Coca-Cola Company

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| William Blair | Bhavan Suri | bsuri@williamblair.com |

| Stifel Nicolaus | Brad R. Reback | rebackb@stifel.com |

| Pacific Crest Securities-KBCM | Brent Bracelin | bbracelin@pacific-crest.com |

| Drexel Hamilton | Brian J. White | bwhite@drexelhamilton.com |

| JMP Securities | Greg Mcdowell | gmcdowell@jmpsecurities.com |

| Cowen & Company | Gregg Moskowitz | gregg.moskowitz@cowen.com |

| DA Davidson | Jack Andrews | jandrews@dadco.com |

| Jefferies | John DiFucci | jdifucci@jefferies.com |

| SunTrust Robinson Humphrey | John Rizzuto | john.rizzuto@suntrust.com |

| Stephens Inc | Jonathan B. Ruykhaver | jonathan.ruykhaver@stephens.com |

| Atlantic Equities | Josep Bori | j.bori@atlantic-equities.com |

| Deutsche Bank Research | Karl Keirstead | karl.keirstead@db.com |

| BMO Capital Markets | Keith Bachman | keith.bachman@bmo.com |

| Evercore ISI | Kirk Materne | kirk.materne@evercoreisi.com |

| RBC Capital Markets | Matthew Hedberg | matthew.hedberg@rbccm.com |

| Raymond James | Michael Turits | michael.turits@raymondjames.com |

| Maxim Group | Nehal Chokshi | nehalchokshi@techinsightsresearch.com |

| Credit Suisse | Philip Winslow | philip.winslow@credit-suisse.com |

| Canaccord Genuity | Richard Davis Jr. | rdavis@canaccordgenuity.com |

| Guggenheim Securities | Ryan Hutchinson | ryan.hutchinson@guggenheimpartners.com |

| Needham | Scott Zeller | szeller@needhamco.com |

| Oppenheimer | Shaul Eyal | shaul.eyal@opco.com |

| FBN Securities | Shebly Seyrafi | sseyrafi@fbnsecurities.com |

| Mitsubishi UFJ Securities (USA) | Stephen D. Bersey | sbersey@us.sc.mufg.jp |

| Wedbush Securities | Steve Koenig | steve.koenig@wedbush.com |

| Northland Securities | Tim Klasell | tklasell@northlandcapitalmarkets.com |

| Bernstein Research | Ali Dibadj | ali.dibadj@bernstein.com |

| BMO Capital Markets | Amit Sharma | amit.sharma@bmo.com |

| Deutsche Bank Research | Bill Schmitz Jr. | william.schmitz@db.com |

| Wells Fargo Securities | Bonnie Herzog | bonnie.herzog@wellsfargo.com |

| Consumer Edge Research | Brett Cooper | bcooper@consumeredgeresearch.com |

| Jefferies | Kevin Grundy | kgrundy@jefferies.com |

| Stifel Nicolaus | Mark D. Swartzberg | mswartzberg@stifel.com |

| RBC Capital Markets | Nik Modi | nik.modi@rbccm.com |

| Susquehanna Financial Group | Pablo Zuanic | pablo.zuanic@sig.com |

| Evercore ISI | Robert Ottenstein | robert.ottenstein@evercoreisi.com |

| Cowen & Company | Vivien Azer | vivien.azer@cowen.com |

| SunTrust Robinson Humphrey | William B. Chappell Jr. | bill.chappell@suntrust.com |

