Occidental Petroleum Corp.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Atlantic Equities | Barry MacCarthy | b.maccarthy@atlantic-equities.com |

| Cowen & Company | Charles Robertson | charles.robertson@cowen.com |

| Evercore ISI | Douglas Terreson | doug.terreson@evercoreisi.com |

| Credit Suisse | Edward Westlake | edward.westlake@credit-suisse.com |

| IBERIA Capital Partners | Eric Fox | eric.fox@iberiabank.com |

| Piper Jaffray | Guy Baber | roger.read@wellsfargo.com |

| Jefferies | Jason Gammel | jason.gammel@jefferies.com |

| Tudor Pickering Holt & Co. | Matthew Portillo | mportillo@tphco.com |

| Wolfe Research | Paul Sankey | psankey@wolferesearch.com |

| Raymond James | Pavel Molchanov | pavel.molchanov@raymondjames.com |

| Scotia Howard Weil | Peter Kissel | peter.kissel@scotiabank.com |

| BMO Capital Markets | Phillip Jungwirth | phillip.jungwirth@bmo.com |

| Capital One Securities | Richard Tullis | richard.tullis@capitalone.com |

| GMP Securities | Robert Bakanauskas | bbakan@gmpsecurities.com |

| Wells Fargo Securities | Roger D. Read | roger.read@wellsfargo.com |

| Deutsche Bank Research | Ryan Todd | ryan.todd@db.com |

| CRT Capital Group | Tim Rezvan | trezvan@sterneageecrt.com |

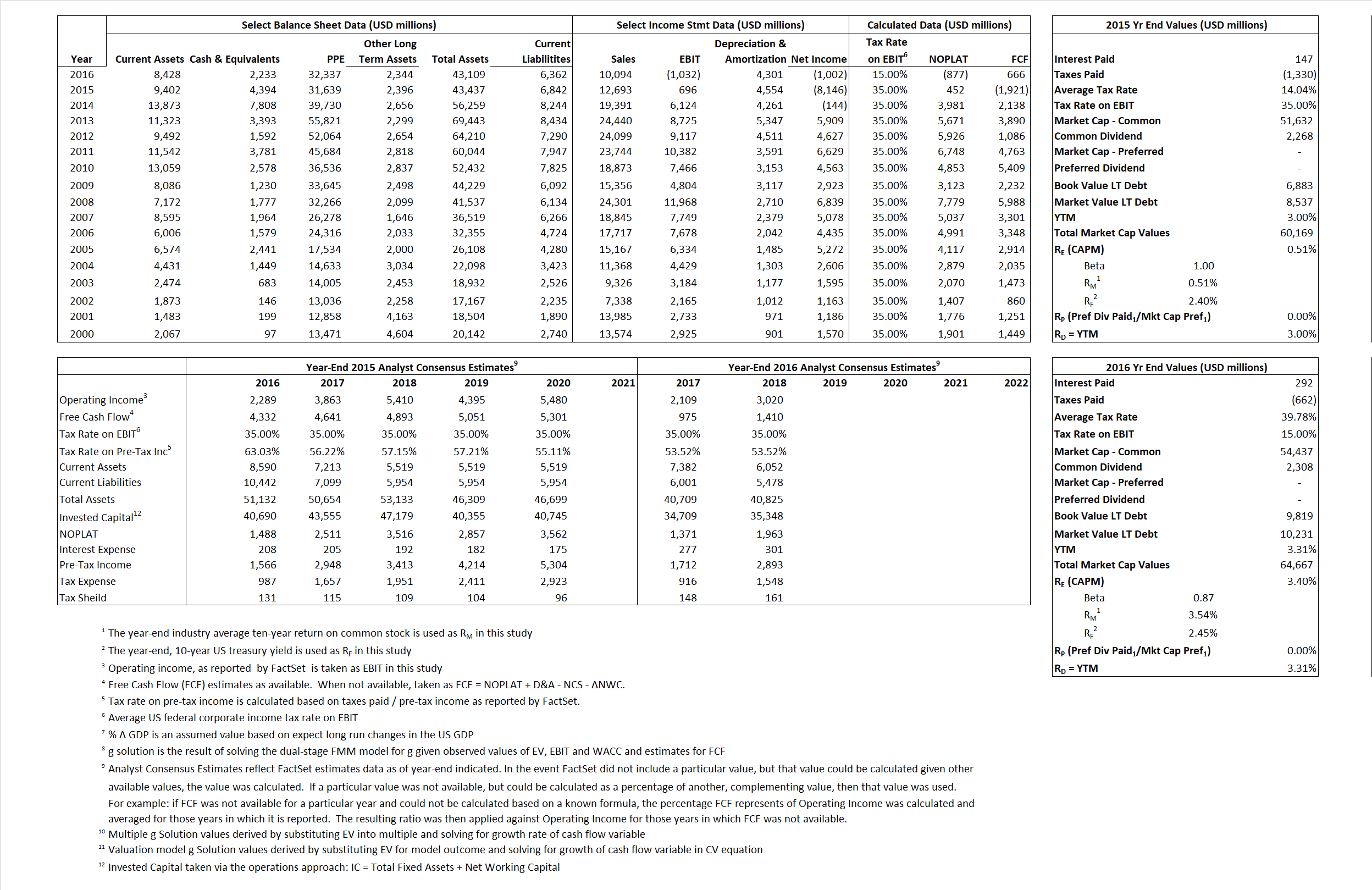

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 452 | (877) | |

| Free Cash Flow | FCF | (1,921) | 666 | |

| Tax Shield | TS | 21 | 116 | |

| Invested Capital | IC | 36,595 | 36,747 | |

| Return on Invested Capital | ROIC | 1.24% | -2.39% | |

| Net Investment | NetInv | (6,866) | 4,453 | |

| Investment Rate | IR | -1,517.68% | -507.64% | |

| Weighted Average Cost of Capital |

WACCMarket | 0.80% | 3.18% | |

| WACCBook | 8.46% | 6.57% | ||

| Enterprise value |

EVMarket | 55,775 | 62,434 | |

| EVBook | 56,282 | 62,023 | ||

| Long-Run Growth |

g = IR x ROIC |

-18.76% | 12.12% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 5.48% | -10.22% | |

| Depreciation/Amortization Rate | D | 86.74% | 131.57% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

4.39 | 6.19 | -.02% | 11.13% | 5.86% | 10.06% |

|

|

10.62 | 19.10 | -.02% | 11.13% | 5.86% | 10.06% |

|

|

123.29 | -71.17 | -.02% | 11.13% | 5.86% | 10.06% |

|

|

-29.03 | 93.75 | -.02% | 11.13% | 5.86% | 10.06% |

|

|

80.14 | -60.50 | -.02% | 11.13% | 5.86% | 10.06% |

|

|

1.52 | 1.70 | -.02% | 11.13% | 5.86% | 10.06% |