Lowe’s Companies, Inc.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Oppenheimer | Brian Nagel | brian.nagel@opco.com |

| Raymond James | Budd Bugatch | budd.bugatch@raymondjames.com |

| Jefferies | Daniel Binder | dbinder@jefferies.com |

| Consumer Edge Research | David A. Schick | dschick@consumeredgeresearch.com |

| Longbow Research | David S. MacGregor | dmacgregor@longbowresearch.com |

| Evercore ISI | Greg Melich | greg.melich@evercoreisi.com |

| Nomura Research | Jessica A. Schoen | jessica.schoen@nomura.com |

| Telsey Advisory Group | Joseph Feldman | jfeldman@telseygroup.com |

| SunTrust Robinson Humphrey | Keith Hughes | keith.hughes@suntrust.com |

| Deutsche Bank Research | Mike Baker | michael.baker@db.com |

| Piper Jaffray | Peter J. Keith | peter.j.keith@pjc.com |

| Atlantic Equities | Sam Hudson | s.hudson@atlantic-equities.com |

| RBC Capital Markets | Scot Ciccarelli | scot.ciccarelli@rbccm.com |

| Wolfe Research | Scott Mushkin | smushkin@wolferesearch.com |

| Wedbush Securities | Seth Basham | seth.basham@wedbush.com |

| BMO Capital Markets | Wayne Hood | wayne.hood@bmo.com |

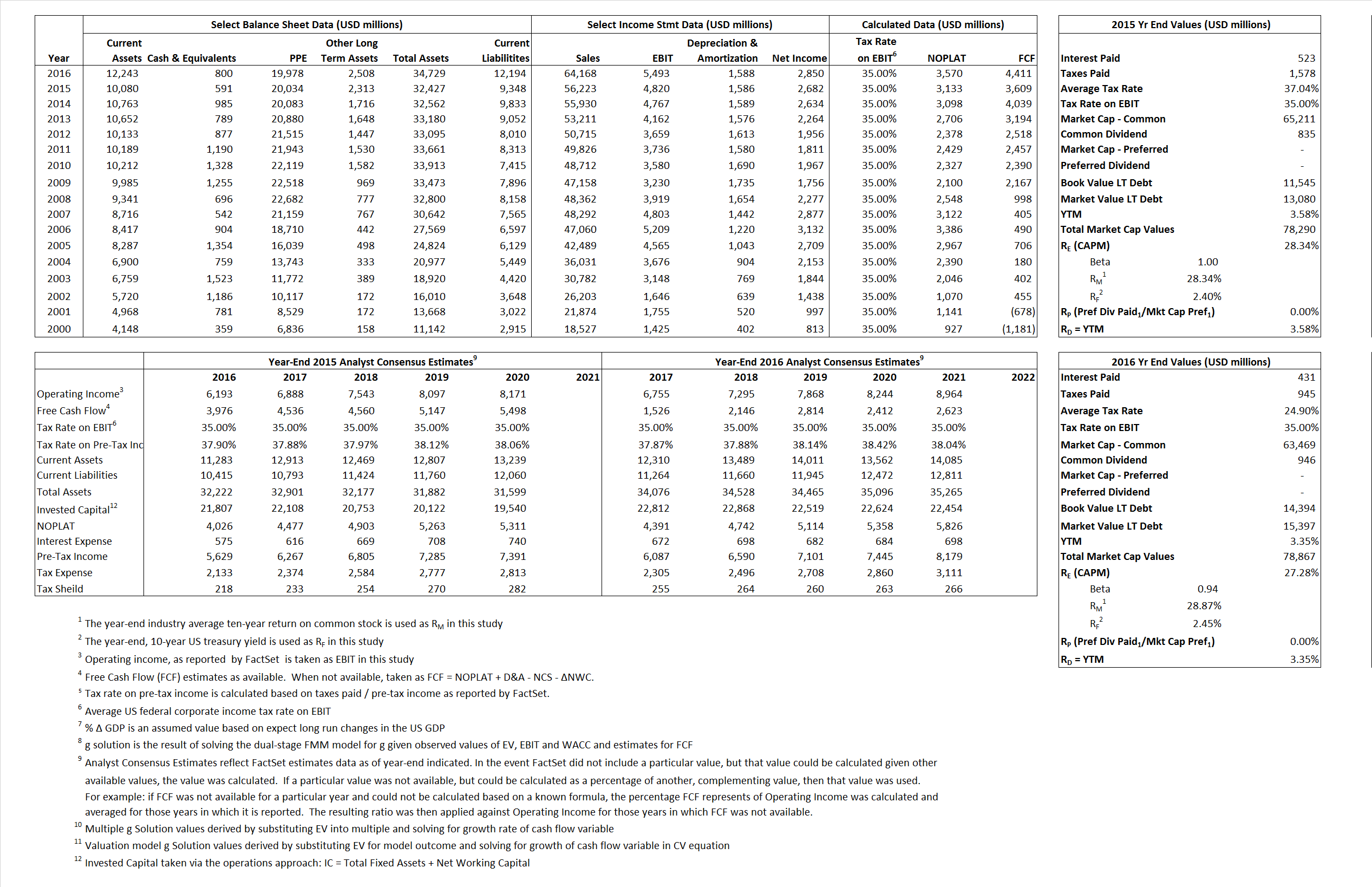

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 3,133 | 3,570 | |

| Free Cash Flow | FCF | 3,609 | 4,411 | |

| Tax Shield | TS | 194 | 107 | |

| Invested Capital | IC | 23,079 | 22,535 | |

| Return on Invested Capital | ROIC | 13.58% | 15.84% | |

| Net Investment | NetInv | 1,936 | 1,044 | |

| Investment Rate | IR | 61.80% | 29.23% | |

| Weighted Average Cost of Capital |

WACCMarket | 23.98% | 22.45% | |

| WACCBook | 7.31% | 7.62% | ||

| Enterprise value |

EVMarket | 77,699 | 78,067 | |

| EVBook | 75,956 | 77,063 | ||

| Long-Run Growth |

g = IR x ROIC |

8.39% | 4.63% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 8.57% | 8.56% | |

| Depreciation/Amortization Rate | D | 24.76% | 22.43% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

1.38 | 1.22 | 28.38% | 25.13% | 25.41% | 23.22% |

|

|

12.13 | 11.02 | 28.38% | 25.13% | 25.41% | 23.22% |

|

|

24.80 | 21.86 | 28.38% | 25.13% | 25.41% | 23.22% |

|

|

21.53 | 17.70 | 28.38% | 25.13% | 25.41% | 23.22% |

|

|

16.12 | 14.21 | 28.38% | 25.13% | 25.41% | 23.22% |

|

|

3.37 | 3.36 | 28.38% | 25.13% | 25.41% | 23.22% |