MasterCard Inc.

Analyst Listing

The following analysts provide coverage for the subject firm as of May 2016:

| Broker | Analyst | Analyst Email |

| SunTrust Robinson Humphrey | Andrew Jeffrey | andrew.jeffrey@suntrust.com |

| Nomura Research | Bill Carcache | bill.carcache@nomura.com |

| Deutsche Bank Research | Bryan Keane | bryan.keane@db.com |

| Stifel Nicolaus | Christopher C. Brendler | ccbrendler@stifel.com |

| Atlantic Equities | Christopher Hickey | c.hickey@atlantic-equities.com |

| Sandler O’Neill & Partners | Christopher R. Donat | cdonat@sandleroneill.com |

| RBC Capital Markets | Daniel Perlin | daniel.perlin@rbccm.com |

| Evercore ISI | David Togut | david.togut@evercoreisi.com |

| Guggenheim Securities | Eric Wasserstrom | eric.wasserstrom@guggenheimpartners.com |

| Cowen & Company | Georgios Mihalos | george.mihalos@cowen.com |

| Wedbush Securities | Gil Luria | gil.luria@wedbush.com |

| Oppenheimer | Glenn Greene | glenn.greene@opco.com |

| BMO Capital Markets | James Fotheringham | james.fotheringham@bmo.com |

| Susquehanna Financial Group | James Friedman | james.friedman@sig.com |

| Piper Jaffray | Jason Deleeuw | jason.s.deleeuw@pjc.com |

| Jefferies | Jason Kupferberg | jkupferberg@jefferies.com |

| Compass Point Research | John T. Williams | jwilliams@compasspointllc.com |

| Pacific Crest Securities-KBCM | Josh Beck | jbeck@pacific-crest.com |

| Bernstein Research | Lisa D. Ellis | lisa.ellis@bernstein.com |

| CRT Capital Group | Moshe Katri | mkatri@sterneageecrt.com |

| Credit Suisse | Moshe Orenbuch | moshe.orenbuch@credit-suisse.com |

| William Blair | Robert Napoli | bnapoli@williamblair.com |

| Keefe Bruyette & Woods | Sanjay Sakhrani | ssakhrani@kbw.com |

| Wells Fargo Securities | Timothy Willi | timothy.willi@wellsfargo.com |

