|

22.69 |

23.60 |

15.85% |

12.57% |

16.53% |

13.46% |

|

|

19.31 |

16.89 |

15.85% |

12.57% |

16.53% |

13.46% |

|

|

14.75 |

15.34 |

15.85% |

12.57% |

16.53% |

13.46% |

|

|

6.85 |

6.68 |

15.85% |

12.57% |

16.53% |

13.46% |