BlackRock Inc

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Deutsche Bank Research | Brian Bedell | brian.bedell@db.com |

| Wells Fargo Securities | Christopher Harris | christopher.harris1@wellsfargo.com |

| Credit Suisse | Craig Siegenthaler | craig.siegenthaler@credit-suisse.com |

| Jefferies | Daniel T. Fannon | dfannon@jefferies.com |

| RBC Capital Markets | Eric N. Berg | eric.berg@rbccm.com |

| Evercore ISI | Glenn Schorr | glenn.schorr@evercoreisi.com |

| Piper Jaffray | Jason Weyeneth | jason.l.weyeneth@pjc.com |

| Bernstein Research | Luke Montgomery | lucas.montgomery@bernstein.com |

| Gabelli & Company | Macrae Sykes | msykes@gabelli.com |

| Keefe Bruyette & Woods | Robert Lee | rlee@kbw.com |

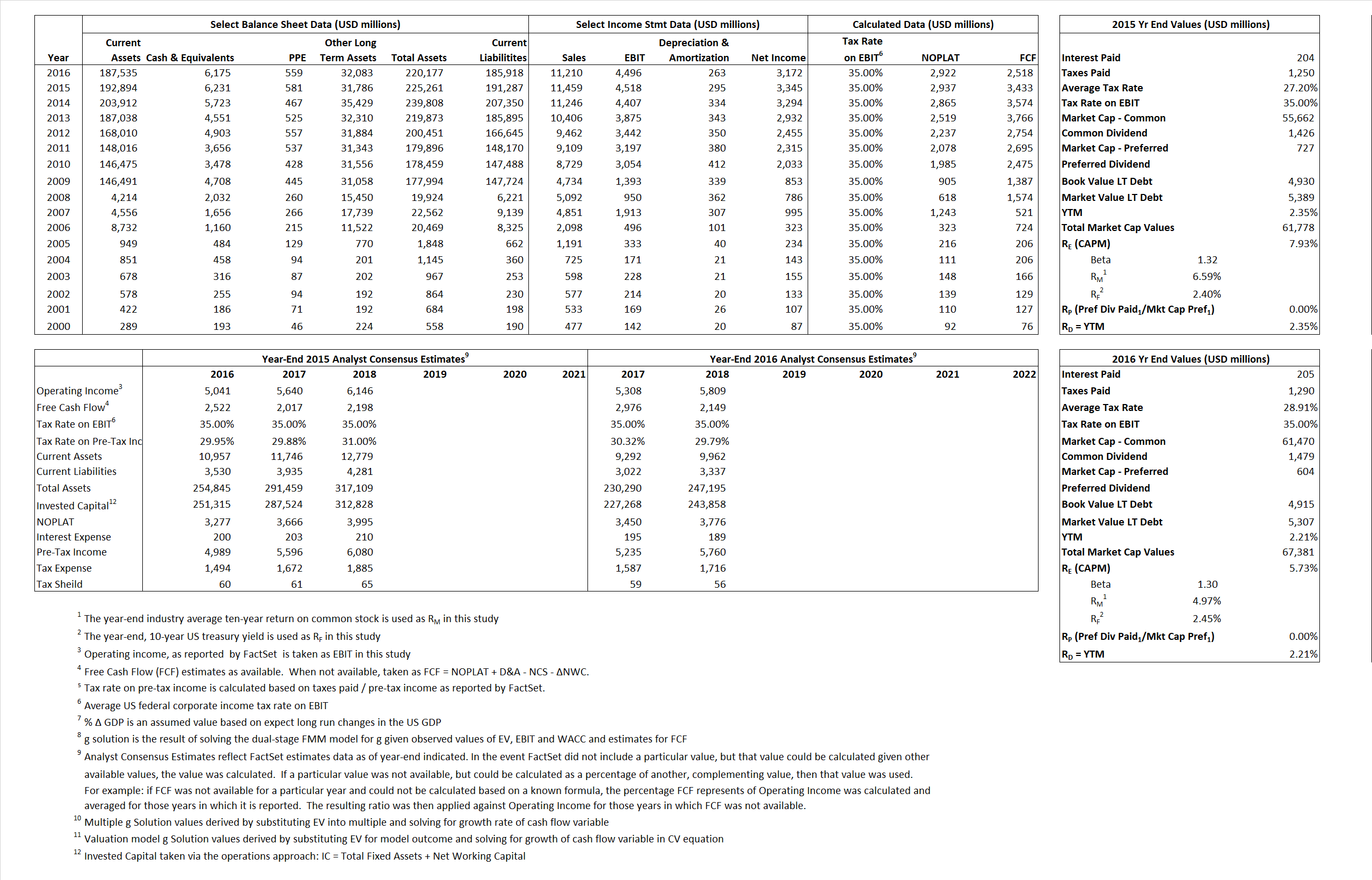

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,937 | 2,922 | |

| Free Cash Flow | FCF | 3,433 | 2,518 | |

| Tax Shield | TS | 55 | 59 | |

| Invested Capital | IC | 33,974 | 34,259 | |

| Return on Invested Capital | ROIC | 8.64% | 8.53% | |

| Net Investment | NetInv | 1,811 | 548 | |

| Investment Rate | IR | 61.67% | 18.75% | |

| Weighted Average Cost of Capital |

WACCMarket | 7.29% | 5.35% | |

| WACCBook | 10.93% | 10.27% | ||

| Enterprise value |

EVMarket | 55,547 | 61,206 | |

| EVBook | 55,088 | 60,814 | ||

| Long-Run Growth |

g = IR x ROIC |

5.33% | 1.60% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 39.43% | 40.11% | |

| Depreciation/Amortization Rate | D | 6.13% | 5.53% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

4.85 |

5.46 |

5.17% | 1.30% | 5.62% | 2.11% |

|

|

11.54 | 12.86 | 5.17% | 1.30% | 5.62% | 2.11% |

|

|

18.91 | 20.94 | 5.17% | 1.30% | 5.62% | 2.11% |

|

|

16.18 | 24.31 | 5.17% | 1.30% | 5.62% | 2.11% |

|

|

12.29 | 13.61 | 5.17% | 1.30% | 5.62% | 2.11% |

|

|

1.63 | 1.79 | 5.17% | 1.30% | 5.62% | 2.11% |