| Raymond James | Wayne Johnson | wayne.johnson@raymondjames.com |

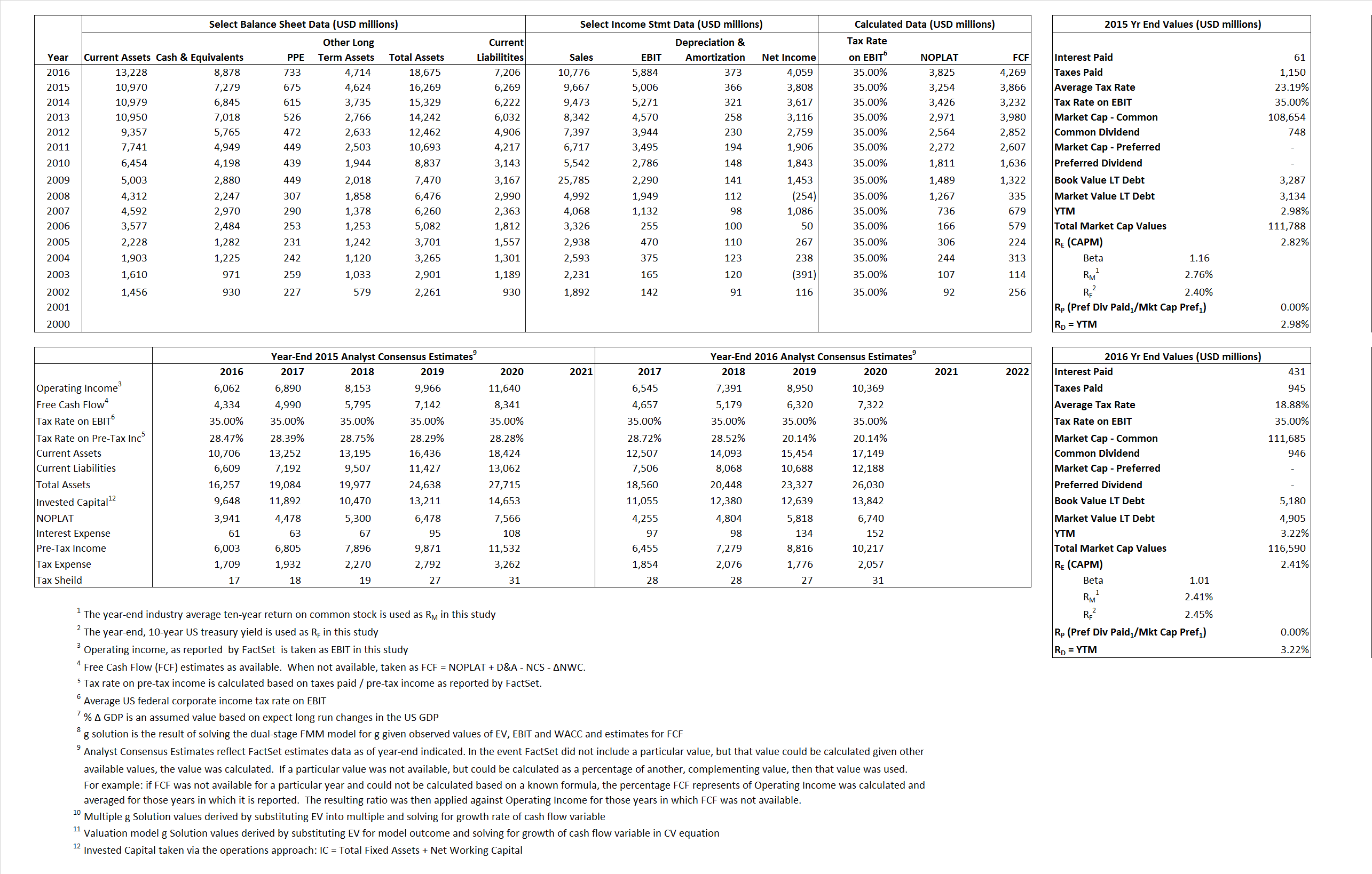

Primary Input Data

Derived Input Data

Derived Input |

Label |

2015 Value |

2016

|

Equational Form |

| Net Operating Profit Less Adjusted Taxes | NOPLAT | 3,254 | 3,825 | |

| Free Cash Flow | FCF | 3,866 | 4,269 | |

| Tax Shield | TS | 14 | 81 | |

| Invested Capital | IC | 10,000 | 11,469 | |

| Return on Invested Capital | ROIC | 32.54% | 33.35% | |

| Net Investment | NetInv | 1,259 | 1,842 | |

| Investment Rate | IR | 38.69% | 48.16% | |

| Weighted Average Cost of Capital |

WACCMarket | 2.80% | 2.42% | |

| WACCBook | 10.30% | 8.71% | ||

| Enterprise value |

EVMarket | 104,509 | 107,712 | |

| EVBook | 103,063 | 107,987 | ||

| Long-Run Growth |

g = IR x ROIC |

12.59% | 16.06% | Long-run growth rates of the income variable are used in the Continuing Value portion of the valuation models. |

| g = % |

2.50% | 2.50% | ||

| Margin from Operations | M | 51.78% | 54.60% | |

| Depreciation/Amortization Rate | D | 6.81% | 5.96% |

Valuation Multiple Outcomes

The outcomes presented in this study are the result of original input data, derived data, and synthesized inputs.

Equational Form |

Observed Value |

Single-stagemultiple g solution |

Two-stage valuationmodel g solution |

|||

| 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | 12/31/2016 | |

|

|

10.81 | 10.00 | -0.34% | -1.27% | -1.01% | -0.90% |

|

|

19.45 | 17.21 | -0.34% | -1.27% | -1.01% | c-0.90% |

|

|

32.12 | 28.16 | -0.34% | -1.27% | -1.01% | -0.90% |

|

|

27.03 | 25.23 | -0.34% | -1.27% | -1.01% | -0.90% |

|

|

20.88 | 18.31 | -0.34% | -1.27% | -1.01% | -0.90% |

|

|

c10.45 | 9.39 | -0.34% | -1.27% | -1.01% | -0.90% |