Biogen Idec

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Credit Suisse | Alethia Young | alethia.young@credit-suisse.com |

| HC Wainwright | Andrew S. Fein | afein@hcwresearch.com |

| Jefferies | Brian Abrahams | babrahams@jefferies.com |

| Raymond James | Christopher J. Raymond | chris.raymond@raymondjames.com |

| Cowen & Company | Eric Schmidt | eric.schmidt@cowen.com |

| Leerink Partners | Geoffrey C. Porges | geoffrey.porges@leerink.com |

| Wells Fargo Securities | Jim Birchenough | jim.birchenough@wellsfargo.com |

| William Blair | John Sonnier | jsonnier@williamblair.com |

| Piper Jaffray | Joshua Schimmer | joshua.e.schimmer@pjc.com |

| BMO Capital Markets | M. Ian Somaiya | ian.somaiya@bmo.com |

| Evercore ISI | Mark Schoenebaum | mark.schoenebaum@evercoreisi.com |

| RBC Capital Markets | Michael J. Yee | michael.yee@rbccm.com |

| Atlantic Equities | Steve Chesney | s.chesney@atlantic-equities.com |

| Stifel Nicolaus | Thomas Shrader | shradert@stifel.com |

| Guggenheim Securities | William Tanner | william.tanner@guggenheimpartners.com |

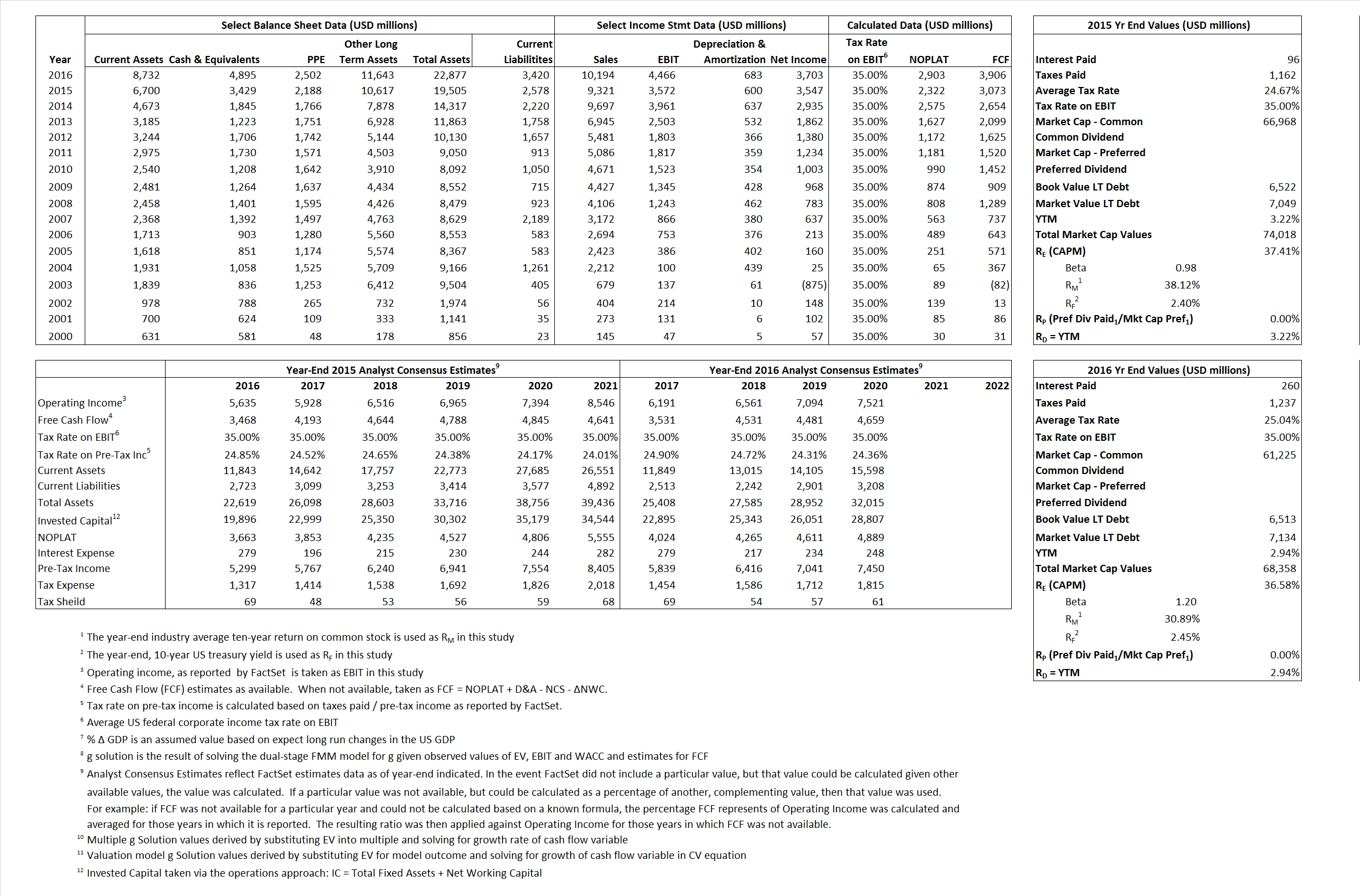

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,322 | 2,903 | |

| Free Cash Flow | FCF | 3,073 | 3,906 | |

| Tax Shield | TS | 24 | 65 | |

| Invested Capital | IC | 16,927 | 19,457 | |

| Return on Invested Capital | ROIC | 13.72% | 14.92% | |

| Net Investment | NetInv | 5,431 | 3,213 | |

| Investment Rate | IR | 233.90% | 110.68% | |

| Weighted Average Cost of Capital |

WACCMarket | 34.07% | 32.99% | |

| WACCBook | 8.63% | 9.54% | ||

| Enterprise value |

EVMarket | 70,589 | 63,463 | |

| EVBook | 70,061 | 62,843 | ||

| Long-Run Growth |

g = IR x ROIC |

32.08% | 16.51% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 38.32% | 43.81% | |

| Depreciation/Amortization Rate | D | 14.39% | 13.26% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

7.57 | 6.23 | 40.50% | 40.98% | 35.46% | 34.95% |

|

|

16.92 | 12.33 | 40.50% | 40.98% | 35.46% | 34.95% |

|

|

30.40 | 21.86 | 40.50% | 40.98% | 35.46% | 34.95% |

|

|

22.97 | 16.25 | 40.50% | 40.98% | 35.46% | 34.95% |

|

|

19.76 | 14.21 | 40.50% | 40.98% | 35.46% | 34.95% |

|

|

4.17 | 3.26 | 40.50% | 40.98% | 35.46% | 34.95% |