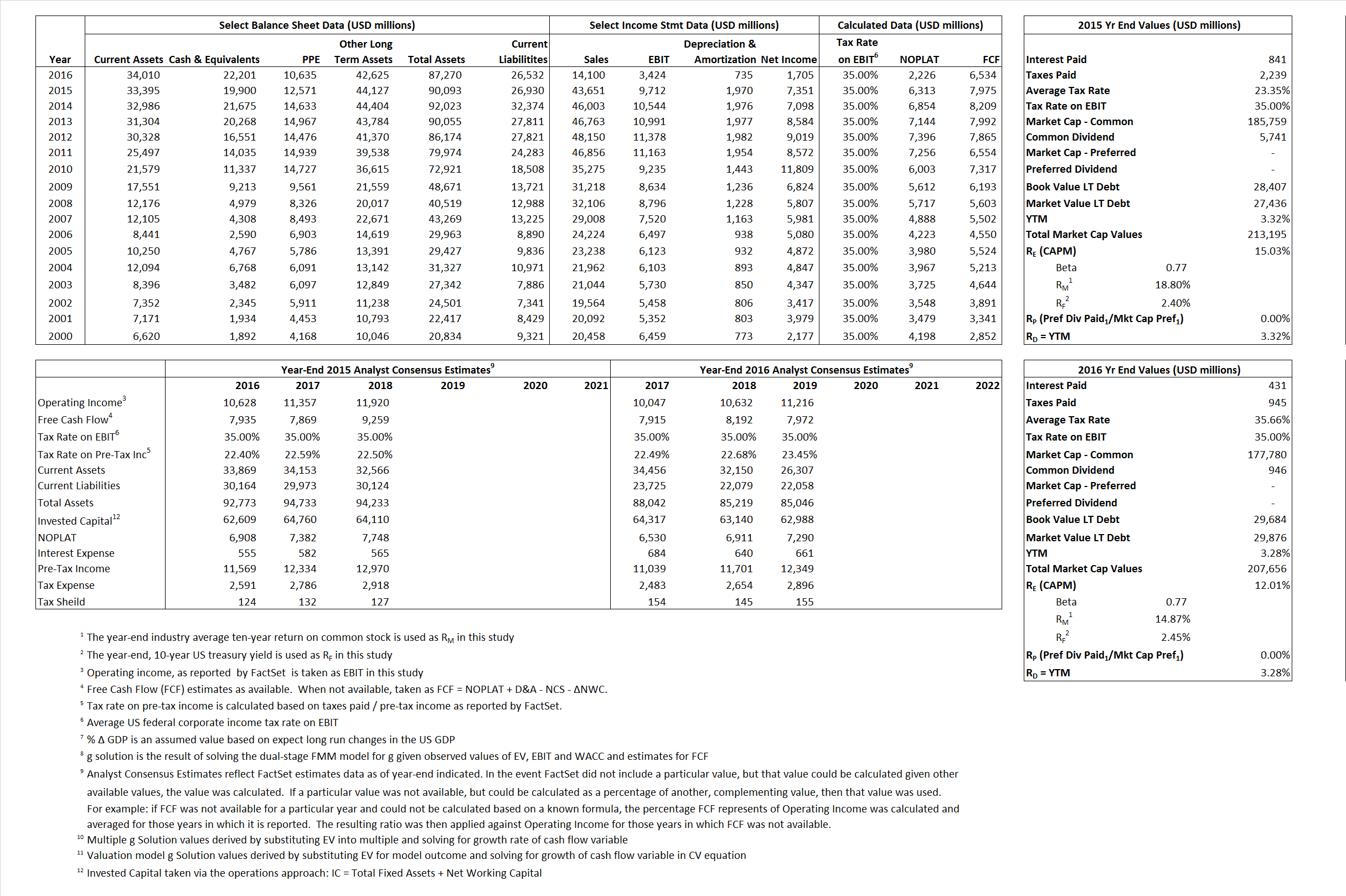

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 6,313 | 2,226 | |

| Free Cash Flow | FCF | 7,975 | 6,534 | |

| Tax Shield | TS | 196 | 154 | |

| Invested Capital | IC | 63,163 | 60,738 | |

| Return on Invested Capital | ROIC | 9.99% | 3.66% | |

| Net Investment | NetInv | 5,484 | (1,690) | |

| Investment Rate | IR | 86.87% | -75.93% | |

| Weighted Average Cost of Capital |

WACCMarket | 13.42% | 10.59% | |

| WACCBook | 6.60% | 6.31% | ||

| Enterprise value |

EVMarket | 193,295 | 185,455 | |

| EVBook | 191,965 | 185,263 | ||

| Long-Run Growth |

g = IR x ROIC |

8.68% | -2.78% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 22.25% | 24.28% | |

| Depreciation/Amortization Rate | D | 16.86% | 17.67% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

4.43 | 13.15 | 15.08% | 13.96% | 14.56% | 12.80% |

|

|

16.55 | 44.59 | 15.08% | 13.96% | 14.56% | 12.80% |

|

|

30.62 | 83.33 | 15.08% | 13.96% | 14.56% | 12.80% |

|

|

24.24 | 28.38 | 15.08% | 13.96% | 14.56% | 12.80% |

|

|

19.90 | 54.16 | 15.08% | 13.96% | 14.56% | 12.80% |

|

|

3.06 | 3.05 | 15.08% | 13.96% | 14.56% | 12.80% |