Mondolez

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| Bernstein Research | Alexia Howard | alexia.howard@bernstein.com |

| Stifel Nicolaus | Christopher R. Growe | growec@stifel.com |

| RBC Capital Markets | David Palmer | david.palmer@rbccm.com |

| Deutsche Bank Research | Eric Katzman | eric.katzman@db.com |

| Buckingham Research | Eric Larson | elarson@buckresearch.com |

| Wells Fargo Securities | John J. Baumgartner | john.baumgartner@wellsfargo.com |

| Athlos Research | Jonathan P. Feeney | jonathan@athlosresearch.com |

| First Global Stockbroking | Kavita Thomas | kavita.thomas@fglobal.com |

| BMO Capital Markets | Kenneth B. Zaslow | kenneth.zaslow@bmo.com |

| Susquehanna Financial Group | Pablo Zuanic | pablo.zuanic@sig.com |

| Credit Suisse | Robert Moskow | robert.moskow@credit-suisse.com |

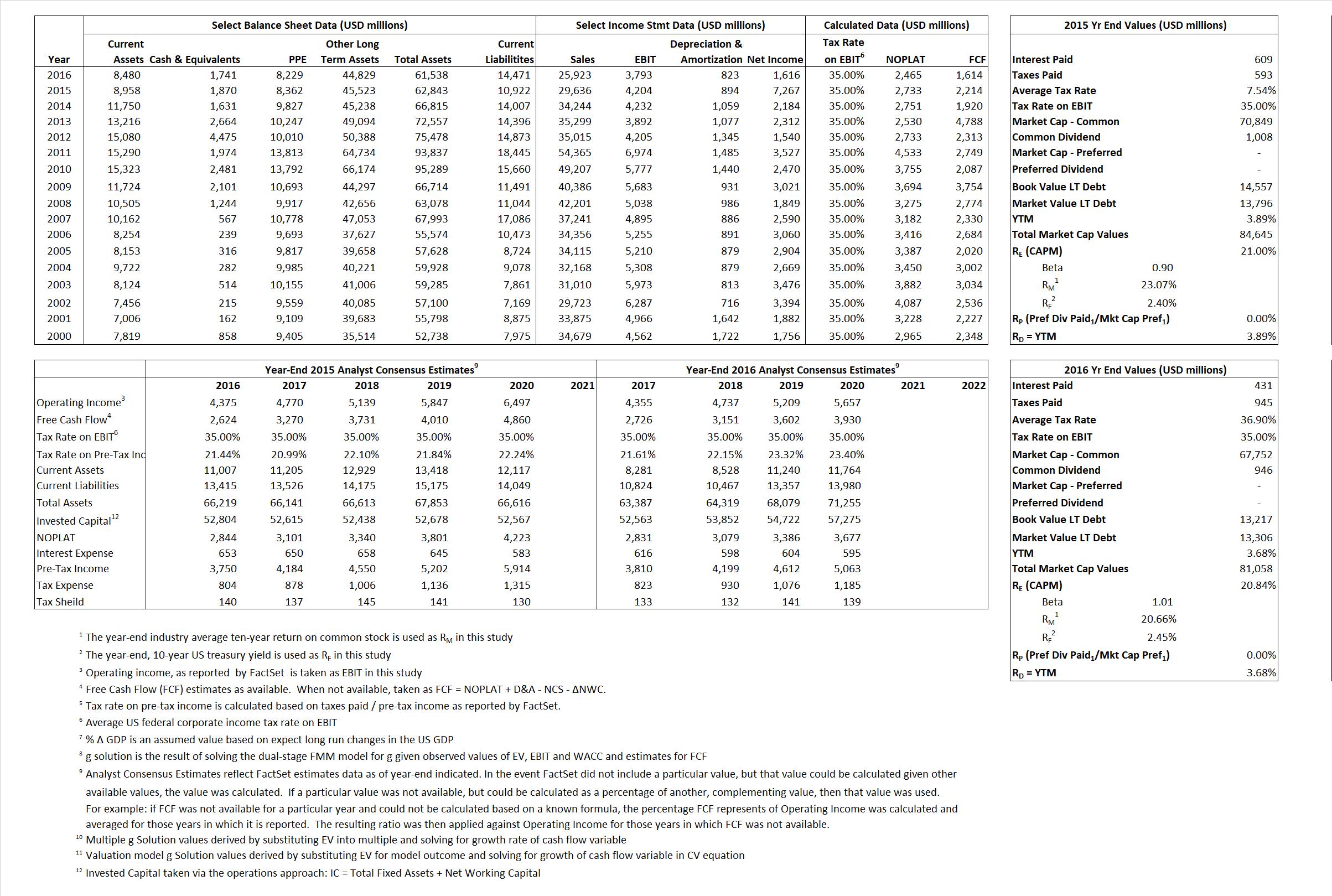

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 2,733 | 2,465 | |

| Free Cash Flow | FCF | 2,214 | 1,614 | |

| Tax Shield | TS | 46 | 159 | |

| Invested Capital | IC | 51,921 | 47,067 | |

| Return on Invested Capital | ROIC | 5.26% | 5.24% | |

| Net Investment | NetInv | 7 | (4,031) | |

| Investment Rate | IR | 0.26% | -163.50% | |

| Weighted Average Cost of Capital |

WACCMarket | 18.17% | 17.80% | |

| WACCBook | 7.68% | 7.76% | ||

| Enterprise value |

EVMarket | 82,775 | 79,317 | |

| EVBook | 83,665 | 79,228 | ||

| Long-Run Growth |

g = IR x ROIC |

0.01% | -8.56% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 14.19% | 14.63% | |

| Depreciation/Amortization Rate | D | 17.54% | 17.83% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

2.79 | 3.06 | 39.88% | 36.14% | 24.07% | 23.40% |

|

|

16.24 | 17.18 | 39.88% | 36.14% | 24.07% | 23.40% |

|

|

30.29 | 32.17 | 39.88% | 36.14% | 24.07% | 23.40% |

|

|

37.39 | 49.14 | 39.88% | 36.14% | 24.07% | 23.40% |

|

|

19.69 | 20.91 | 39.88% | 36.14% | 24.07% | 23.40% |

|

|

1.59 | 1.69 | 39.88% | 36.14% | 24.07% | 23.40% |