Nike

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| DA Davidson | Andrew Burns | aburns@dadco.com |

| Canaccord Genuity | Camilo Lyon | clyon@canaccordgenuity.com |

| Credit Suisse | Christian Buss | christian.buss@credit-suisse.com |

| Susquehanna Financial Group | Christopher Svezia | christopher.svezia@sig.com |

| BB&T Capital Markets | Corinna L. Freedman | cfreedman@bbandtcm.com |

| Jefferies | Edward Plank | eplank@jefferies.com |

| Brean Capital, LLC | Eric B. Tracy | etracy@breancapital.com |

| Piper Jaffray | Erinn E. Murphy | erinn.e.murphy@pjc.com |

| Hilliard Lyons | Jeffrey S. Thomison | jthomison@hilliard.com |

| Stifel Nicolaus | Jim Duffy | jduffy@stifel.com |

| Cowen & Company | John Kernan | john.kernan@cowen.com |

| Telsey Advisory Group | Kelly Chen | kchen@telseygroup.com |

| B Riley & Co | Mitch Kummetz | mkummetz@brileyco.com |

| Evercore ISI | Omar Saad | omar.saad@evercoreisi.com |

| Nomura Research | Robert S. Drbul | robert.drbul@nomura.com |

| CRT Capital Group | Sam Poser | sposer@sterneageecrt.com |

| Buckingham Research | Scott Krasik | skrasik@buckresearch.com |

| FBR Capital Markets & Co | Susan Anderson | sanderson@fbr.com |

| Wells Fargo Securities | Tom Nikic | tom.nikic@wellsfargo.com |

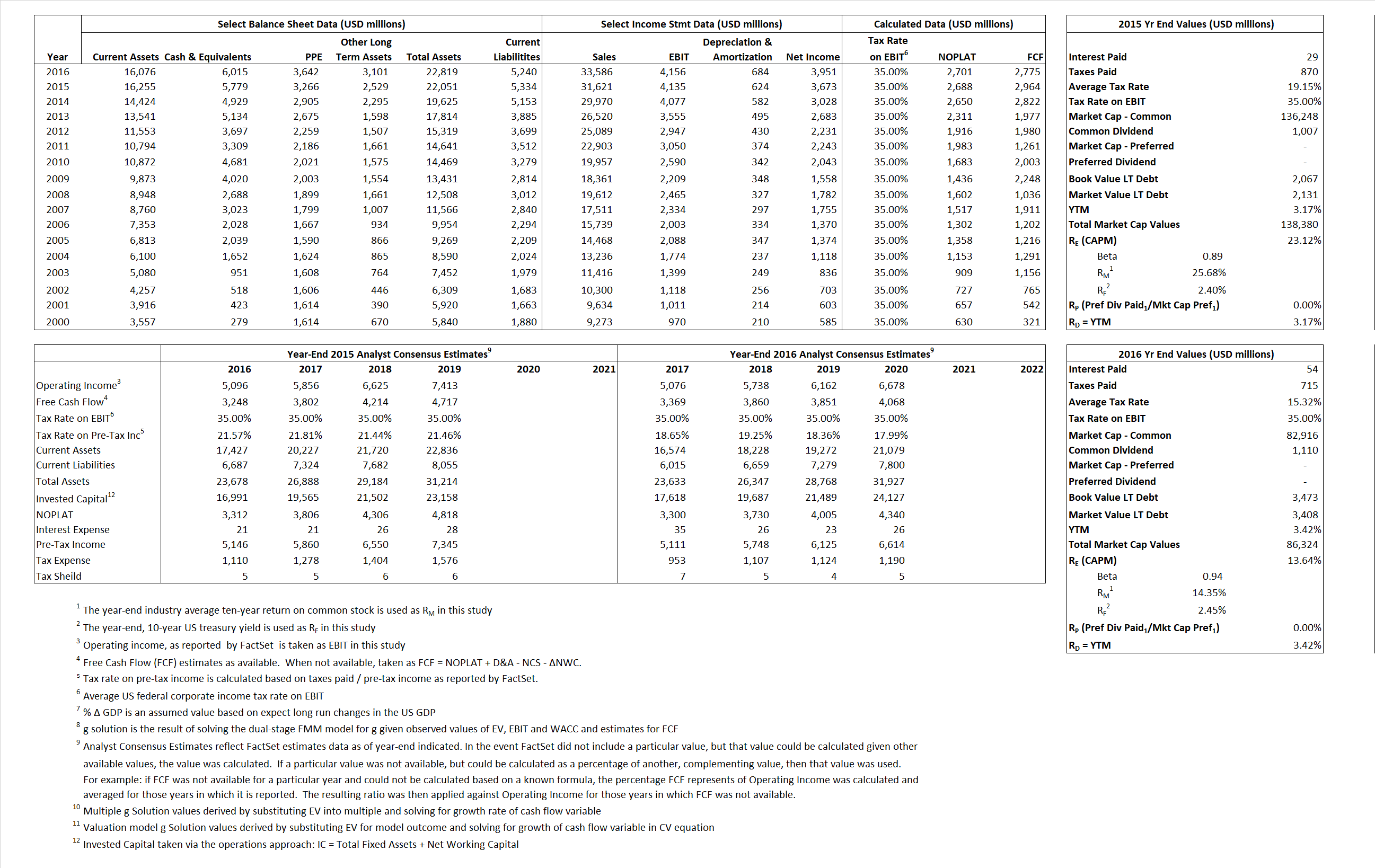

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,688 | 2,701 | |

| Free Cash Flow | FCF | 2,964 | 2,775 | |

| Tax Shield | TS | 6 | 8 | |

| Invested Capital | IC | 16,717 | 17,578 | |

| Return on Invested Capital | ROIC | 16.08% | 15.37% | |

| Net Investment | NetInv | 2,869 | 1,545 | |

| Investment Rate | IR | 106.75% | 57.20% | |

| Weighted Average Cost of Capital |

WACCMarket | 22.80% | 13.21% | |

| WACCBook | 8.52% | 8.86% | ||

| Enterprise value |

EVMarket | 132,600 | 80,309 | |

| EVBook | 132,300 | 80,374 | ||

| Long-Run Growth |

g = IR x ROIC |

17.16% | 8.79% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 13.08% | 12.37% | |

| Depreciation/Amortization Rate | D | 13.11% | 14.13% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

4.19 | 2.39 | 23.77% | 12.61% | 23.23% | 12.88% |

|

|

27.86 | 16.59 | 23.77% | 12.61% | 23.23% | 12.88% |

|

|

49.33 | 29.73 | 23.77% | 12.61% | 23.23% | 12.88% |

|

|

44.73 | 28.94 | 23.77% | 12.61% | 23.23% | 12.88% |

|

|

32.07 | 19.33 | 23.77% | 12.61% | 23.23% | 12.88% |

|

|

7.93 | 4.57 | 23.77% | 12.61% | 23.23% | 12.88% |